While we believe that inflation is not a concern for investors in 2024, we do see the next challenge that the market might use as an opportunity to create fear and initiate a (strong?) pullback. While we do not expect a market crash in 2024, we certainly expect at least one period of strong volatility, most likely after markets will have hit all-time highs.

In 2022 and the early part of 2023, markets were gripped by the inflation narrative.

The input side, driven by escalating wages, rising commodities, and surging raw material costs, sparked a wave of volatility and uncertainty.

However, this inflationary pressure wasn’t uniformly reflected on the revenue side for many businesses.

Fast forward to the present, and the inflation scenario has undergone a remarkable shift.

From a peak of 9% year-over-year inflation in May 2022, the latest readings indicate a significant descent, now standing at 1.4% (year-over-year) – even lower than the Fed’s target of 2%, excluding shelter costs.

This reduction signals a positive turn of events for the markets, marking the dissipation of inflation concerns.

What Investors Should Look Out for in 2024

The downturn in inflation is undoubtedly good news for investors.

However, it beckons the question: What’s the next challenge the market will grapple with in 2024?

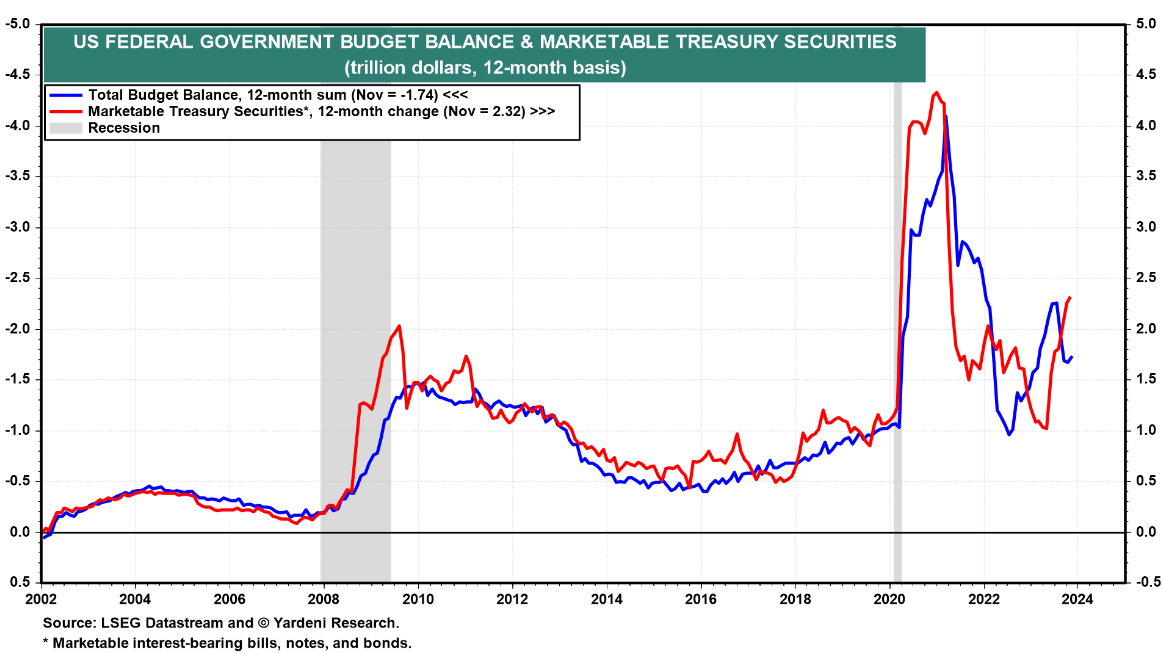

The spotlight is increasingly turning toward the US government budget balance, which appears to be spiraling out of control.

Over the 12 months through November, the federal budget deficit reached a staggering $1.74 trillion, prompting the US Treasury to borrow $2.32 trillion.

While the markets are currently reveling in bullish inflation news, the looming bearish budget deficit remains an underplayed concern. Chart courtesy: Ed Yardeni.

As we step into 2024, investors should be attuned to upcoming bullish time frames. However, a critical juncture, likely before August 2024, will see the US government budget balance taking center stage.

The implications are significant: an anticipated surge in the USD and Yields as the government resorts to substantial Treasury sales to fund the ballooning deficit.

While this doesn’t amount to a specific forecast, it does signal a potential trigger for a market sell-off, possibly around the election period.

Investors are well-advised to keep a watchful eye on this unfolding scenario as one of the paramount risks in the market landscape for the year.

In order to diversify your portfolio in 2024, you might want to consider our passive income service.