Nike (NKE) is in an amazing shape, both the company as well as its stock. It has one of the most beautiful chart patterns imaginable. InvestingHaven’s research team is on record with a Nike stock forecast for 2019: $100 at a minimum, most likely towards $130 by 2019 or 2020.

Which method do we apply to do a stock price forecast like this one for Nike? Very simple, it is based on the principle ‘start with the chart’.

The vast majority of investors tend to follow news on the one hand and gurus on the other hand. Both damage financial health, seriously. It is a recipe for disaster. Let’s first explain why that’s the case.

Note that we covered analysis on Nike’s bullish forecast already three times in 2018:

Nike: A Great Stock That Looks Strongly Bullish In 2018 (February 2018)

Nike Is Making Its Way Higher In A Long Breakout Process, Still A Buy In 2018 (April 2018)

Nike’s Stock Price Will Go Much Higher In 2018, This Is Why (May 2018)

Forecasting stock prices? Start with the (long term) chart!

The principle that InvestingHaven applies is ‘start with the chart’. It means that the chart is the first data point to review. Only if it looks attractive is it acceptable to continue investigating a market, stock, commodity, cryptocurrency. It is also the first step to forecasting any stock, for instance forecasting the stock price of Nike for 2019 and beyond.

This is a very tough concept to apply as the vast majority of investors tend to start with the news. That is because, per our 1/99 Investing Principles, only 1 pct of news is somehow relevant for investors, the other 99 pct is ‘noise’ (interesting stories at best).

Only if the chart setup gives green light it is ‘allowed’ to look into the next ‘layers’: first financials, followed by fundamentals and outlook.

Not convinced? We calculated the returns of following the man that became richest with investing: Warren Buffet. They registered every buy or sell that Berkshire Hathaway published, and calculated the performance. Guess what? By following guru Warren Buffet’s publications you would underperform significantly the S&P 500! You heard this very well. Stay away from the news, it hurts financial health.

Test it out now: do a google search on the keywords “Nike” and “stock” or click this link. Absolutely worthless what you will get as a result, at least from an investor’s perspective.

A Nike stock forecast for 2019

Nike stock forecast: start with the chart

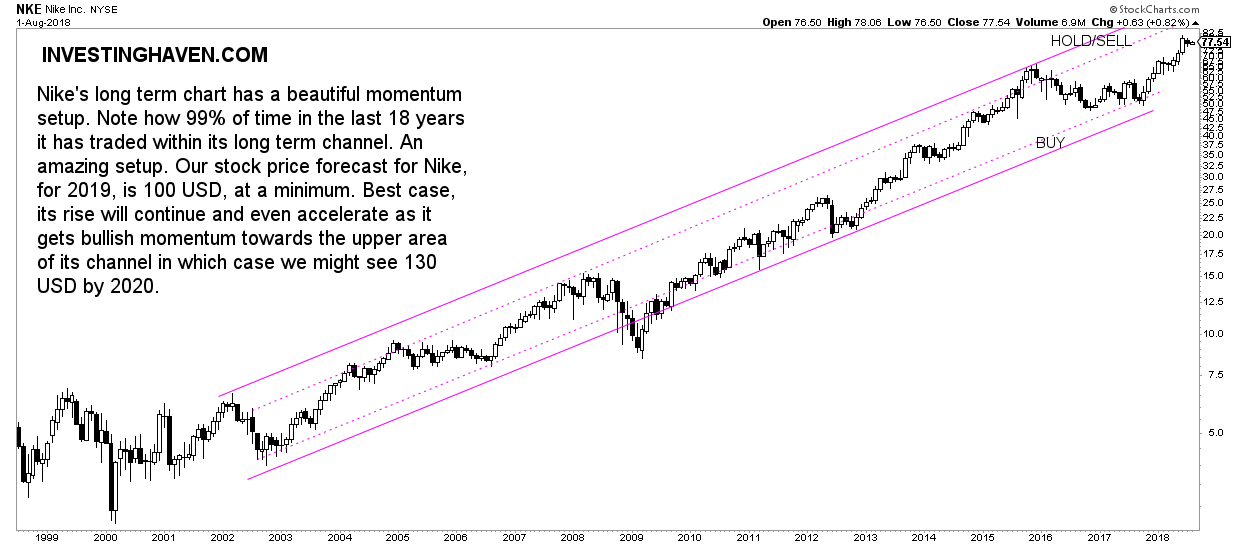

So per Nike’s stock chart, obviously the monthly chart over 20 years, there is one, and only one, dominant pattern. As seen below, it is a beautiful long term momentum pattern.

This is the strongest pattern out there. It is the best low risk / decent reward that investors can have. This is more so the case if there is a long term momentum pattern like the one of Nike over almost 20 years.

Note how doing a forecast for the stock price of Nike is facilitated by the 3 areas within the momentum setup. The upper area is mostly when investors better hold or take profits, the lower area is a buy area, in the center it is a hold.

Financials for Nike

The second layer to review, after green light from the chart, is financials. What do Nike’s financials look like, and what can it suggest for our Nike stock forecast for 2019?

- Revenue is rising with each passing quarter. It went from $8.6B at the end of May of last year to $9.7B at the end of May 2018

- Earnings per share (EPS) of 2.4 with a P/E ratio 32x

- Future EPS of 3.1 with a future P/E ratio of 25x

- Cash position of $3.9B

- Debt/equity ratio of 0.39x

- Dividend of 1 pct

- Shares outstanding are slightly lower in recent quarters.

These are outstanding top line figures. A very healthy, sound set of financial results give green light to go to the 3d layer, and confirm the signal on the chart.

Fundamentals of Nike

Last, the fundamentals of the company are primarily the dynamics in its sector combined with the outlook of the company.

The sector is doing amazingly well. Consumer discretionary, as said many times on this blog, is one of the outperformers after the recent retracement. Our point of view is that the January retracement, mini-crash, triggered a rotation between sectors, and that one of the winning sectors is consumer discretionary of which Nike is part.

Moreover, the outlook of the company looks great. On Nike’s investor relations site we find two quotes from the most recent earnings call (transcript) that are telling:

“We’re updating our guidance for FY19. As of our last earnings call, we expected mid-to-high single-digit revenue growth in FY19. As we now close Q4, our expectations for revenue growth in FY19 has moved up slightly entering the high-single-digit range. This improved outlook takes into account building consumer demand for NIKE; however, we are also mindful of renewed FX volatility and the strengthening dollar of late. As for Gross Margin, we now expect expansion of roughly 50-basis points or slightly greater fueled by strong full-priced sales, expanding average selling prices, and growth in our NIKE Direct businesses, partially offset by higher input costs.”

“Our guidance for North America was that we believed it was a mid-single-digit growth market over the next five years. And so, we don’t typically provide geographical guidance, certainly by quarter or for the full year, but I would say we have momentum going into the year. And that’s really primarily fueled by new innovation platforms that we’re scaling NIKE Direct, certainly NIKE Digital, which accelerated to well over 30% growth … So we do see strong momentum, sustainable momentum going into FY19, but we aren’t providing specific guidance by line item by geography.”

Nike stock forecast 2019 of 100 USD

Taking the approach we outlined in this article we see that a bullish Nike stock forecast for 2019 and beyond is not only confirmed by its chart pattern but also by its financials and fundamentals. This leaves us with a high level confidence forecast of $100 by 2019, and, most likely, unless a crash takes place in broad markets, $130 by 2020.