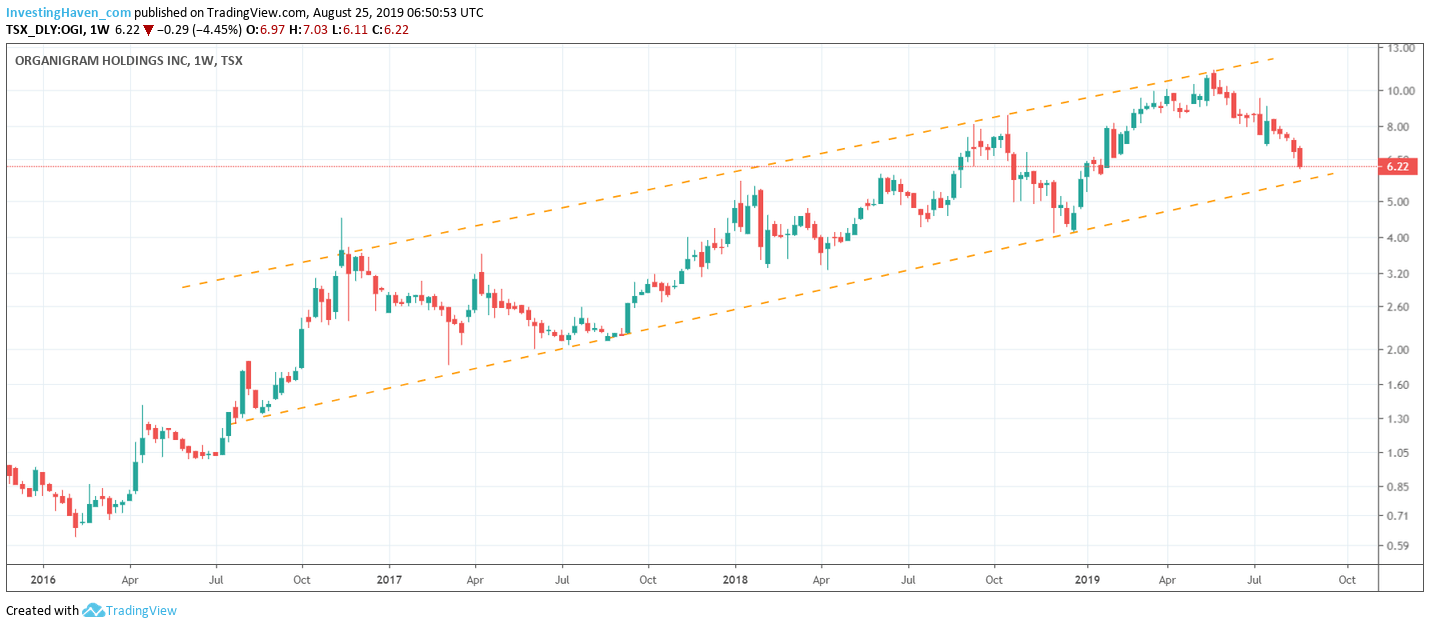

We identified Organigram (OGI) as one of the top cannabis stocks. Just 3 months ago it was breaking out to new highs when we saw a potential acceleration on its chart: Organigram Holdings THE Secular Breakout Of 2019. However, soon after, the stock fell back, and now trades almost 50% below its May 2019 peak. Is this the end of the cannabis stock market, is Organigram a big scam similar to some other stocks that once did well but crashed and never recovered? Or did they fall victim of over-speculation? We believe the answer is “none of all this”. We believe there is an amazing buy opportunity shaping up although we must see the $5.75 level hold strong!

Organigram Holdings graduated from the Toronto Junior Exchange (TSXV) to the Toronto Exchange (TSX) last week. Its symbol changed from OGI.V to OGI.

The company published quarterly results in July, and these are the top line figures:

- Q3 and year to date 2019 net revenue of $24.8 million and $64.1 million, respectively, and Q3 net loss and net income from continuing operations of $10.2 million and $12.9 million, respectively

- Q3 and year to date gross margin, which includes the impact of fair value adjustments was ($0.2 million) and $59.5 million, respectively.

- Excluding the impact of non-cash fair value adjustments, the Q3 and year to date adjusted gross margin was $12.3 million or 50%, and $37.1 million or 58%, respectively.

- Q3 adjusted EBITDA of $7.7 million, or 31%, which was positive for the fourth consecutive quarter and year to date adjusted EBITDA of $27.8 million, or 43%

And this stands out in terms of outlook:

- Significant growth expected for fiscal 2020 as edibles and derivative products legalized, the number of cannabis retail stores expand, Organigram’s harvested amounts expected to increase materially, and further economies of scale expected to be realized

- To date in fiscal year 2019, the Company has captured strong market share and generated strong operating and financial results and focused on running its business to generate sustainable return on investment for shareholders in both the near-term and long-term. Although Q3 2019 results were impacted by a temporary decline in yield per plant, yields returned to previous levels toward the end of Q3 and into Q4 2019 (to date). The Company expects higher yields and increased efficiencies and economies of scale to decrease cost of cultivation in Q4 fiscal 2019 and Q1 fiscal 2020.

- Just as importantly, the Company’s average cannabinoid content continues to increase, and the Company has identified what it views as an optimal combination of high yields and high cannabinoid content. In addition, labour costs are not expected to increase commensurate with production, processing and sales volume, which should translate to further economies of scale.

Fundamentals of Organigram are great, its outlook is great, so why is this stock falling?

First, the whole sector is in a serious decline since April/May of this year.

Second, we believe because of intermarket dynamics capital is flowing out of this tiny cannabis sector into the much bigger precious metals space as explained in How Long Will Bearish Momentum Continue In Cannabis Stocks?

In fact we were able to quantify the outflow out of cannabis into precious metals: it is a factor 15x.

Third, chart-wise we identified a certain pattern on the Organigram chart but it might be that a different dynamic is at play. That’s why it is crucial to always (ALWAYS) challenge yourself and stay open minded. There may be another dominant chart pattern at play that you are not looking at. Always and continuously look for the ‘right’, dominant pattern.

Below is the shape of the pattern that may be at play. If this is the dominant pattern we will see strong support between $6 and $5.75. That’s just 10% below current levels. If support holds OGI is a strong (STRONG) buy!

[Ed. note: As of August of 2019 we provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific investing tips on a weekly basis, mid-week, free of charge. We do this for 4 months. Subscribe to our free newsletter and get premium investing insights in 2019 for free.]