Investing in banking stocks. Sound old fashioned, right? We would caution for narratives, they create bias. Banking stocks may not be the hot thing, like Robinhood and Gamestop in 2021. Then again, whatever ‘worked’ in 2021 is not likely going to work in 2022. We believe that the leading indicator(s) for banking stocks favor a profitable 2022. This is in line with our forecasts, especially the financials heavy Dow Jones suggested a moderately bullish 2022 because of the 100 year Dow Jones chart.

As per our 7 Secrets of Successful Investing we said that “narratives create tremendous bias and result in unawareness.” Admittedly, investing in banking stocks may not sound as the next big thing. But not every year in markets will favor the next big thing. Sometimes, it is the old big thing that goes up again.

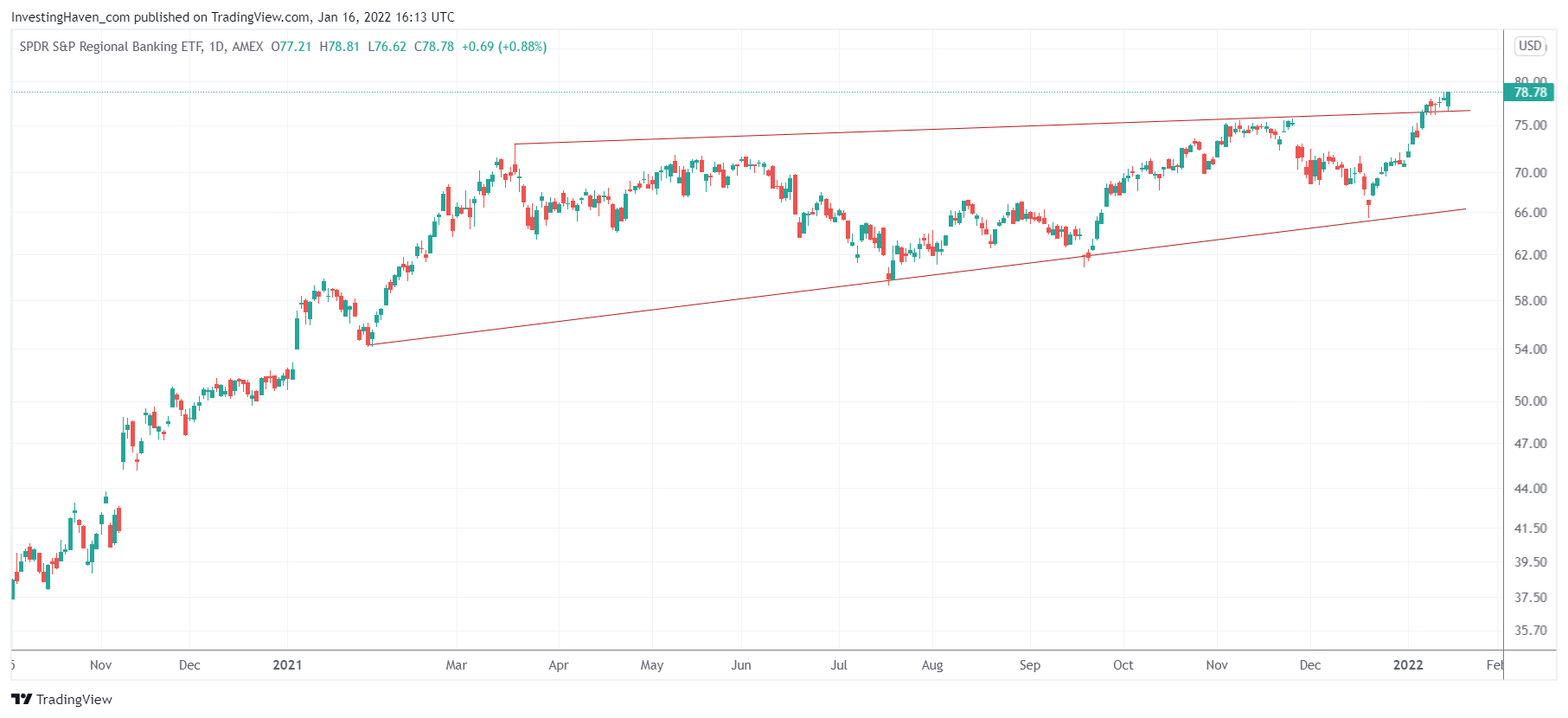

This is the chart of regional banks.

A breakout, as simple as that, it could have not been more clear. One that is in the making for a year.

You can clearly see a very nice W reversal, or a cup and handle formation, in between the two red trendlines.

Note: regional banks are unrelated to the newly emerging and popular trend of digital banks.

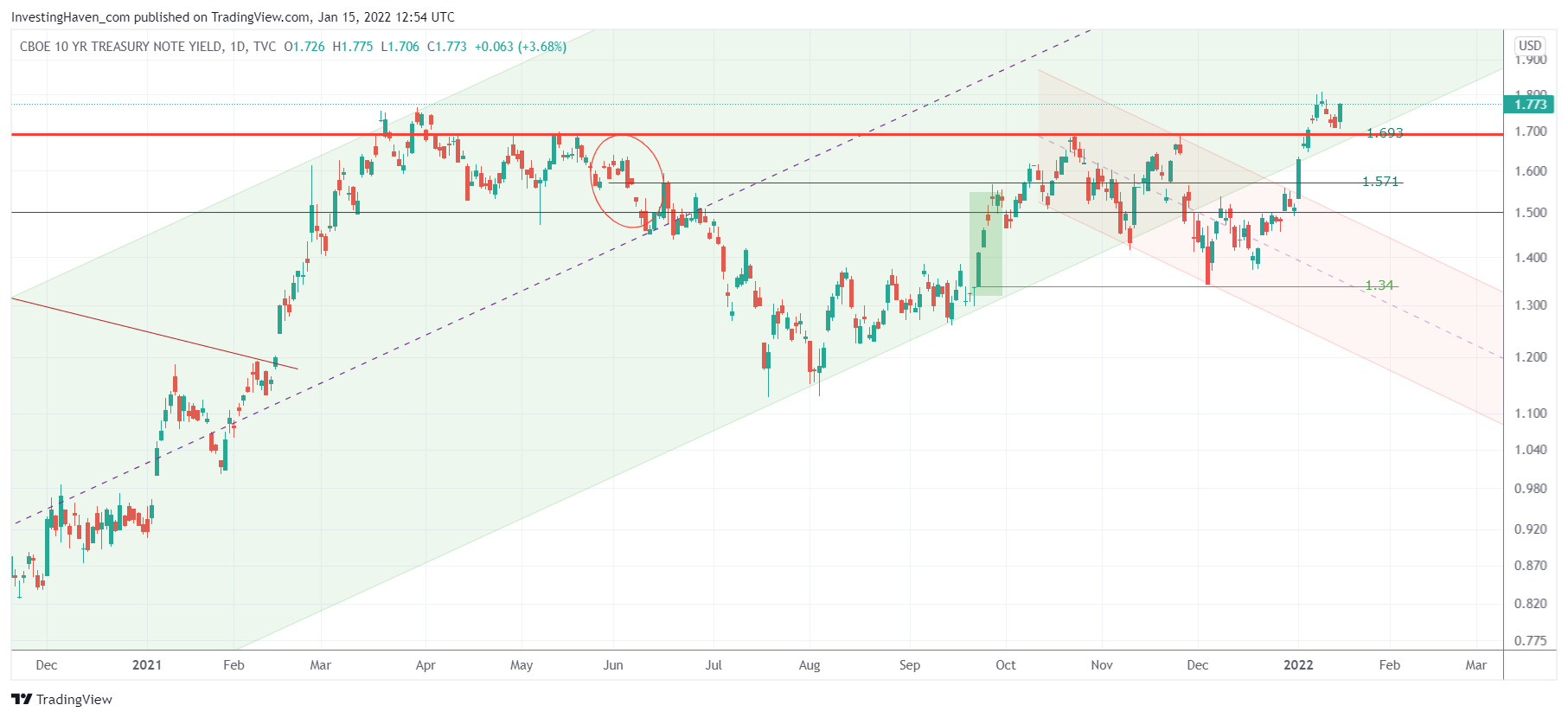

This is the leading indicator for financials: bond yields.

What else should we say about this chart other than ‘bullish’. If a leading indicator is bullish then the market it is influencing will be bullish as well.