The stock market acted weak this week. That is not a problem in and on itself. However, our leading indicator, the Russell 2000 (RUT) was the weakest of all indexes. That is a warning sign, though far from a stock market crash warning. We review our 2 leading stock market forecasting indicators in this article.

As per our 100 investing tips this is how we look at our 2 stock market forecasting indicators:

The secret about forecasting U.S. stock markets and turning points is to properly use 3 charts and leading indicators. First, on the highest level and longest timeframe, the 10 year Yields determine the multi-quarter risk on / risk off direction of stock markets as they move from top to bottom in rising or falling channels. Second, on a multi-year timeframe, the Russell 2000 to S&P 500 ratio determines the turning points based on breakout and breakdown patterns. Third, on an intra-year basis, the Russell 2000 to 10 year Yields ratio determines the turning points based on breakout and breakdown patterns.

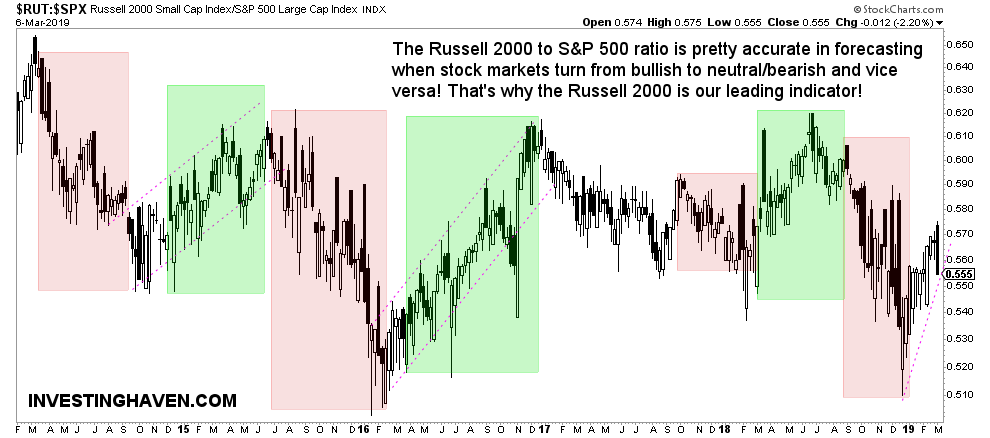

Let’s first review the a multi-year timeframe forecasting indicator: the Russell 2000 to S&P 500 ratio which determines the turning points based on breakout and breakdown patterns.

We see that the recent bearish period of 6 months ended in January. After a strong rise of this forecasting indicator there is retracement to the newly rising trendline (dotted pink trendline annotated on the chart).

The message of this forecasting indicator is clear: a test of the turning point. No harm done yet, but an important point to watch.

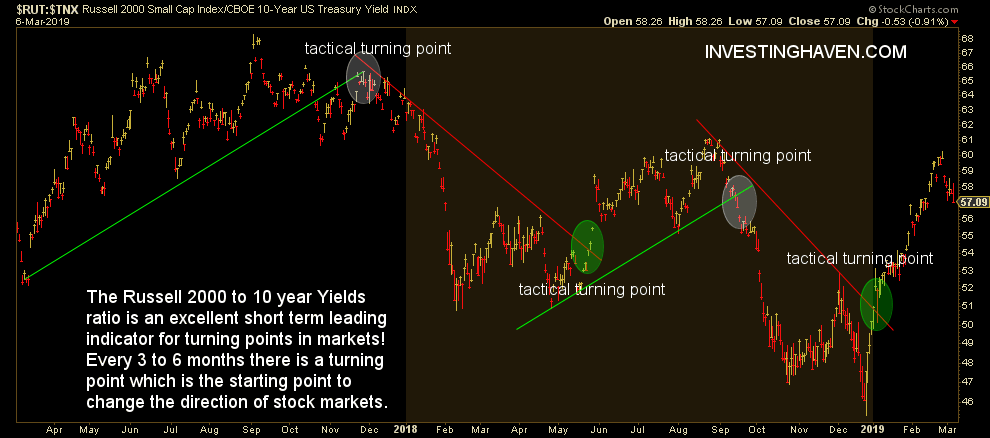

Let’s then review the intra-year forecasting indicator: the Russell 2000 to 10 year Yields ratio determines the turning points based on breakout and breakdown patterns.

After the bearish ‘risk off’ trend from October till January this forecasting indicator shot up sharply. It is now coming down. This is a very short term oriented indicator. It mostly turns in a time period from 3 to 9 months. We believe this indicator needs more data before setting a new pattern. For now benefits of the doubt to the ‘risk on’ thesis.