Stocks were weak, and even saw a strong -3% sell off since the U.S. Fed lowered interest rates some 10 days ago. Is this the start of the next stock market crash is what many are asking? Or, maybe not as extreme, but can we expect above average stock market turmoil in August of 2019? One potential clue can be found in our leading indicators, and the other one in our 100 investing tips. We also review how the 5 Shocking Charts From 1987 and Similarities with a Market Crash In 2019.

Note that what happened in the last ten days is a serious clean up in the camp of bulls, even to extreme levels. We recommend checking the bulls vs. bears chart (showing that bulls plummeted from 38% to 22% and bears literally doubled to 48% – most extreme levels since December) as well as this historic S&P 500 corrections chart (since 1990, the average year has seen 3.3 separate 5% pullbacks a year, for 2019 this was the second).

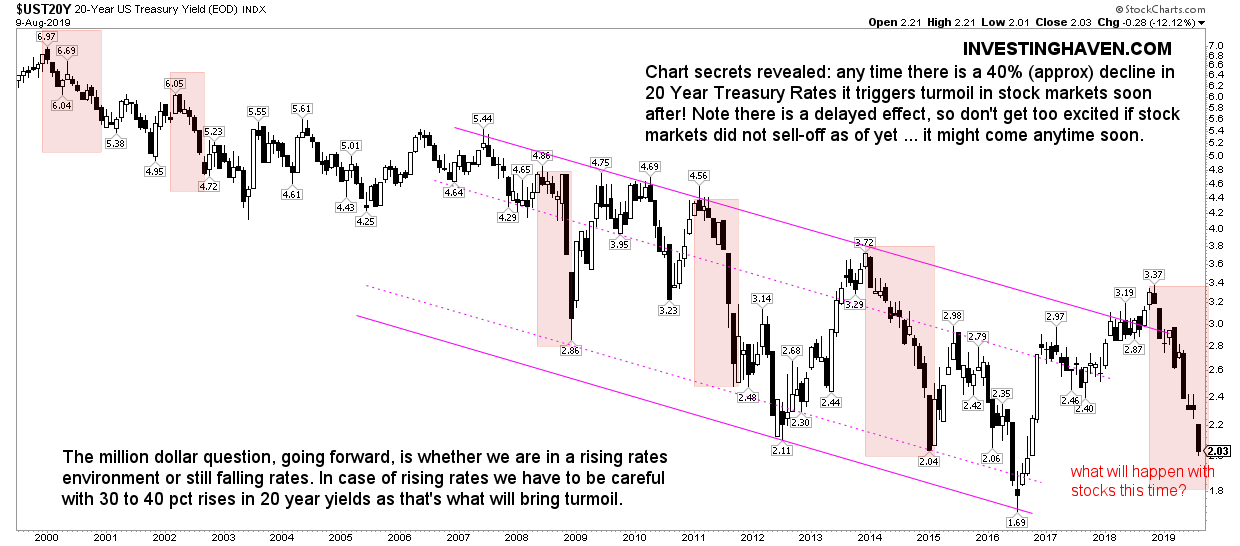

First of all, as said in our investing method, it is Treasury rates as well as the Euro that are leading indicators for stocks.

All major moves in markets, especially market crashes, start with major turning points in credit and currency markets. That’s why 10 and 20 year rates, as well as leading currency pairs, have the most influence on all other markets, including stock markets around the globe.

What does this mean?

That investors do NOT have to check all the stock market indexes. The answer to our question “Is this the start of the next stock market crash is what many are asking? Or, maybe not as extreme, but can we expect above average stock market turmoil in August of 2019?” does not come from the charts WITHIN the stock market, but from charts OUTSIDE of the stock market.

Counter intuitive?

Maybe, but not when taking intermarket dynamics into account. In the end all capital in almost a finite ‘body’ so capital simply flows from one asset (class) to another asset (class) in its never ending search for profits.

The one chart that may have an answer to the question we are looking for is the Euro. As said Currency Market Writes History: Why Is The Euro Flat For 12 Months the Euro chart is flat, flat, flat. It did not change in the last weeks.

No, the Euro has not the answer we are looking for.

What about Treasury rates?

Different story, as this is the source of the turmoil we have seen lately.

The 20 year rates chart, embedded in this article, shows what a crash took place in credit markets. This is serious, it really is. It’s an almost 50% decline in rates only in 2019!

Our rule of thumb is the 30 to 40 pct declines in rates result in shockwaves across global markets.

So we have two questions to solve:

- Is there more downside, as in how bad can it get? The answer is that we are near rock solid bottoms, at least for the short and medium term. We see another 10% downside to 1.8 in 20 year Treasuries.

- What is the effect of an almost 50% decline? This may be serious! On the one hand we do NOT see a similar big move in leading currencies, which is the good news. If the Euro would have crashed we would have flashed a big SELL on all stocks! That’s not the case now!

What is happening probably is this massive flight into Treasuries, a safe haven. There is serious capital flowing out of stocks into bonds, hence the falling rates.

As the Euro remains stable we believe there will be no serious impact on stocks and other markets. This remains to be confirmed though, so we may come in a high alert state but we don’t believe so.

We don’t see similar effects as in 1987, with Black Monday, when both rates and the USD went through a big, big move a few months for the stock market crash. This is subject to change, and we keep a very, very close eye on this!

[Ed. note: As of this week we will provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific investing tips on a weekly basis, mid-week, free of charge. We will do this for 4 months. Subscribe to our free newsletter and get premium investing insights in 2019 for free.]