How many times, recently, did you notice media or analysts referring to a stock market crash similar to the 2008 crash? Quite often, most likely. It is unbelievable how anyone can buy this coming-market-crash story. All risk indicators, literally all of them, signal ‘risk on’ and a continuation, if not acceleration, of the grand stock bull market in 2018. Especially the mid-cap sector, one of our risk indicators, confirms the ongoing stocks bull market as well as ‘risk on’ in the second half of 2018!

Reading markets is all about identifying and understanding leading indicators. Whether it is a risk indicator, an inflation indicator, deflationary forces, sector breakouts, …, every trend has leading indicators that must be followed closely and interpreted correctly.

Guess what, this work is completely unrelated to ‘news’. That is the reason we keep on repeating to stay away from news, or, ultimately, understand which 1% of the news really matters. This is part of our 1/99 Investing Principles, and we apply our principles strictly as they have stood the test of time.

At InvestingHaven our only objective is to bring the news that truly matters, the 1% that we pick up on mainstream media or the news we create ourselves which can be deducted from charts as well as leading indicators.

What does ‘risk on’ in 2018 imply?

Particularly in the U.S. we follow a limited number of leading indicators when it comes to understanding whether investors lean towards ‘risk on’ vs ‘risk off’. That’s important because ‘risk off’ implies markets will fall (significantly) which typically happens in cycles of 6 (minimum) to 18 (maximum) months.

On the other hand during ‘risk on’ cycles we not only see higher stock price, but, more importantly, specific sectors literally get on fire. Think of the cryptocurrency market last year (it peaked at the end of a strong ‘risk on’ period), and, most likely, the cannabis sector in the second part of 2018. That’s the 1% of times when investors can make asymmetrical returns!

Mid-Cap Sector Confirms Stocks Bull Market And ‘Risk On’ In 2018

How to know whether markets are in ‘risk on’ in 2018?

It is very simple, there are a small number of leading indicators to follow.

First, interest rates must point up, especially 20 year yields as well as the differential between long term vs shorter term yields. This indicator is bullish today.

Second, small cap and mid cap stock sectors must be bullish. What does bullish mean? It means that their chart pattern is in bullish territory, and points to higher prices based on the dominant trend.

Think of it as a heatmap. Every chart, when analyzed properly, annotated with patterns, resembles a heatmap.

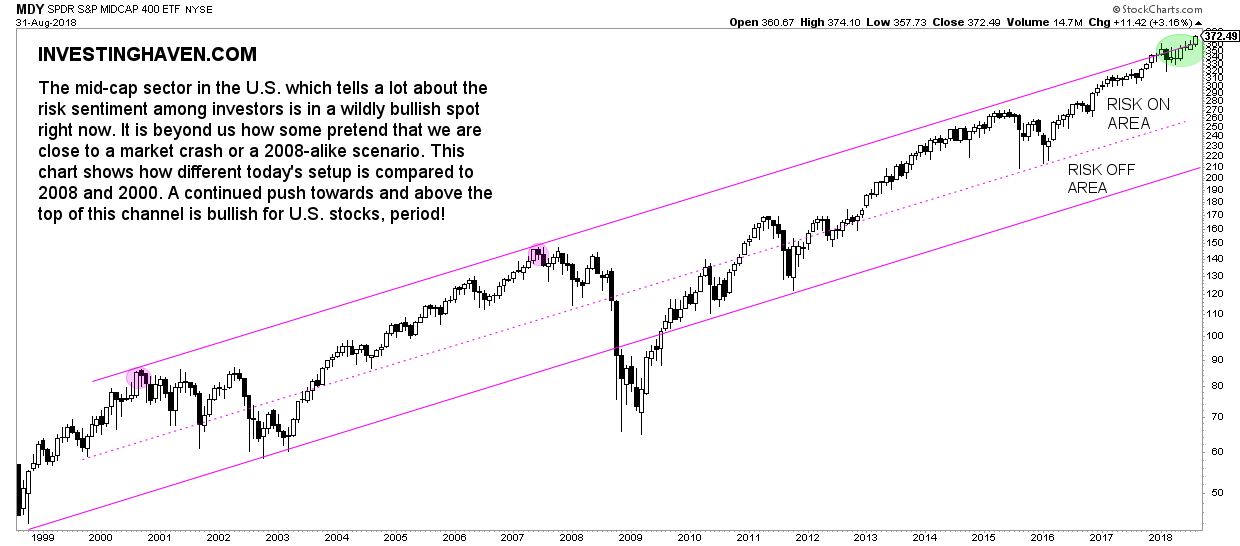

If we apply this to the mid-cap sector, and take the MDY ETF for the purpose of ou analysis, two things stand out. First, the long term channel is intact, and, particularly, the sector is in the bullish ‘risk on’ area. Second, and more importantly, the mid-cap sector continues to trade near the upper area of its bullish ‘risk on’ area for 10 consecutive months now!

You should compare today’s situation with the 2000 and 2007 tops. In no way is 2018 comparable with the major crashes we saw back then!

It really (really) is that simple. No magic, no guru talk, no Warren Buffet or George Soros has to be consulted.

InvestingHaven firmly believes that stock markets, not only in the U.S. but even global stock markets, are pointing higher in the months to come. We prepare for a strong end-of-year rally.

More importantly, we expect one or two sub sectors to perform extremely well. First and foremost, the cannabis sector is about to explode. As said before, during ‘risk on’ times there is explosive power in high risk sectors. Second, the crypto market will do well, though not as exceptional (yet) as last November/December, it is more like a warming up that we expect for explosive prices next year (ultimately 2020) so now is the time to take positions as prices are low. Remember, smart investors buy low when nobody cares (after the puke phase) and sell high, not the other way around!

Want to know which cryptocurrencies and blockchain stocks to buy? Become a premium crypto member and find out >>