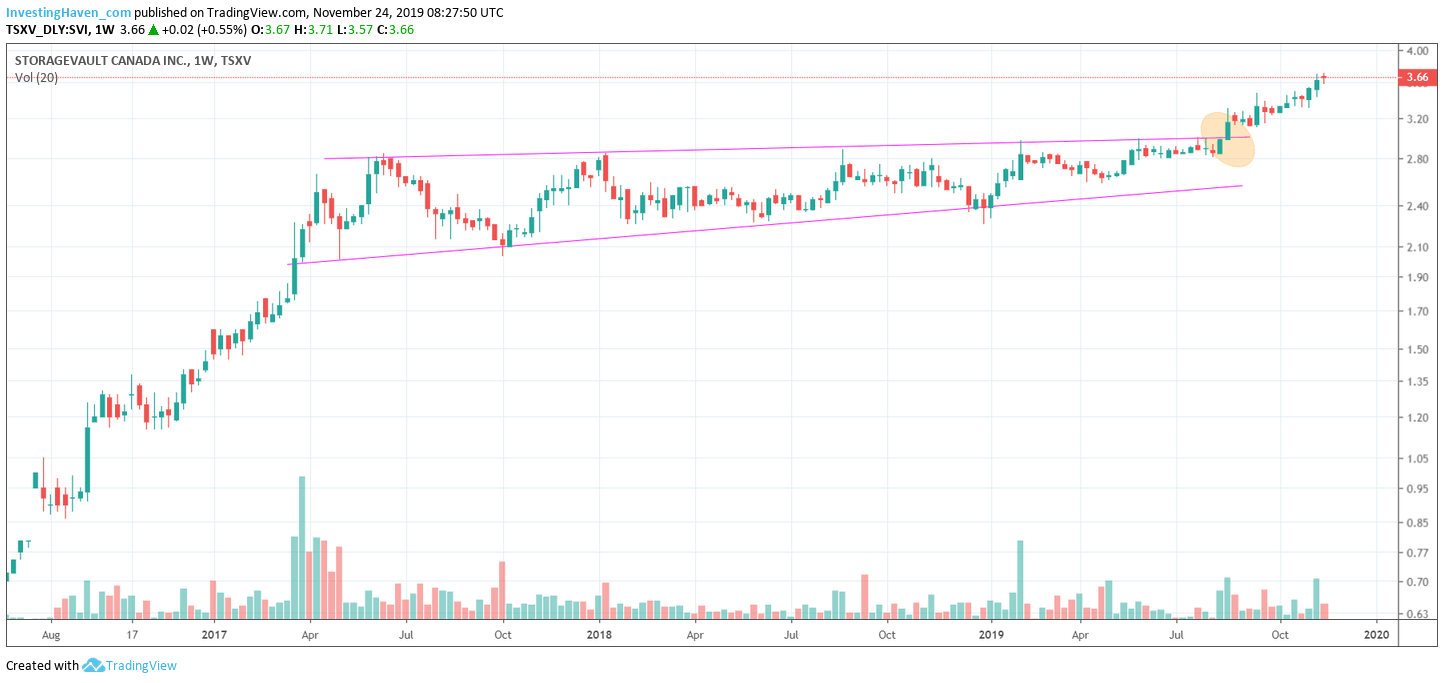

A few months ago we started our series of Investing Opportunities. This is a series of 16 articles in which we apply our method of identifying a less risky investing opportunity which should return 30% in a year, and one high risk opportunity that should double. If we avoid significant losses we are able to (more than) double our capital each and every year. The cumulative power kicks in, and it allows to turn 10k into 1M in approx. 7 years (maybe 8 or 9, but it’s the direction that matters). In September we disclosed one of our top picks which was Storagevault Canada (SVI.V), and tipped it at 3.20 CAD to subscribers. Today, it trades at 3.66 CAD, and we are happy to make it public now.

This series of 16 articles on Investing Opportunities runs until the end of this year. That’s where we will make a choice to offer this as a premium service.

In the meantime we want to prove out if we are capable of spotting those opportunities. That’s why we offer this premium service for free, until December. If you are not a subscriber of our free newsletter you can sign up here and try it out for free.

All this fits into InvestingHaven’s Mission to Forecast The 3 Top Opportunities Per Year.

One of the things we try to do is guide our members in the process of identifying candidates and making the most optimal choice. That’s what we did in these 2 editions:

Investing Opportunities #9: Stock Shortlist For The Coming 12 Months

Investing Opportunities #10: Actively Manage (Y)Our Shortlist

That’s because many investors simply don’t understand what that process looks like. We are told a rosy story by those subscription sellers who pick stocks and pretend as if this is simple business. It really isn’t.

The one stock that we selected in edition #9 and #10, after reviewing many hundreds and selecting a shortlist of 10, is Storagevault Canada (SVI.V).

Today we show this in the public, after this stock has gone up +15%. We tipped it at 3.20 CAD.

This chart shows awesome. Other than the financials and fundamentals of this company being sound and solid, the chart is eve more constructive!

What we particularly like is horizontal breakouts after a +2 year basing period. That’s extremely powerful, and that’s why SVI.V became our top pick.

The other pick was XLNX, and it is struggling currently. We will cover both in the first next edition which is due before 11.26.