Tesla’s stock price is falling fast. Just one week ago we wrote Tesla’s Stock: Bearish Target Almost Met, Buy Opportunity Of 2019? when it was trading at $214 with a price target of $190. At Friday’s close our bearish target was met. To make things worse a CNBC article this week summed up the very ‘disturbing’ variety of price targets that Tesla’s stock price got from analysts and financial institutions. The most bearish price target for Tesla is $10 while $560 was mentioned by another firm as their most bearish case and $4000 being their most bullish projection. Tesla is the most controversial stock right now. Where do we go from here?

Tesla’s fundamental picture

Interestingly this CNBC article sums up the price target mentioned before, especially who made them and why. Two quotes are helpful:

Tasha Keeney, an Ark analyst, said in an interview on CNBC that Wall Street is “misunderstanding the Tesla story” and the potential upside of Elon Musk’s vision. Musk’s accomplishments are widely acknowledged, but he’s gotten himself and Tesla into trouble with the government over his comments, stemming from an August tweet about possibly taking the company private with “funding secured.”

“We want them to get as many cars on the road as possible” with the next step of running a “fully autonomous taxi network.” Last month, Musk promised 1 million vehicles on the road next year that are able to function as “robo-taxis,” a claim that was generally thought to be optimistic, at best. On an investor call earlier this month, two of the invitees told CNBC that Musk predicted autonomous driving will transform Tesla into a company with a $500 billion stock market value. As of Thursday’s close, Tesla’s market cap was just over $34 billion.

According to us, there is a phenomenal fundamental story underlying Tesla but their cash burn rate is the major issue. The trillion dollar question is whether there can be any breakthrough which leads to accelerated revenue.

Note that current revenue $22B which makes Tesla’s price to sales valuation stand at 1.6x which is 5 times as high as a car manufacturer Ford or GM but is 4 times lower than a software company like Microsoft. Relative to its sales Tesla is well priced, arguably undervalued, but costs need to be controled an ideally revenue need an acceleration.

The fully autonomous car is of course what may make the difference and disrupt the car industry but also the taxi industry with the comment Elon Musk made “Musk promised 1 million vehicles on the road next year that are able to function as “robo-taxis,” a claim that was generally thought to be optimistic, at best.”

With an unusually high short float ratio of 28% the market clearly tends to doubt about the stories from Elon Musk.

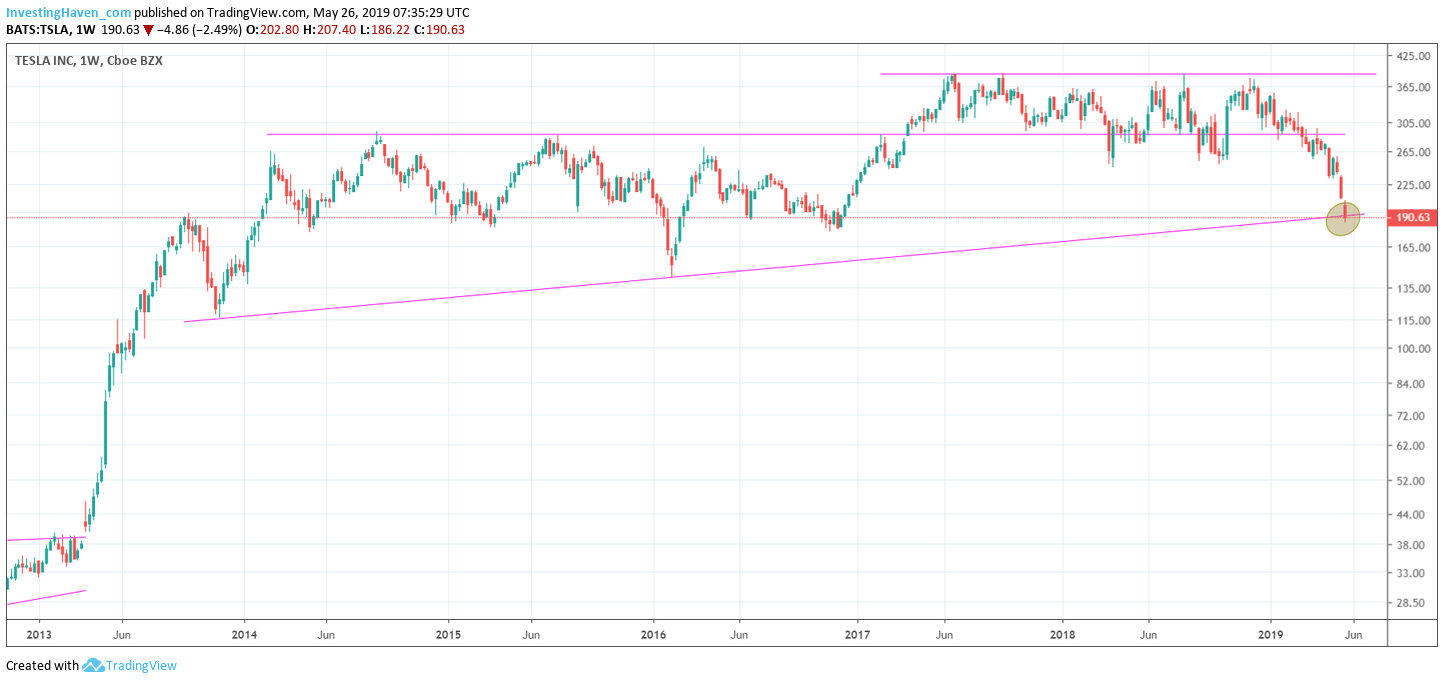

Tesla’s chart

Tesla’s stock price chart is as simple and clear as possible: bearish target met, time for a new pattern.

We either see a continuation of the bearish move which may lead to $115 ultimately.

The other very likely scenario is that the end of the decline is near, we see a consolidation around current price levels, only to start a move higher in the next weeks or months depending on the broad markets as well as Tesla’s news.

We would not bet our money yet, says InvestingHaven, but we prefer to give this stock a bit of time to prove itself first. But Tesla looks like one of the best potential opportunities for the next few years.