What’s the next big trend in the stock market? It looks like tech stocks are getting ‘tired’, and their explosive potential which we witnessed early this year (post Corona-crash) is losing steam. InvestingHaven’s research team is on record with a this market forecast: financial stocks are about to boom. Yes, the next big trend in stock markets is in the financial space, because of the regular leading indicator analysis. As per our 100 investing tips interest rates are trending higher, and this positively affects financial stocks as long as our bullish stock forecast for 2021 remains in play. The two charts we use for this 2021 prediction: 10 year rates and crash indicator VIX.

First, interest rates.

Below is the daily TNX chart, aka 10 year interest rates.

You don’t need a PhD to observe what is happening in 2020. First, a giant bottoming (basing) pattern that took 6 months to complete (any coincidence that this is a 2x 3 month time period?). Second, a new uptrend in the last 6 weeks.

First target is 10.89, and second target 14 points.

Needless to say, as interest rates are the leading indicator for financial stocks: some select financial stocks will be multi-baggers by the time TNX hits 14 points. Which ones? We took 2 positions in our Momentum Investing portfolio, both have between 25 and 50 pct upside potential (if not more) over the next 3 to 6 months.

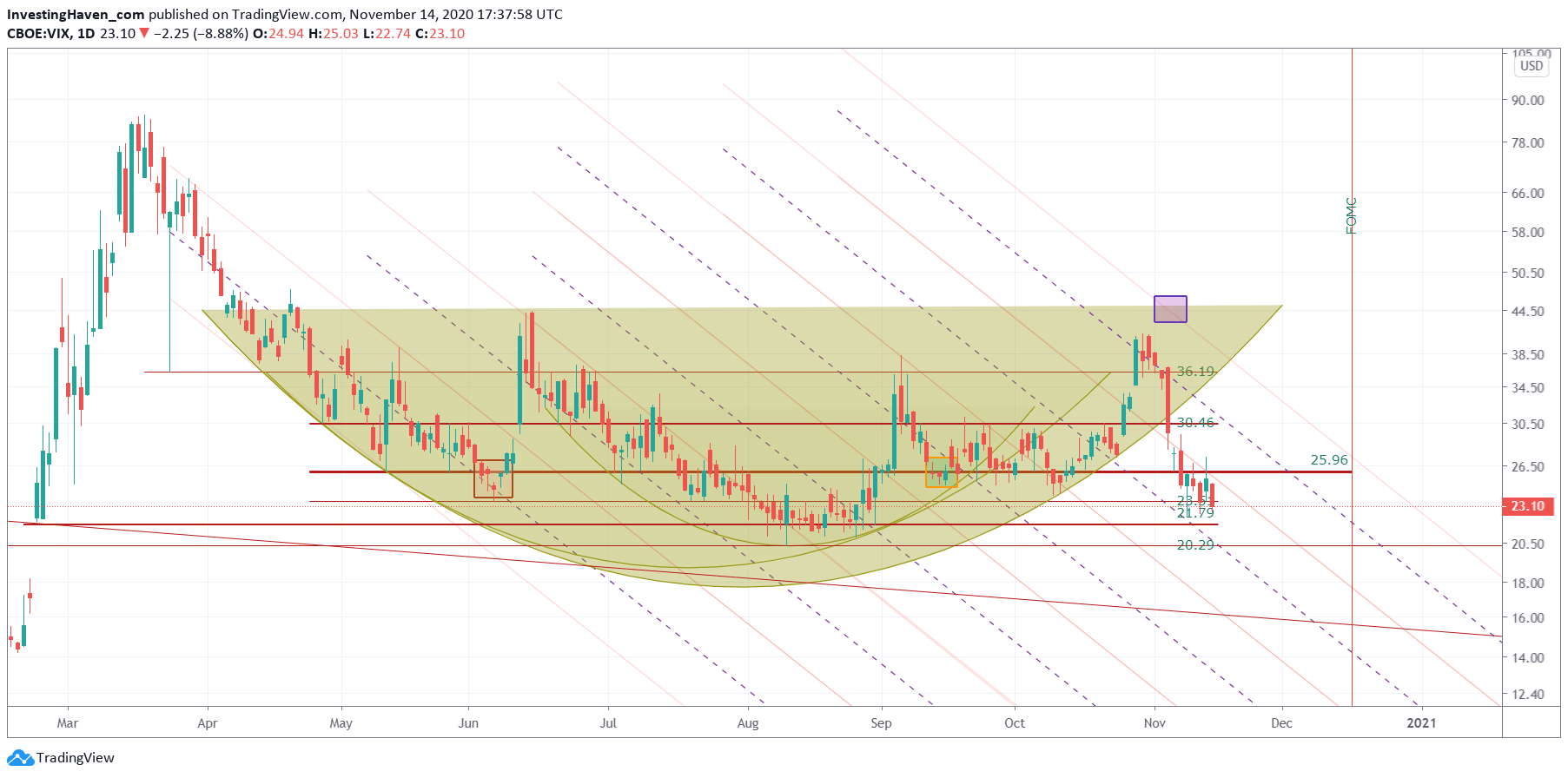

The second chart we use for this bullish financial stocks prediction is the VIX indicator.

The second chart we use for this bullish financial stocks prediction is the VIX indicator.

We can talk for hours about this chart, but the one observation that stands out is that the April to November reversal (bearish for stocks if it would hold) got invalidated last week.

Green light for stocks, and a screaming BUY favoring financial stocks, especially when combined with the above chart … that’s what we conclude.

Financial market analysis does not have to be complicated, it has to be precise and consistent. As per one of the many quotes of wisdom we share with our premium members, from one of our recent educational updates Momentum Investing: Meet Your Biggest Enemies (August 30th, 2020):

As per the book it might be tempting to think that fund managers are more akin to weathermen but sadly the evidence suggests the opposite. The author explains how fund managers leverage information in their investing decisions, leading them to a high level of confidence on the success of their investment. They believe they are a step ahead of the herd, making them believe they get in before everyone else and get out before everyone else.

From the book Behavioral Investing: “Despite the evidence it seems that this is exactly what a large number of investors spend their time doing – trying to be the smartest person in the room. So if we can’t outsmart everyone else how on earth can we invest? The good news is that we don’t need to outsmart everyone else. We need to stick to our investment discipline, ignore the actions of others, and stop listening to the so-called experts.”

And don’t forget, when it comes to information: there is always, ALWAYS, a reason to justify the opposite trade. You may have looked into a long position, and got re-assurance from whomever or whatever out there. But there are equally great points to be made, rationally, that the opposite trade is a good one.

We took 2 positions in financial stocks, in both there is momentum brewing. You can feel free to find out which stocks we invested in by signing up to our Momentum Investing service.