We have been tracking the Euro chart very closely in the last 4 months. Our point of view was that the closing price of April, May and even June would be crucial. For now we continue to see strong price action in the Euro, both on the daily and monthly time frames, which should forecast an overall bullish trend for markets and commodities in 2021.

One of our members asked this question: “Why is Euro an indicator? Especially now, with a bad COVID situation in the EU? Moreover, economically, leading countries like Germany, France, Italy are in bad shape and the EU tourist industry might be at risk for this season.”

That’s a great question, and we’ll have to take a 50,000 feet view to answer this question.

The Euro is a leading indicator for markets. This goes beyond its functional usage of a currency in the EU. It is its intermarket function in global markets that matters.

Intermarket analysis is about identifying capital flows across markets and market segments. As explained in our 100 tips for investors:

All major moves in markets, especially market crashes, start with major turning points in credit and currency markets. That’s why 10 and 20 year rates, as well as leading currency pairs, have the most influence on all other markets, including stock markets around the globe.

In plain simple terms: major moves in currencies are the signs of large capital flows into defensive or aggressive segments. Risk sensitive segments get a bid if the Euro is doing well. The opposite is true as well: once the USD is rising it indicates that large investors are going into cash presumably because they want to protect their capital (selling risk assets, holding USD).

The underlying dynamic here is that the EURUSD pair is such a big market, with a daily trading value of approx. 1.7T, that any significant move in the EUR and the USD is able to influence other markets.

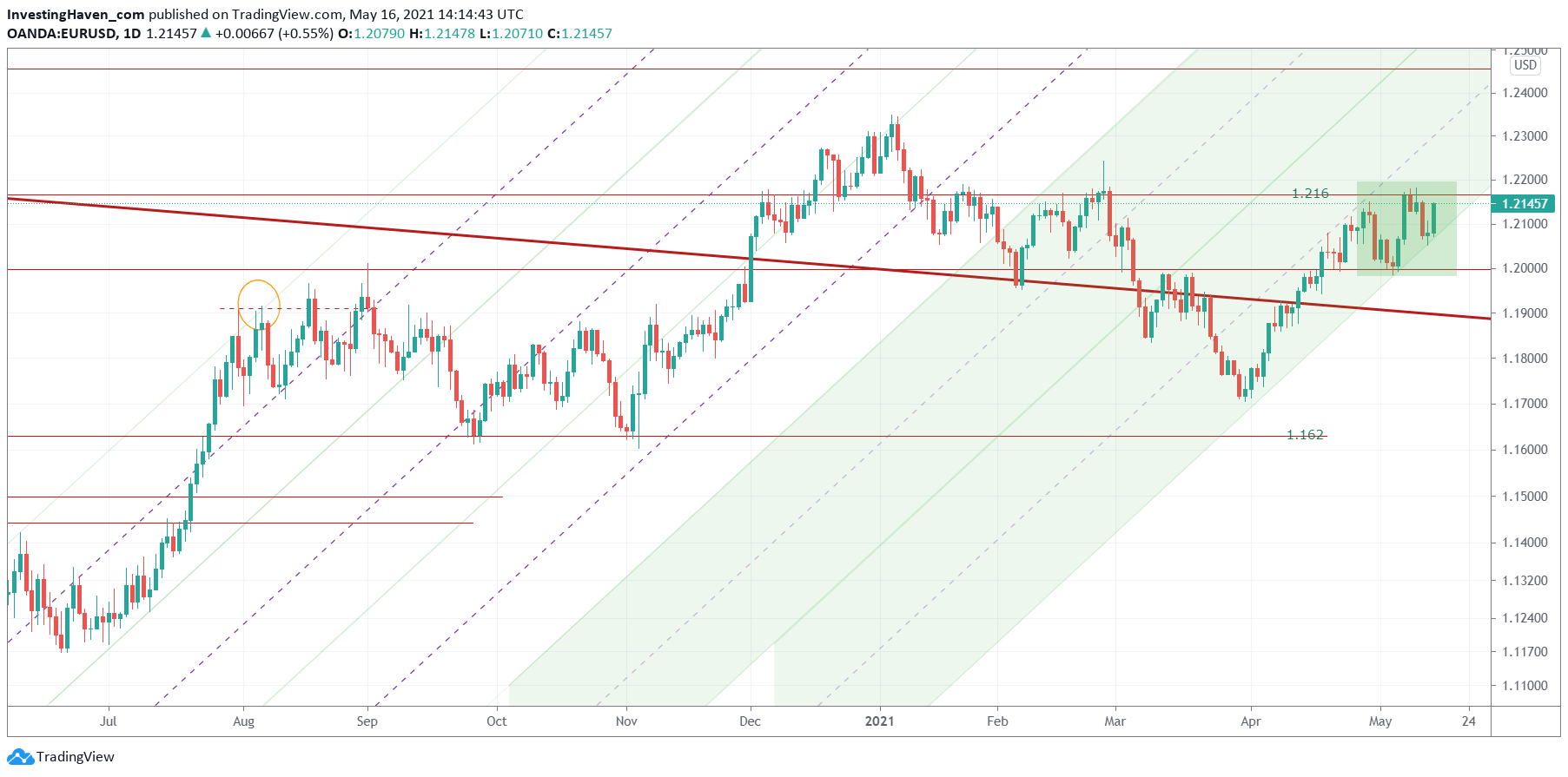

That said, the daily Euro chart has a strongly bullish looking now. The small green box is a bullish micro pattern, and that’s exactly what’s needed to overcome resistance at 1.216 points.

However, it is a MUST for the Euro to break 1.216 points in order to continue to be bullish. The resistance here is big, let’s not underestimate the importance of current levels.

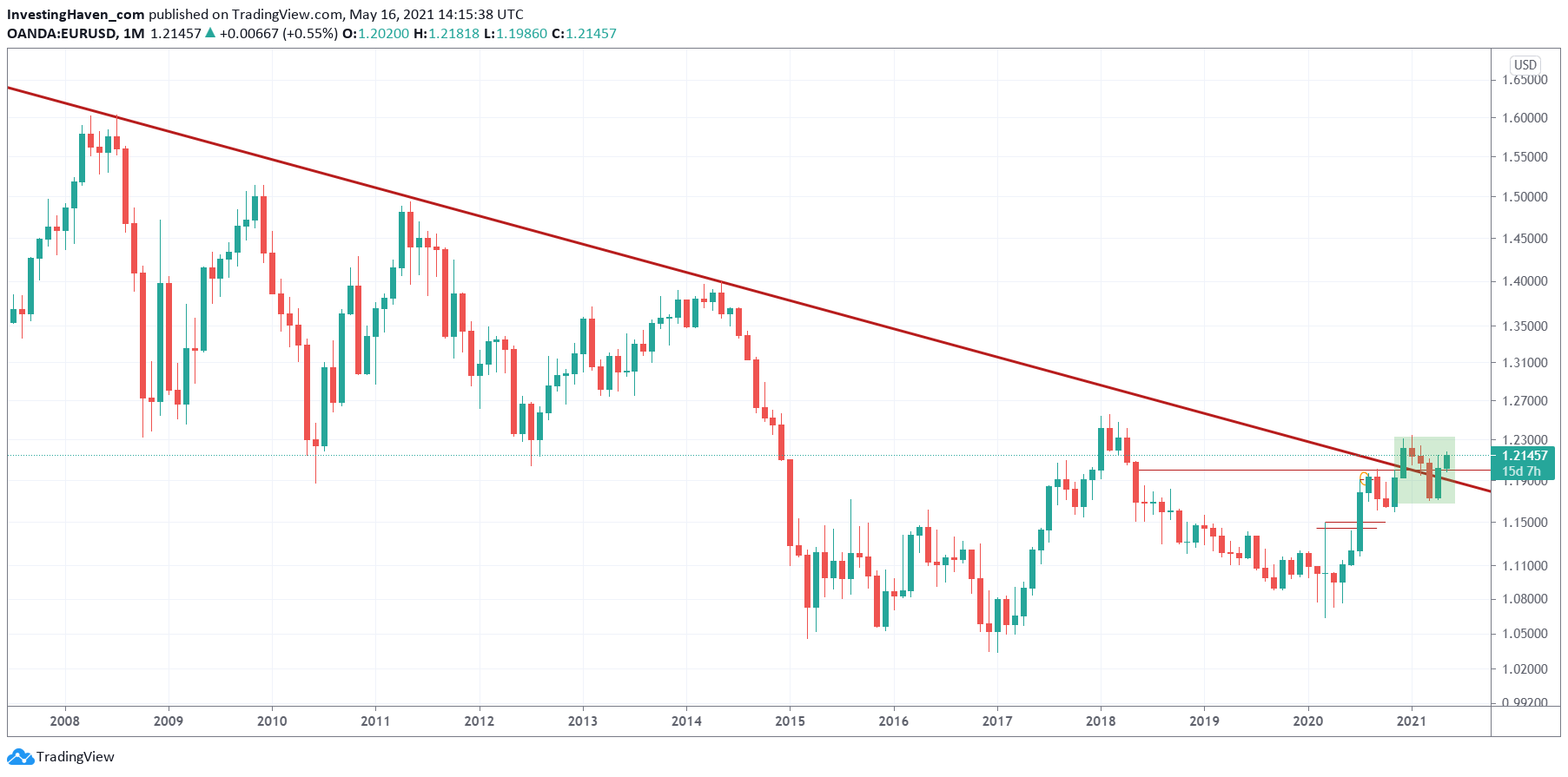

The red thick line on the above chart is also shown on below chart: it is a 12 year trendline. The Euro’s monthly closing price will be crucial, as a bullish setup right at this secular trendline would be crucial. The opposite is true as well.

Note that the Euro may not be influencing markets in the very short term. Think of it as a mid to long term indicator and influencer.