One of our leading indicators lost its bullish structure, as said last week in Small Caps Not In A Great Spot To Weather A Mid-Cycle Turning Point. It is now vulnerable which is not the same as ready to start a market crash. As long as the 2022 lows are respected, on a 3 to 5 day closing basis, it is signaling a continuation of the consolidation. This latter scenario would set the stage of a summer rally, which is one of our 2023 forecasts.

Analyzing the Russell 2000 chart is of utmost importance for investors and chartists, as it serves as a valuable momentum indicator and a leading signal for the broader stock market. This index provides insights into whether momentum is accelerating (bullish) or decelerating (bearish), guiding investors on potential opportunities or risks. The significance of studying the Russell 2000 chart lies in its ability to signal turning points and trend reversals, offering valuable clues for market participants.

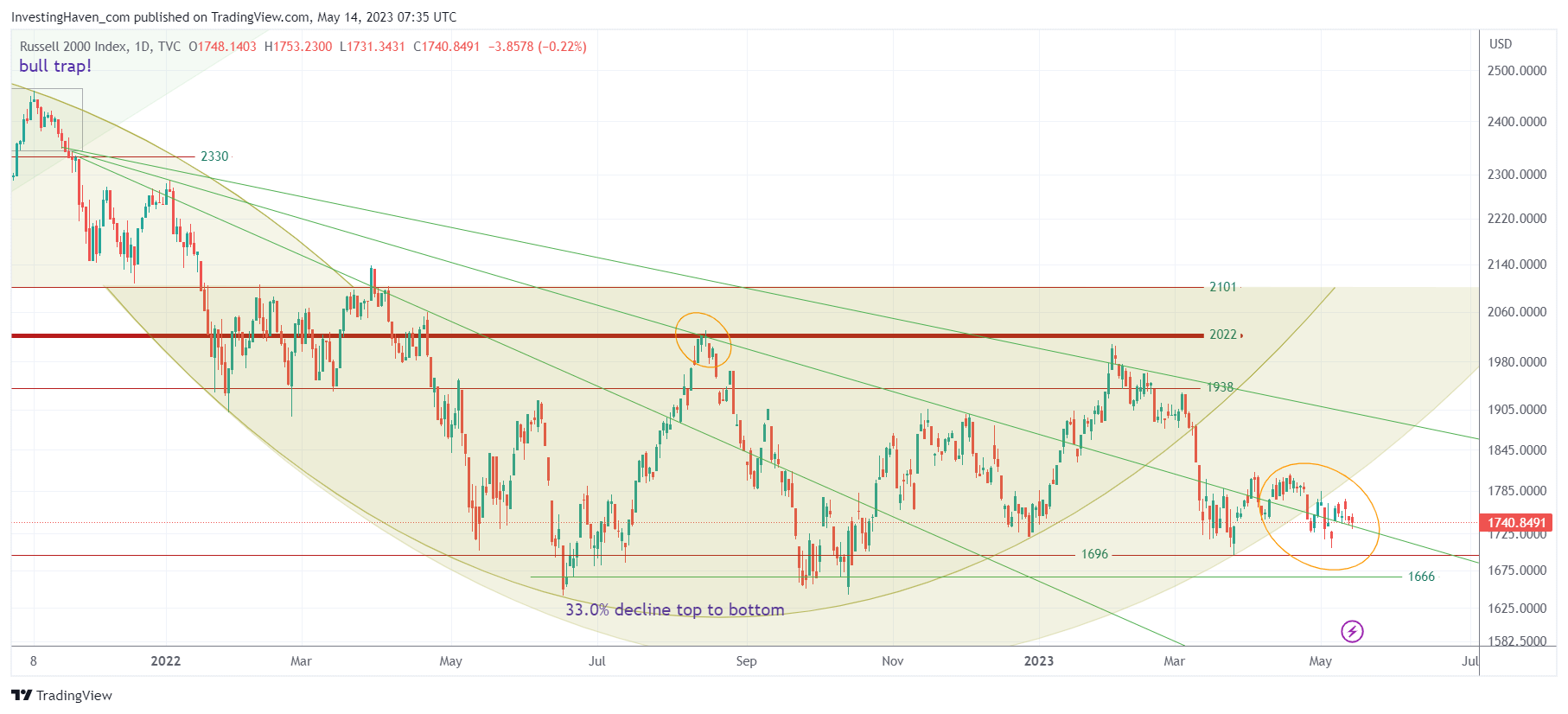

The Russell 2000 chart since its peak in November 2021 reveals a deteriorating pattern, causing concerns about its bullish structure. As a leading indicator, the index’s weakness may imply broader market vulnerabilities. Understanding the interplay between the Russell 2000 and the overall market is crucial for investors seeking to stay ahead of potential market shifts.

Analyzing the Russell 2000’s Chart Structure and Historical Influence

The current chart pattern of the Russell 2000 indicates a significant development: the breach of the rounded pattern on May 1st. This breach suggests a loss of bullish momentum, potentially leading to further downside pressure. Additionally, the presence of three prominent falling trendlines underscores the importance of these levels in shaping the index’s direction. These trendlines have exerted substantial influence over the Russell 2000 since last summer, serving as crucial support and resistance levels.

Looking ahead, a critical factor to monitor is the behavior of the 2022 lows. The upcoming tests in May and June will play a crucial role in determining the index’s trajectory. It is anticipated that the May test will hold, reflecting a temporary pause in the downward momentum. However, the outcome of the June test will depend heavily on the actions of officials and policymakers.

The influence of officials and politicians on market trends is an unfortunate reality in today’s financial landscape. Decisions regarding the debt ceiling and the policies set forth by the Federal Reserve will significantly impact market sentiment and direction. This heavy reliance on external factors highlights the delicate balance between market forces and the actions of those in power.

Conclusion

In conclusion, the Russell 2000 chart’s loss of its bullish structure raises concerns about the vulnerability of this index and potentially the broader market. As a leading indicator, its performance offers valuable insights for investors and chartists seeking to navigate the ever-changing market landscape. The breach of the rounded pattern and the prominence of falling trendlines underscore the importance of key support and resistance levels.

Moving forward, close attention should be paid to the upcoming tests of the 2022 lows in May and June. The outcome of these tests, coupled with the actions of officials and policymakers, will shape the market’s trajectory in the near term. While the influence of officials on market trends is regrettable, investors must stay vigilant and adapt their strategies accordingly to mitigate risks and capitalize on opportunities.