Under Armour (UAA) was in great shape in 2019. However, after its earnings release on July 30th, 2019, the stock lost more than 25 pct of its value. Justified or not? We look into this question in this article, and articulate a very clear conclusion for our followers. Note that we did consider UAA as our opportunity with a 30% upside potential as part of of our momentum investing method, which is why consider this an important stock for 2019.

The earnings report revealed some very good news, and one potential concern.

- The concern was that Under Armour warned of weaker demand in North America, its largest market. North American sales fell 3% to $816 million. This failed to offset a 17% gain in international revenue, which was $339 million.

- Under Armour’s loss for the three months ended in June was 0.04 per share, narrowing from the 0.08 per share loss recorded over the same period last year and just ahead of the Wall Street consensus forecast of a 0.05 loss.

- Group revenue, Under Armour said, matched expectations at $1.2 billion.

- Looking into 2019, the sportswear group said its sees revenue rising between 3% and 4%, with gross margins improving to between 110 and 130 basis points. Earnings were forecast in the region of 33 to 34 cents per share, however, around 2 cents shy of the Wall Street estimate.

This how the CEO summarized the latest earnings report: “Our second quarter results give us increasing conviction that our transformation continues to make solid progress across our business, unlocking efficiencies that are driving greater precision, consistency and repeatability. By staying sharply focused on our long-term strategies – driving our premium athletic brand positioning through industry leading innovation, geographic expansion and creating deep connections with our consumers – we are on track to deliver against our expectations in 2019.”

The last 10 words are the ones that should stand out.

If the market is 6 months ahead of time, then why would UAA sell off almost 30% if this company is on track to deliver against 2019 expectations?

Moreover, CNBC writes that Nancy Tengler, chief investment strategist at Butcher Joseph Asset Management, says “management at companies such as Under Armour and Lululemon has played a massive role in their outperformance this year. However, she is steering clear of the entire apparel retail space in favor of a different slice of the consumer market, referring to stocks like Starbucks.

We partially agree with this. While it is 100% true that Starbucks had an amazing 2019, it was only because of a chart breakout. After several years of consolidation the fundamental picture was just way too good for the market to ignore it. The breakout took place a few months ago, it was unavoidable.

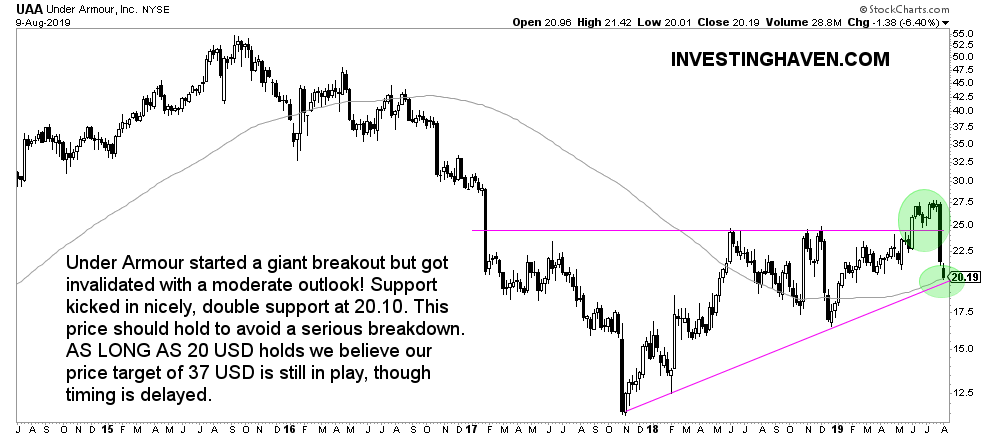

Similarly, Under Armour looked ripe for a breakout when we did spot Under Armour: Breakout Stock Of June 2019.

Under Armour: buy or sell?

Uncoincidentally, the heavy sell off of Under Armour came exactly at the same time all broad stock indexes sold off, the day before the U.S. Fed announced its rate cut. This only accelerated the ongoing sell off.

According to us this is primarily an emotional reaction, which is clearly overdone.

We see that fundamentals of Under Armour look great, and that international sales continues to rise along with profitability. The lower than expected U.S. sales growth is a potential concern, but not to the extent that it justifies such a hard decline in this stock in the last 2 weeks.

It is true that sales against the same quarter last year did hardly grow, as seen here. It is also true that a few % growth in the U.S. would have made a significant difference.

We believe that management has a track record of bringing Under Armour to the state it is in today, because they are capable. We are confident they will find a way to make U.S. sales grow, although this is an expectation and not a proven fact at this point in time.

What we absolutely want to see is strong support at $20. If that’s the case we believe UAA is in a buy area.

We absolutely do not want to see 3 consecutive weekly closings below $20 combined with 5 consecutive daily closings below $20. This would invalidate our investing thesis. Not likely, but important!

[Ed. note: As of this week we will provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific investing tips on a weekly basis, mid-week, free of charge. We will do this for 4 months. Subscribe to our free newsletter and get premium investing insights in 2019 for free.]