Well Health Technologies, symbol WELL.V, rose 32 pct on Friday July 5th, 2019. We tipped this stock exactly one month ago with a strong buy, saying it is our top pick in our MOMENTUM INVESTING METHOD (not officially launched yet) in which we turn 10k into 1M in 7 years. That’s when we wrote Well Health Technologies: Multi-Bagger Small Cap Stock In The Making, and since then WELL.V rose 55 pct. It is not only one of our top investing opportunities of 2019, but it is also on its way to become one of the small cap super stars of 2019.

Let’s recap what we said one month ago in the article mentioned in our intro:

- As part of our MOMENTUM INVESTING METHOD we are on the lookout of one moderately rising investment (30% within one year) and one wildly rising investment (doubling in one year).

- The latter makes a difference in a portfolio, because if you have one such hit each year for 7 consecutive years your portfolio value explodes.

- We call this momentum, and our method to spot these opportunities is labeled MOMENTUM INVESTING.

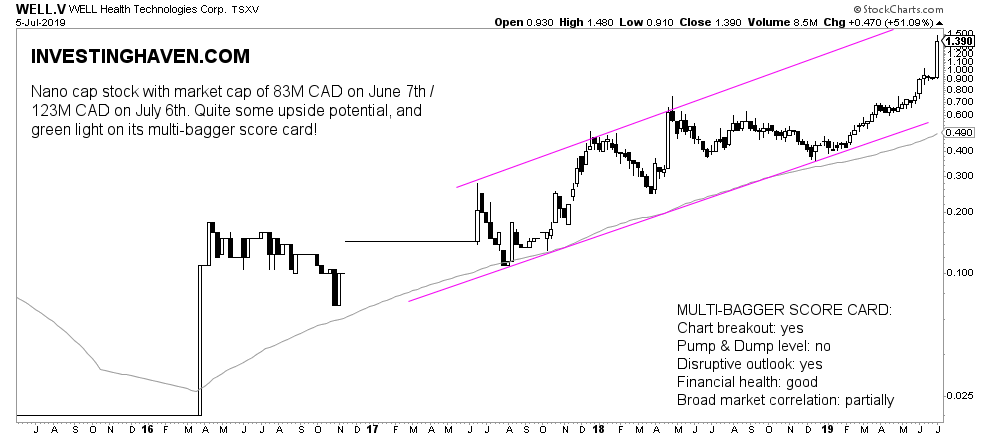

- In assessing these multi-bagger hits we use a score card with criteria, and we call it the ‘multi-bagger score card’.

If we apply this to Well Health Technologies we see the following:

- The cart is beautiful, it is gaining momentum now and went through a breakout. Great.

- There is no pump-and-dump in this stock, one of the biggest dangers of investing small cap stocks.

- The chart looks disruptive, but there must be an equally disruptive outlook for the stock. It is the case, with a 5-fold revenue increase.

- Financials are improving, and pointing in the right direction.

- The broad market correlation is partially there. In other words this stock can continue to rise in a weak broad market environment.

Our score card assessment for WELL.V last month appeared to be accurate.

It really is no coincidence that very bullish news hit the wires yesterday. As per Bloomberg Hong Kong’s richest man (Billionaire Li Ka-shing) becomes the biggest outside investor in Well Health Technologies Corp., the Vancouver-based startup that’s acquiring clinics and electronic medical records providers to bring Canada’s highly fragmented primary care market into the digital era.

This quote is interesting:

Shahbazi describes Well Health as “the WeWork for doctors” — bringing them software tools they couldn’t otherwise afford as standalone clinics. That makes their practices more efficient, meaning better outcomes and shorter waits for patients, he says. Doctors can join Well Health’s growing chain of clinics under a revenue-sharing agreement or simply pay for the services of the company’s medical electronic records software.

And this quote is even more interesting:

Well Health is now Canada’s third-largest provider of electronic medical records following a string of acquisitions, servicing more than 850 clinics, according to Daniel Rosenberg, an analyst at Haywood Securities Inc., who believes the company’s shares are undervalued. All four analysts have “buy” recommendations on the stock.

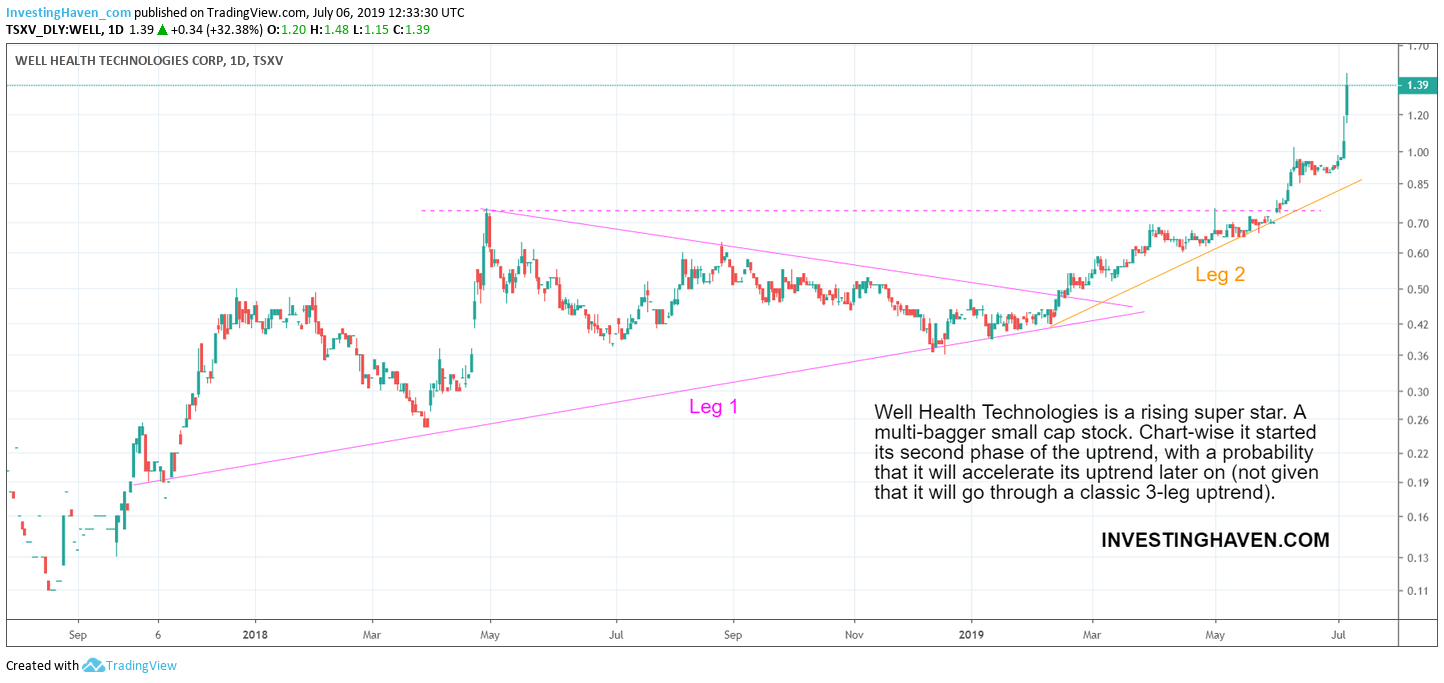

WELL.V may be doing either of two things now.

Either WELL.V may be going through a classic 3-leg uptrend, with a parabolic rise in the 3d upleg. This is what we represent on the first chart.

The second option is that WELL.V is simply moving in its long term rising channel. If this is the dominant scenario then the share price of WELL.V will easily and fast double before setting a major peak.

In any of both cases we did hit a multi-bagger in 2019, and it’s a great dry-run of our MOMENTUM INVESTING METHOD which we are dry-running before opening up to the public!