We identified recently a potential tenbagger opportunity. It could be the best small cap banking stock to buy this year, provided it breaks out from its bottoming formation.

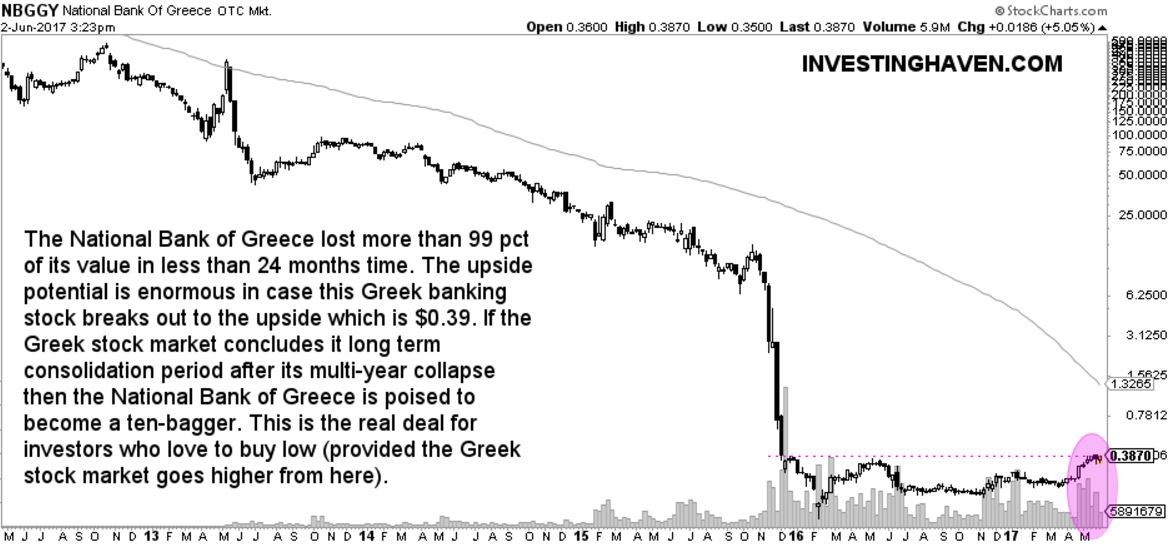

This National Bank stock crashed 99 pct in just 24 months, and is now setting up for a mega-breakout. We are talking the National Bank of Greece. Once it was a bank with a market cap of $1.8 trillion. You read that correctly, that’s trillion. As said in our previous article, this banking stocks lost more than 99 pct of its value in less than ten years.

As point of reference, back in 2007, National Bank of Greece was larger than Apple currently is. Right now, it has a market cap of $3 billion. Until recently, it was a small cap.

Why National Bank of Greece could be the best small cap banking stock to buy

According to this analyst on SeekingAlpha, back in 2007, National Bank of Greece has been recapitalized multiple times incurring heavy share dilution. You see why this could be a banking stock to buy?

Meantime, Greece has not disappeared from planet Earth, nor did the National Bank of Greece. After any total collapse the most likely path is higher, for sure if a longer period of bottoming has passed.

If this stocks breaks out, and that is a big IF, a huge move higher will follow. The chart setup provides definitely a strong reason to buy (after the breakout of course).

All in all, our point of view is that the extreme collapse of the bank, combined with a long consolidation period and first signs of exhaustion in the Greek crisis and the chart setup, provide sufficient reasons to think that this could be a great entry buy signal for this small cap banking stock.