Earlier this month our research team published 4 Biotechnology Stocks Worth Considering In 2018. At that moment in time the IBB ETF (IBB) representing the biotechnology sector was at the verge of a 2-year breakout. While the biotechnology looked very strong in January it looks crucial as February 2018 kicks off, this is why.

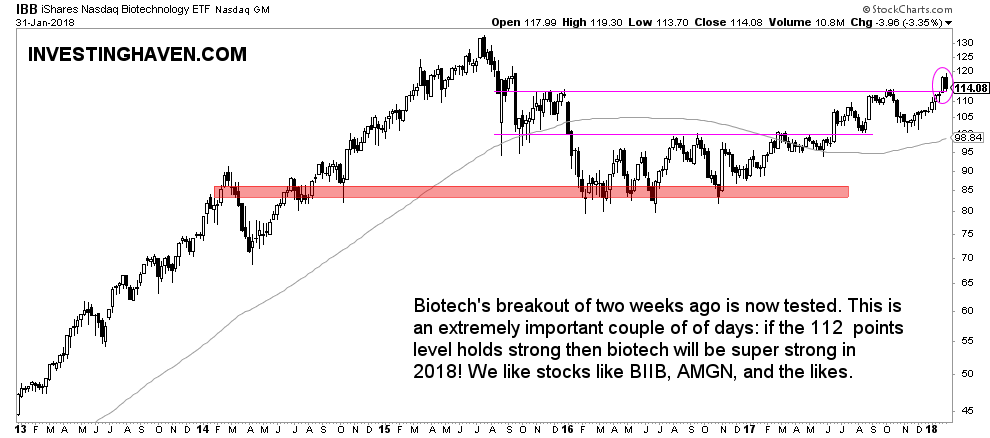

The reason why we believe biotech stocks are trading at a crucial point right now is because of the backtest. What this means is that biotech stocks broke out of a 2-year resistance, came down to test that same (old) resistance level. In case this price point holds strong it means that a very important event takes place: old resistance becomes support. Needless to say, it will imply that biotech stocks will be hugely bullish in 2018, and it would be a strong BUY.

As said in our previous article:

As can be seen from the monthly chart, price is in the process of breaking through the previous resistance. And this could lead to more upside of the constituent stocks.

InvestingHaven’s research team has developed its own methodology, and it is based on our 1/99 Investing Principles. One of the rules in it is the fact that 1% of price points truly matters for investors. Likewise, it is 1% of time on the chart (e.g., 1% of a 5-year weekly chart which coincides with 3 weeks in that whole period of time) which are meant to take a trade (buy or sell). Here is the major news which financial media are not able to report: this is one of those weeks. It basically is THE most important news but most do not see it nor understand it. Most financial media happen to refer to a bullish biotech space but for unfounded reasons.

If the 112 level on the IBB chart holds strong next week it suggests the biotechnology space will continue its secular new bull market after it take a breather between 2015 and … this week.