In our China Stock Market Outlook 2018 released some two months ago we said China’s stock market arrived at critical juncture. This is what we concluded:

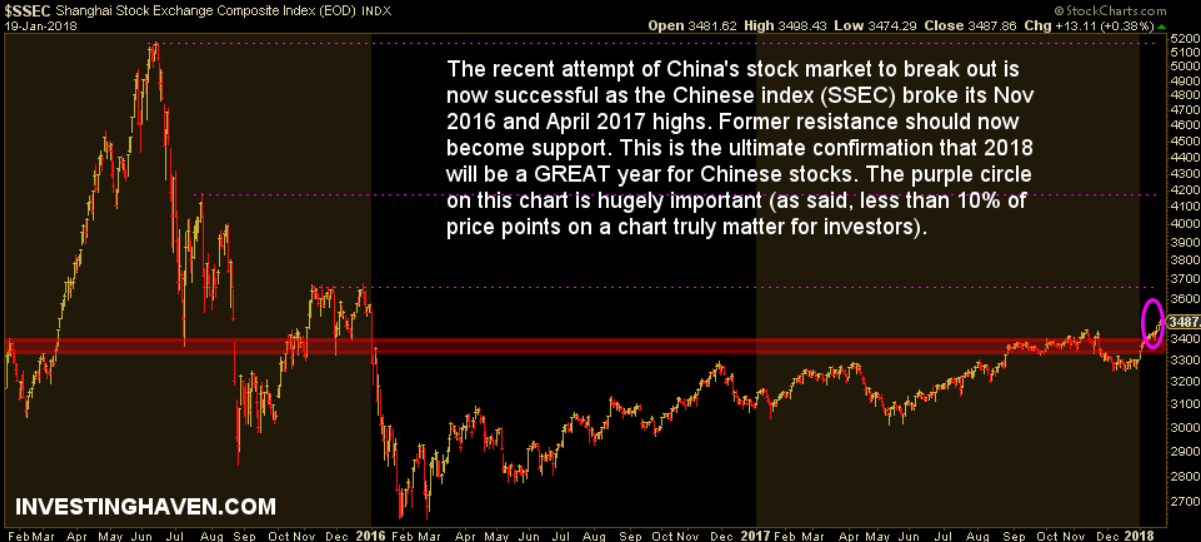

What we are saying is that 3300 points should hold. If that materializes we are convinced China’s stock market outlook will be strongly bullish in 2018.

Now, two months later, we get a very bullish confirmation from China’s stock market (Shanghai Stock Exchange Index) (SSEC). This market wants to go higher, much higher, and it will do starting now, throughout 2018 and even beyond.

China’s stock market chart in this article shows this red thick horizontal line (almost a bar) which distinguishes the bearish area from the bullish area on the chart. There really is one, and only one, important thing to watch: the breakout of last week as shown in the purple circle.

This is the ultimate confirmation that China goes higher.

As said many times before less than 10% of price points on a chart really matter to investors. The rest is basically noise at best but sometimes even misleading.

Talking about noise: we highly recommend NOT to read worthless articles like this one as they really add zero value for an investor.

We see an easy ride to the 4200 level which is a rally of 20 percent in the SSEC index. That should happen in 2018. The test of all-time highs another 20 percent higher could take place in 2019.

How to invest in China? Defensive investors can go for an ETF. However, smart investors select a couple of market leaders. InvestingHaven’s research team analyzed China in-depth, and found a number of sectors that are set for great gains. Moreover, 7 specific stocks are expected to strongly outperform the market. Read this exclusive report 7 high quality China stock tips for long term portfolios >>