It is only a couple of weeks ago when InvestingHaven‘s research team forecasted that China’s stock market would fall 10 pct after which a BUY opportunity would be setting up. Today, China did what we forecasted. It stopped falling exactly at the point we expected. Is this a buy opportunity or the start of a crash?

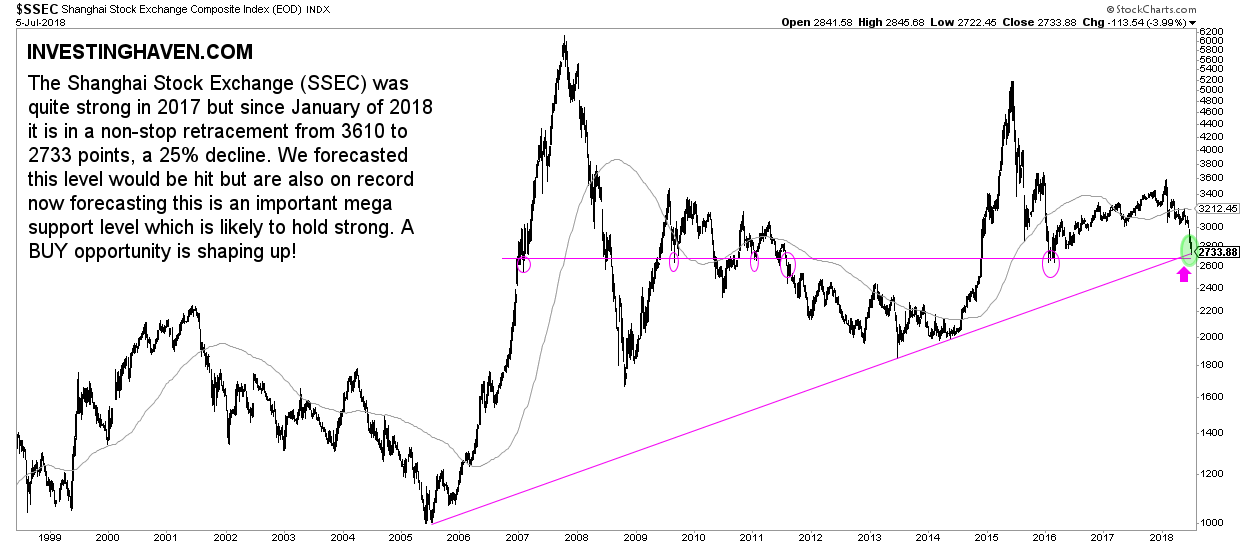

First things first, China’s stock market (SSEC) has fallen sharply in recent months. It has fallen exactly to the point where it connects the uptrend which started in 2005. A 13-year uptrend got tested today, that is a big thing.

Whether China’s stock market will hold this price level is a different thing of course. In other words, how to know whether this market is not about to fall through this support level, and result in a strong crash?

We believe the answer to this question is largely determined by the US Dollar as well as US Treasuries. We explained this in detail recently in this article: How The US Dollar May Impact Emerging Markets In 2018 and 2019

Both the US Dollar and US Treasuries are a key driver for China’s stocks, you read this well. And this is certainly not the type of investing insight that will be shared in mainstream financial media, on the contrary.

For now, it seems that the US Dollar is losing steam. Also, 20 year US Treasuries have successfully tested their 2.8 level, mega support. It seems the key drivers for China’s and emerging markets decline are not pushing these markets lower any longer. It supports the view that China and emerging markets are in a buy area now.

It may become a classic case of ‘sell the rumor, buy the news’. Another reason why news is misleading at best. The day that the import tariffs are confirmed by Trump may be the end of China’s stock market selling, similar to the Brexit vote being the end of the decline of global stock markets?

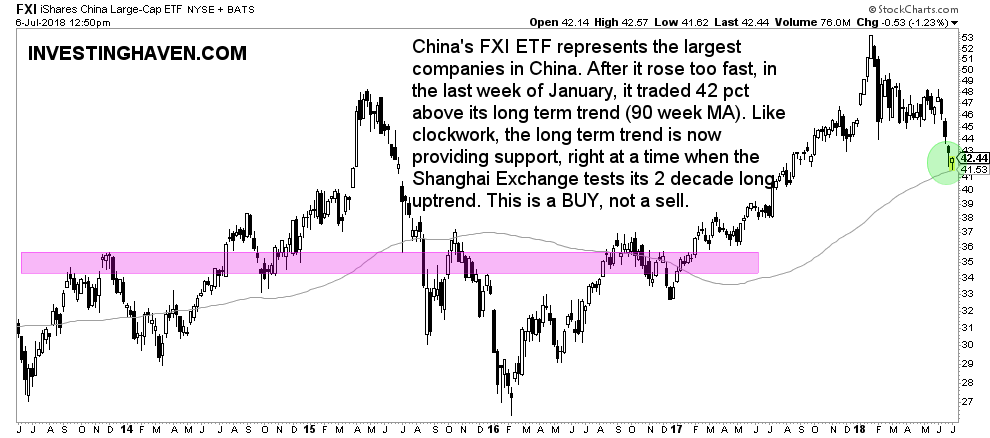

Interestingly, our favorite way to play China’s stock market through the FXI ETF (FXI) is also testing its long term uptrend (90 week moving average). Today, exactly the same day China’s stock market index SSEC tested its 2005 uptrend, FXI ETF did something similar. This may be setting up for a buy rather than a sell.

As one our mantras is that ‘what goes down can always go lower’ we would prefer to wait before getting a confirmation that the current fall in China and emerging markets has stopped instead of going aggressively all-in at this point in time.