Canadian Solar is a small cap clean energy stock trading on the Nasdaq. It has a market cap of $800M.

The stock closed today 0.07% higher. In April 2017, though it went up 15%.

The company offers photovoltaic energy solutions across the globe.

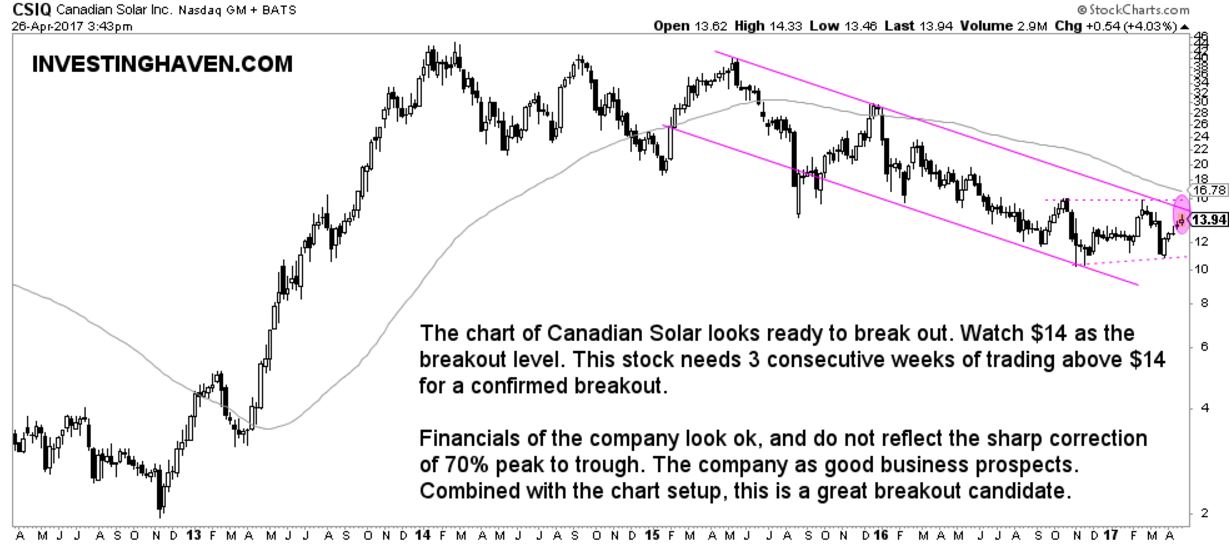

Interestingly, the clean energy stock market sector rallied sharply in 2013 on the prospects of a booming industry. However, since early 2014, the sector stabilized and started a significant retracement. Some clean energy stocks lost even 70%, and CSIQ is no exception to that.

Right now, InvestingHaven’s research team is hinting at Canadian Solar as a potential breakout candidate for 2017, for two reasons.

First, the stock is consolidating for several months now. It has set a higher low. It starts looking solid. That is a pattern not really seen before. The proverbial cherish on the cake is the coming breakout attempt outside of the falling channel.

Second, the financials of the company seem to stabilize as well. After the revenue of the company fell last year, the last 2 quarters are stable. The small loss in the recent quarter is a small concern. There is sufficient cash in the company.

The relatively high short float ratio (15%) is not good, but if a breakout occurs we expect that ratio to come down sharply triggering a strong rally.

All in all, we believe the prospects of this industry and the company are solid.