This article is educational. We analyze one great case which highlights the importance of chart analysis. In particular it is a triangle breakout, a textbook pattern in chart analysis, which is very high reward / low risk setup for investors. Case in point: Kush Bottles, symbol KSHB. Note: InvestingHaven’s research team noticed this setup back in October when the stock was trading below $2 while it touched $7 this week, see this article Cannabis Stock Kush Bottles, Packaging Producer, On The Verge Of A Big Breakout.

Kush Bottles is specialized in manufacturing packaging for the cannabis industry. Whether there is a moral aspect to investing in the cannabis industry is not relevant in today’s discussion.

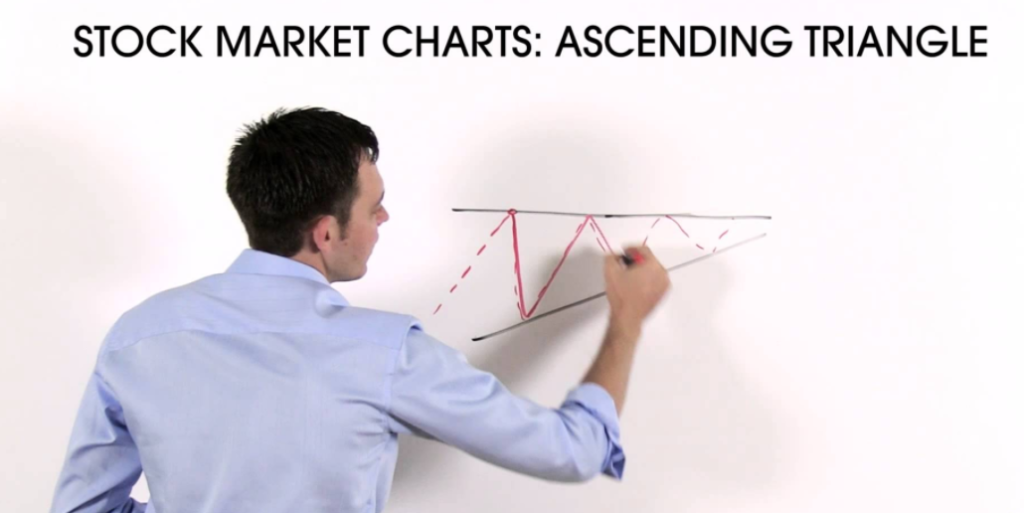

The point is that Kush Bottles had an amazing setup on its chart: a triangle pattern. That pattern was in the making for almost 2 years which is an amazingly important fact. The longer it takes to create a pattern the stronger the move once it breaks out or breaks down.

This is what we wrote back in October:

Moreover, the chart looks awesome. Kush Bottles is trading at a big breakout level, and is doing so on rising volume. In addition, it has been consolidating since early this year, a 9 month period, in which it respected support at $1.80.

If Kush Bottles goes slightly here from here, and trades above $2.20 for at least two consecutive weeks, it will be a breakout which could double the price of this stock.

The way to interpret a triangle pattern is highlighted in the above quote. Sellers were not able to push this stock below a certain price point, in this case $1.60, for more than a year. However, buyers were not able to push this stock above falling resistance neither. That is exactly what the triangle pattern stands for, and how buyers/sellers collectively create this pattern.

Once the price of a stock reaches to the apex of the triangle it is ‘forced’ to choose a direction: Either up or down. That is when a breakout (up) or a breakdown takes place.

That is how we were able to determine that Kush Bottles would start trending. The timing was really perfect. The fact that this stock would trend higher (as opposed to a breakdown) was based on the fact that sellers were not able to get this stock below $1.60 for more than a year.

Another great case of a triangle breakout pattern, maybe even greater than the one outlined above, is emerging markets. We believe the case is stronger because the setup of the triangle pattern took 9 full years! That is very unusual, and its setup was a clear indication for us that emerging markets would start a mega-breakout, which they did recently. Read our article from last June: Emerging Markets Testing Mega-Breakout, About To Start Strong Bull Market. This is the quote from that article:

On the chart of emerging markets (EEM ETF) the most important price point is 42 points. Why? As the secular trendline (purple line) suggests this is the resistance of the consolidation which took an amazing 9 years will. As explained in our Emerging Markets forecast for 2017 we observed this already a year ago.

Of course, a triangle pattern is not the only indicator which is important to consider. It is mandatory to always look at a set of indicators: fundamental value of a market, sentiment, industry. The point is this: ultimately, the chart provides the timing, and reveals upfront which markets are setting up for a new bullish or bearish trend while fundamental analysis / sentiment / industry market trends provide the indication of which direction the new trend will be going.