Sketchers USA, symbol SKX, trades on the NYSE and has a market cap of $4.4B. It is one of the smaller large caps in other words.

The stock price of Sketchers is in a downtrend since the summer of 2015 after it touched $55 (all-time highs). The stock dipped at $18 in October last year. Is this stock worth buying? That was one of the readers questions of this week.

First of all some fundamental data. The company announced earnings last week:

- The EPS was 0.04 which is significantly lower than the expected 0.11, a negative surprise.

- Revenue grew with 6% to $764M against the market expectation of $725M, so that was a positive surprise.

- Resellers sales in US was down, but international sales was up (much) more than expected.

- Revenue growth will undoubtedly be much higher next year than the former market expectations of +8%.

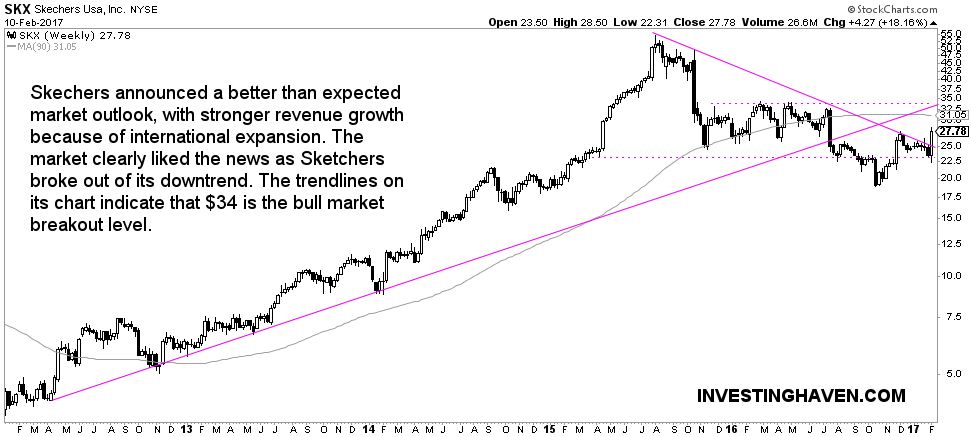

That last bullet point was the most important trigger for the stock price of SKX to go much higher after the earnings announcement. As per the chart below SKX broke out to the upside. It shot through a long term falling trendline, and that is very bullish.

Right now, the market suggests that the bear market has turned into a bull market, provided that the stock remains at least 3 weeks above $25 per share.

Is Sketchers worth buying at this point? InvestingHaven’s research team believes this is a buy, and the most important will be the $34 level. If that level will not be broken to the upside, it would suggest that the market is simply ‘bullish’ and not ‘very bullish’, and that implies a big difference in terms of potential profits.

With a Price/Earnings ratio of 16 the Sketchers stock price is a good short to medium term play, but the long term potential is not sufficiently clear at this point, says InvestingHaven’s research team.