Steel stocks are in an amazing shape. Since they bottomed in January 2016 the steel stocks ETF SLX is up 3-fold. An index rising 3-fold in just 2 years is exceptional.

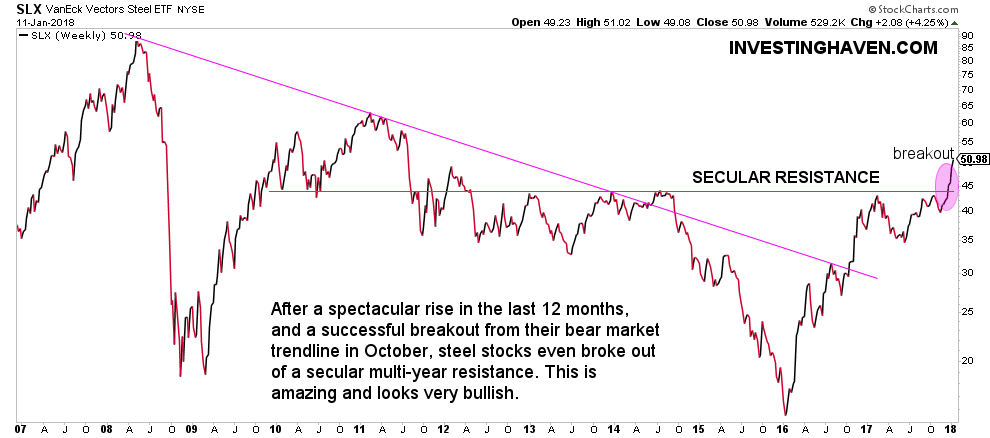

What strikes us on this chart is the fact that SLX ETF broke through a major resistance level at 44 points. Note on the chart how this is a secular resistance level, which, in plain simple terms, means that a multi-year resistance level did give away.

Full disclosure, we were cautious when SLX ETF rested the 40 to 44 area when we wrote Steel Stock Market Sector Is Trading At A Critical Juncture in May last year. Admittedly, it tooks this market 8 full months before it broke out, that’s a significant time period. Still, though, the pullback was rather insignificant when compared to the steep rise which took place in 2016.

Right now steel stocks show a clear breakout. Visibly, there is much more upside potential.

Interestingly, the analysts at Marketrealist even looked into a fundamental valuation of the steel stock sector and concluded the valuation is not high yet. They analyzed the price earnings ratio to derive this conclusion.

According to the investment management company Van Eck the top holdings in the SLX ETF are Rio Tinto Plc, Vale Sa, Ternium Sa, Vedanta Ltd.