Last week, we published Breaking News: The Great Stock Bull Market Resumes In 2018. This was in the making since 2 months. Our research team came together in January and February, when stock markets were selling off sharply, spent (collectively) hundreds of hours analyzing all markets in order to understand whether the big stock bull market came to an end, and we concluded the answer was NO. Today, InvestingHaven’s research team appeared to be correct.

“Kudos to our research team. I am incredibly proud that they were able to forecast this so accurately, and that the leading indicators they defined were spot-on. I personally challenged the team in January of this year with the observation that the 20 Year Yield chart was testing major resistance which, in the last 12 years, always coincided with a major stock market peak (followed by a strong correction). My request was whether this time would be different, and the outcome of the research was YES. Statistically, this conclusion had a very small probability to be right. But the power of high quality analysis is that it wins over probability!”

Why does the research team at InvestingHaven believe that the great stock bull market now officially resumes? Because of several reasons and leading indicators, but two of them stand out:

- 20-Year Yields

- Russell 2000 stock index (RUT)

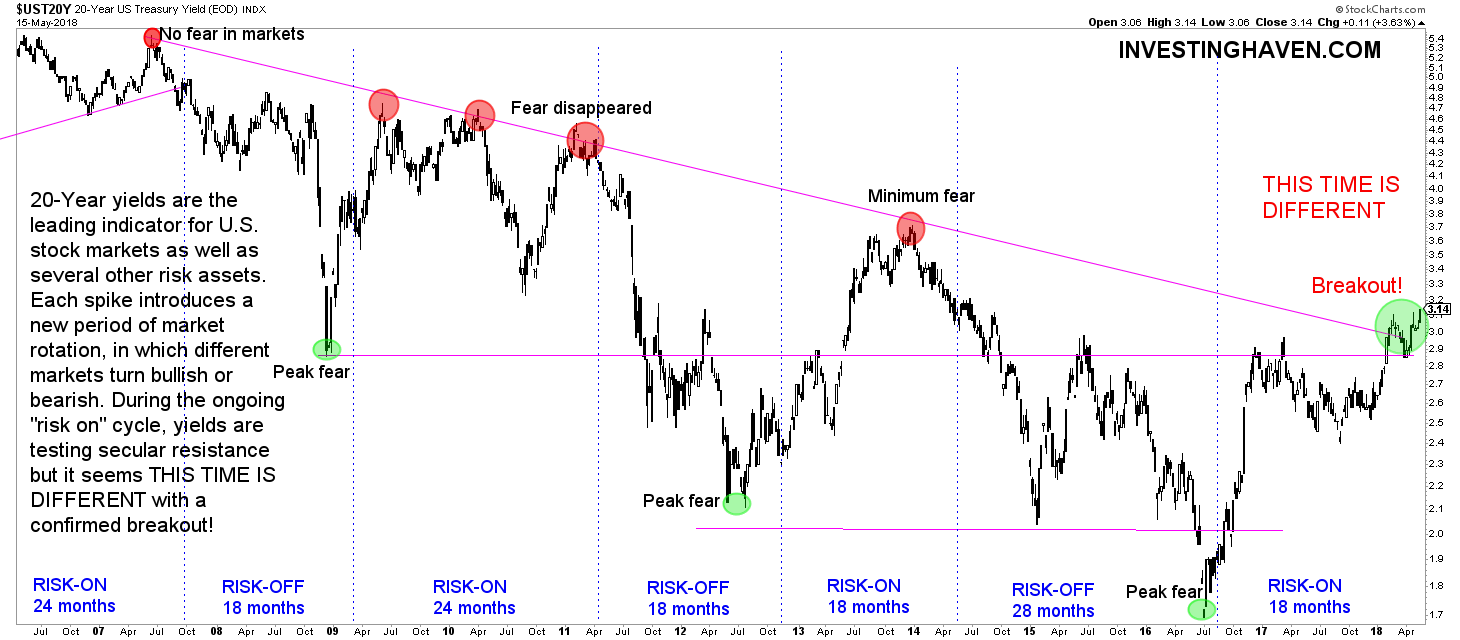

We explained last week that our leading indicator, as explained for instance in The Most Important Chart Of This Decade: Are Yields Signaling A 2008-Alike Scenario, is 20 year yields. The first chart below shows the structure in which it moves, and that is always has signaled a major stock market top once it tested its long term resistance trendline.

However, this time IS different, which is something that occurs only very exceptional (statistically).

Yields confirmed their breakout, not only from their 12-year chart but also from their 40 year chart! This is major and breaking news, do not underestimate what is happening right here right now in front of (y)our eyes.

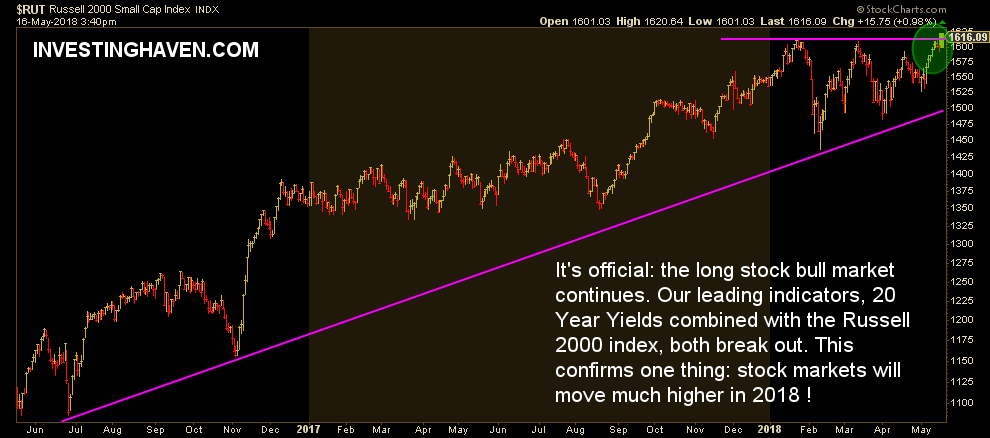

Simultaneously, the stock market index Russell 2000 shows a breakout. It rises to all-time highs, and breaks above the former double top of January and March of 2018.

The message from both charts in this article? It’s official, RISK ON is back, and, because of this, stock markets will go much higher in 2018. More importantly, the 4-decade long trend of falling yields has now officially ended, and we are in a new era of rising yields, something that has not occurred since 1980.