There is a lot of debate whether there is a US dollar bull market or bear market. Many believe, because of the monetary easing policies of the Fed, that the dollar should be declining in value. While that could be an outcome, it is not a ‘must’ as it all depends on how global markets will evolve over time (as the dollar is not trading in a ‘vacuum’).

The US currency is acting very strongly recently. It has bullish energy. The key question we try to answer is whether the US dollar is in a long term bull market.

According to this Forbes article from earlier this year, there was no confirmation yet of a US dollar bull market. The analyst of this article peformed chart analysis to come to that conclusion, which is similar to our work. However, we see that the author did not identify all major trendlines. In fact, by far THE most important trendline was not discussed in the article.

The key trendline within the US dollar bull market

The point is not whether there is a bull market in the dollar, the question is how strong it will be.

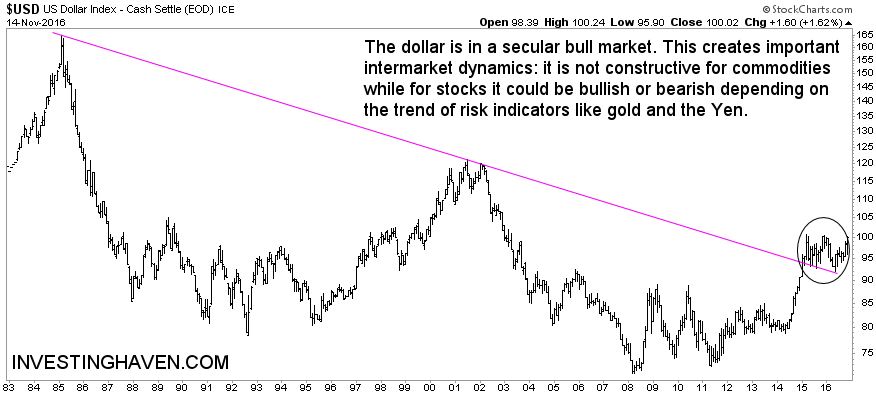

By far the most important trendline in the dollar’s bull market is visible on the first chart, a 33-year chart. In December of 2014, the dollar broke out of its bear market. Note that the descending trendline is represented by the long term which connects the peaks of 1985 and 2001. Since then, the US dollar got in a clear bull market, marked with the circle on the chart.

On a shorter term timeframe, a 5-year chart, we see that the dollar is testing major resistance, for the third time. A break above the 100 to 101 level will have major implications for all markets globally.

Implications for global markets of a sustained US dollar bull market

Make no mistake, if the dollar index will trade above its 101 level, there will be a sustained bull market. The implications for all markets globally will be huge. This is what will likely happen:

- Most commodities will suffer, without any doubt.

- The ongoing strength in base metals could continue if Mr. Market believes that economic conditions are improving, but we do not expect a huge bull market in base metals if the dollar continues its bull market.

- Gold and silver will lose value.

- Stock markets can go both directions, it really will depend on intermarket dynamics. In other words, stocks will follow the primary trend. If the US dollar will be so strong that it will create panic, similar to what happened in 2015, then stocks will suffer. However, if the US dollar bull market will be ‘soft’, then we would not exclude strength in US stocks. In such a scenario, emerging markets will likely be ‘contained’.

- Global currencies will feel (serious) pressure.

Investors must follow closely what the US dollar will be doing in the coming days and weeks, in particular around current levels.