We warned our readers in August about the unusually high level of complacency in markets. So far nothing major has happened, and stock markets keep on moving higher. Even the small cap index Russell 2000 is on the rise again.

Should investors become aggressive, and go all in?

Not that fast, at least according to us. Let’s revisit the indicators which made us so prudent.

This is what we wrote early August: Volatility Hit Historic Lows This Week. Maximum Complacency Is Bearish!

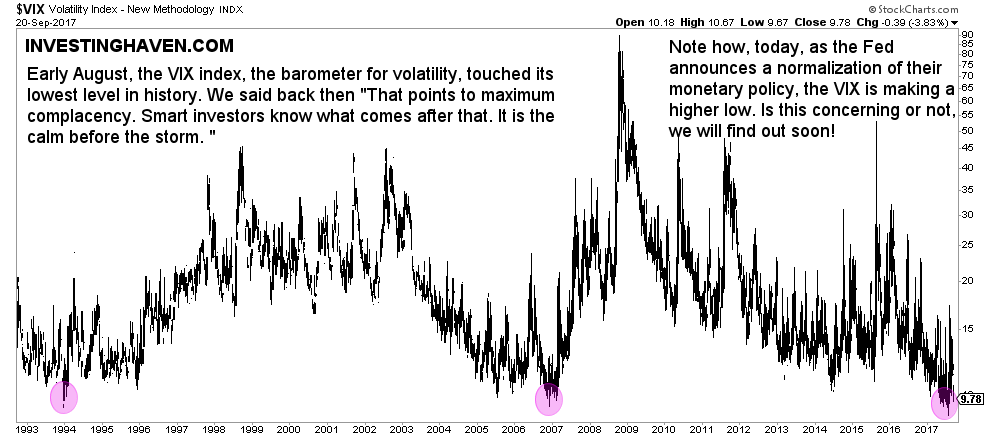

The volatility index (symbol VIX) is a measure for volatility on the U.S. stock exchanges. The VIX wrote history this week: it hit its lowest level EVER, at 8.84 points. That has never happened before in the almost 30 years this instrument exists. The only instances where the index was that low, around 10 points, in the last 30 years, were followed by quick spikes up … maybe not immediately, but relatively soon after the 10 point mark was hit.

Does that suggest that markets will crash? That is certainly NOT what we are suggesting. We are saying that historically low volatility will not last long. As volatility picks up, it bears watching which markets and segments do well and which ones sell off. For instance, it could well be that gold will act as a fear trade in the coming months (if that is the case, it will be reverse its long term bear trend into a bull trend) and that bonds will outperform …

Maximum complacency is not bullish, but it triggers smart investors to watch closely what is going to happen as volatility will pick up in the coming weeks and months.

We followed up a little bit later with another set of charts related to the volatility index: Ignore This Series Of Volatility Warning Signs At Your Own Peril

Admittedly, early September we thought volatility would continue to rise when we wrote Volatility On The Rise As Expected. Volatility fell back since then.

So far we are proven “wrong”, and our S&P 500 forecast of 2125 points seems one of the most foolish things we have ever written.

However, we remain cautious. The volatility index has moved lower in recent days, and stopped falling right below 10 points. Today’s intraday low was set at 9.67. Note how that is, so far at least, a higher low.

IF our concern is valid, it could well be that volatility will start rising anytime soon.

The VIX is not a good timing indicator, but we cannot believe that in a period of such a high complacency market will simply continue to go straight up. We continue to remain cautious.