China’s stock market (SSEC) is one of the major themes at InvestingHaven in 2018. That is because its stock market was wildly bullish in the first weeks of 2018, next almost fell off a cliff only to touch secular support right in the week when President Trump’s induced trade war discussion got momentum. Our thesis was that it was a classic case of ‘sell the rumor buy the news’. Now it seems that we are absolutely right, and China’s stock market continues to look very bullish again for the remainder of 2018!

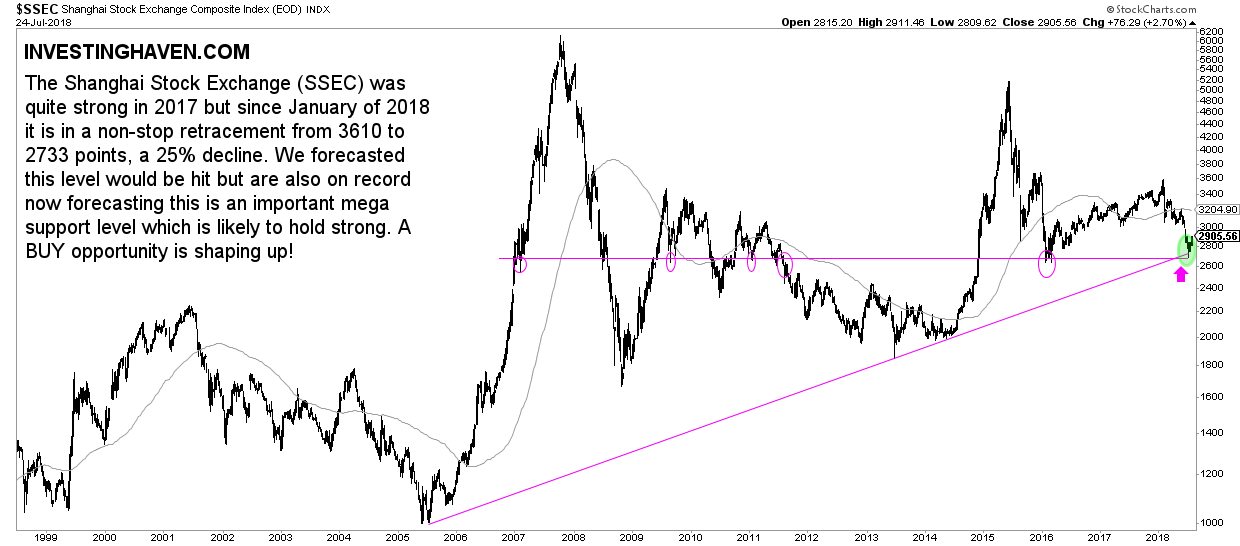

In June we forecasted that China’s Stock Market Had 10 Pct More Downside, and a Major Buy Opportunity was Setting Up. It appeared to be a spot-on call if you look at the current state of things, particularly the Shanghai Composite chart we have embedded below. China’s leading index Shanghai Composite bounced EXACTLY at the level we forecasted.

Moreover, right in the week in which trade war fears peaked worldwide we came out with this article China Stock Market At Make-Or-Break Level saying the following:

It may become a classic case of ‘sell the rumor, buy the news’. Another reason why news is misleading at best. The day that the import tariffs are confirmed by Trump may be the end of China’s stock market selling, similar to the Brexit vote being the end of the decline of global stock markets?

In the midst of panic and scary headlines we remained cool and focused on the chart. No news whatsoever influenced our viewpoint. We even did not read the news as, per our methodology, it is a waste of time at best and the root cause of bad performance of your portfolio at worst.

The chart below suggests that China’s stock market bounced right at secular support. The chart of the FXI ETF (FXI) shows a similar bounce right at support, so does the emerging markets ETF EEM.

This all confirms our BUY signal that we saw coming several months ago. Emerging markets, in particular China’s stock market, is a BUY in 2018, as we expect them to continue to be wildly bullish in the second part of 2018!