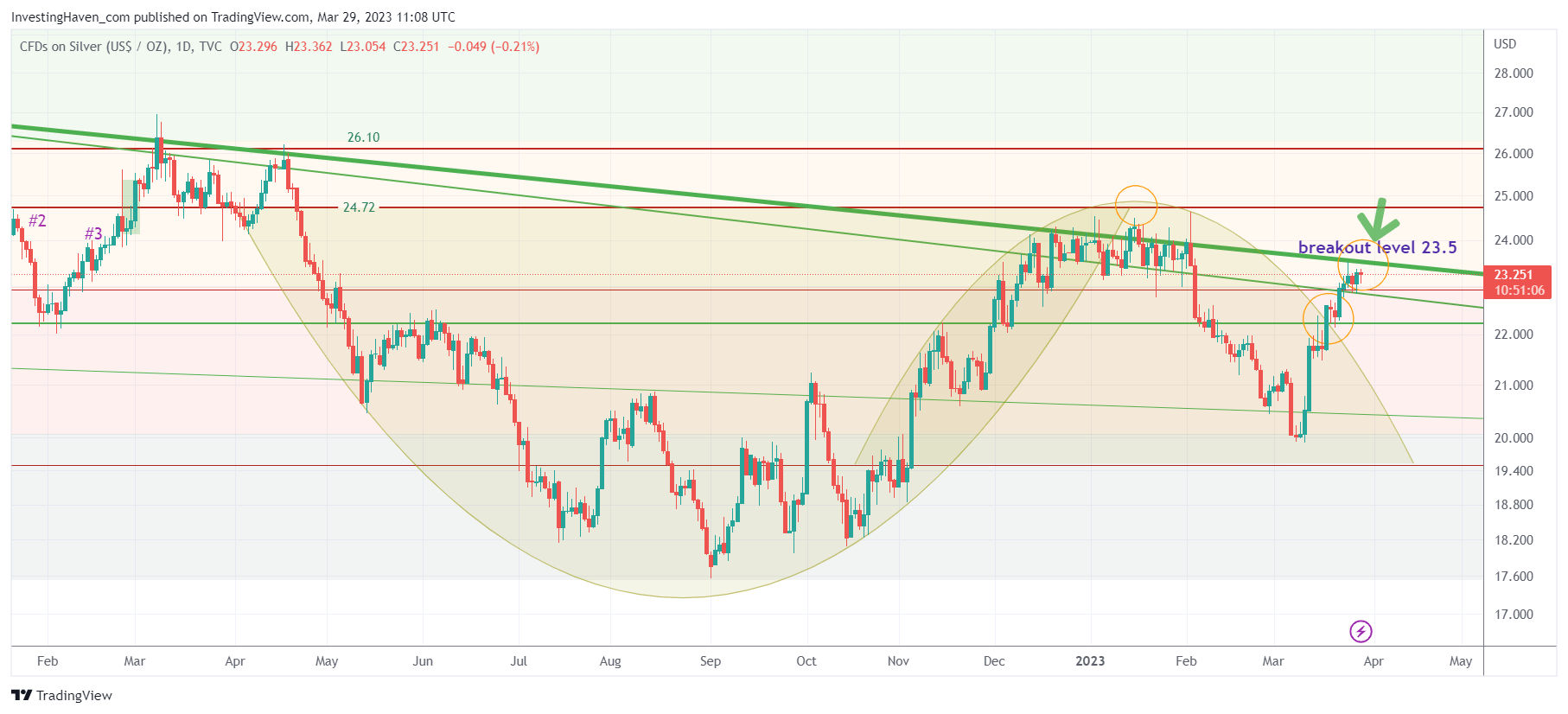

Silver has been on investors’ radars for some time now, as the price of the precious metal has been showing signs of breaking out of a secular trendline that has been in place for nearly 3 years. The green thick line on the chart below represents this trendline, and as we can see, silver has struggled to clear it since July of 2020. In line with our most recent silver forecast, we believe the time has come for silver to stage a secular breakout.

Despite bullish sentiment around silver last year and earlier this year, the precious metal has been unable to break out of this trendline, until now. As we approach the 23.5 level, which represents the exact breakout point, investors are waiting with bated breath to see if silver will finally break out of this trendline.

A confirmed breakout will occur once we have at least 5 daily candles above this level without touching it, signaling that a secular breakout is near. If it’s not in the next few weeks, then it is likely to occur in the coming months.

So, what does this potential breakout mean for investors? First, it’s important to note that the secular trendline is about to cross the 50% retracement (red/yellow shaded areas), which is a significant milestone. Second, there is a physical supply crunch underway, as explained in a recent article by InvestingHaven:

Silver: 4 Structural Changes That Confirm The Start Of A New Secular Bull Market

These two factors combined suggest that a secular breakout is imminent, and investors who are positioned correctly could stand to benefit greatly.

For those who are bullish on silver and are willing to take on some risk, the potential rewards could be significant.

Invalidation: a broke below 20 USD. We cannot exclude a quick dip to the 21-22 area, although the dip might not come, it seems more likely that a consolidation in the 22.5-23.5 will occur for a certain period of time.

In conclusion, silver is about to test a secular breakout point, and investors should pay close attention to see if it finally breaks out of this long-term trendline. With the physical supply crunch and the 50% retracement milestone approaching, a confirmed breakout could lead to significant upside potential for those who are positioned correctly.

For our Momentum Investing members, we created a selection of top silver miners:

Top Silvers Stocks For Long Term Portfolios >>