While 2022 was one of the best years ever in terms of silver imports in India, it happened on declining silver prices. In 2024, silver prices are on the rise, which is a very important difference.

RELATED – When Exactly Will Silver Hit $50 An Ounce?

While we focus on India silver imports in this article, we start with some context about the silver market as silver as an investment opportunity.

Silver market & investment opportunity

In order to put the silver India imports in perspective, we need to provide an overview of the silver market and its message. Context is important, also when analyzing financial markets and assets like silver.

Silver: Long Term Chart Now Officially The Most Powerful Bullish Reversal In History (Oct 6th, 2024)

This is what we wrote: “The silver price chart is now the most powerful bullish reversal we have ever seen.”

India silver imports are going through the roof at a time when the long term silver price chart is exhibiting an unusually bullish reversal chart structure. Coincidence or correlation?

Silver: This One Leading Indicator Confirms Massive Upside Potential In 2025 (Sept 30th, 2024)

This is one important data point that caught our attention:

Currently, concentration of the largest silver traders short is nowhere near extremes. In fact, it is pretty low, considering the significant silver price increase between the 2022 lows and 2024 highs. This suggest there is significant upside potential in silver, maybe even massive upside potential, in 2025 and presumably also in 2026.

While this data point may not be visible to silver investors and buyers in India, it probably is no coincidence that both are occurring in a similar time period.

Silver: This Hidden ‘Risk On’ Indicator Is Breaking Out, Silver Market Soon On Fire (Oct 16th, 2024)

This is what we wrote on October 16th:

The silver miners to silver junior miners ratio, the ultimate RISK indicator for the silver market, is breaking out! It’s a RISK ON indicator when it’s on the rise.

We continued:

The silver market will soon be on fire, is what the data is telling.

Literally one day later, silver started an epic breakout, clearing THE most important level 32.70 USD/oz, probably THE breakout that will lead silver to new ATH.

Readers can read more about the silver market opportunity in this recent article: 5 Reasons Why Silver Is The Investment Opportunity Of The Decade.

India silver imports

India’s appetite for silver is close to hitting extremes, as reflected in the latest import data.

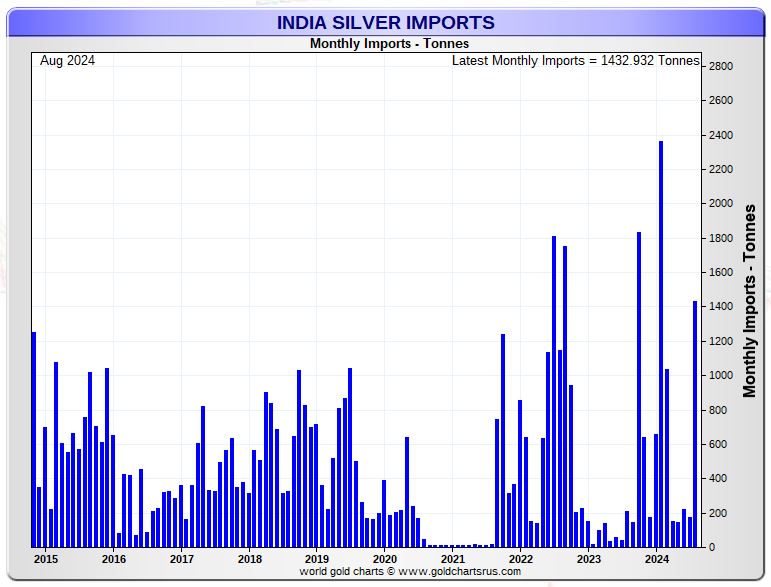

The chart below (courtesy of GoldChartsRUs) shows a staggering surge in silver imports as of August 2024: 1432.93 tonnes.

This signals a strong demand for silver in one of the world’s largest silver-consuming countries.

A few observations when looking at the 10-year India silver imports chart:

- August marks the second ‘spike’ of 2024, with still 4 months to go on this chart. 2024 might become one (if not the) best years when it comes to India silver imports.

- Since 2022, there is a structural increase in demand. Essentially, 2022 and 2024 stand out against the previous 10 years visible on this chart, but also against the last 25 years (not available on this chart).

- The really important difference between 2022 and 2024 is that the silver price was falling in 2022 while silver is on the rise in 2024.

So, India silver imports are close to hitting ATH when silver is rising. THAT is the important take-away. And it’s meaningful, very meaningful.

Note – The spike in January 2024 was the best month ever when it comes to India silver imports (based on 25 years of data).

Silver soaring demand – a bogus explanation by AI

We though to ask an explanation to ChatGPT. This is what it returned:

- Hedge against inflation: With inflation continuing to be a key concern, many investors in India are turning to silver as a safe haven asset. Silver’s historical role as a store of value during times of financial uncertainty makes it an attractive option for wealth preservation.

- Industrial demand: India’s booming industrial sector is another major factor driving silver imports. The metal’s wide range of uses in electronics, solar energy, and other industrial applications has pushed demand to new levels.

- Cultural and seasonal factors: Silver has a long-standing cultural significance in India, especially during the festive season. The demand often peaks during festivals and weddings, adding to the already robust interest in the metal.

Unfortunately, none of the points brought up by AI is relevant: inflation is declining in 2024 (it was rising in 2022), industrial demand in sectors like solar and electronics is strong elsewhere but not in India, the festive period in India starts in Sept and runs through Nov (the chart above shows data till August).

Soaring silver India imports – our expert explanation

Needless to say, AI completely missed the point that we made.

Again, India silver imports are close to hitting ATH when silver is rising. That’s the key point, and there is one and only one explanation for this:

India truly understands that the value of silver is on the rise, and will continue to rise.

Remember, India is savvy when it comes to precious metals.

A few weeks ago, we wrote this: Silver Reaches All-Time Highs in Most Global Currencies… Silver in USD is Next! The point we made is that silver is hitting new ATH in many global currencies. The silver price expressed in USD is only part of the story, in fact silver in USD is lagging most against other global currencies.

Case in point: silver priced in Indian Rupee is hitting multiple all-time highs in 2024.

Call it FOMO, call it smart, call it foresight.

The point is this – India is more advanced in terms of silver bull market maturity.

This, in our view, explains the staggering demand for silver in India, reflected in India silver imports.

Sooner or later, the West will wake up but it will be too late for the majority of Western investors to enter. Silver is set to accelerate its move higher, leaving the majority of investors behind…