Silver is consolidating. That’s a good thing, not a bad thing. A consolidation enables a market to gather strength. For silver it means that it is going take its time to prepare for its next leg higher because it has to move to our bullish target defined in our silver forecast 2023. We said that an epic buy opportunity in silver is underway, we mentioned the drivers. Here is a date that you may want to watch based on the chart we shared in our latest research note to Momentum Investing members.

As a refresher we highlight the articles that we wrote in the public domain with valuable insights about the silver market and the silver opportunity:

Another Silver Leading Indicator Turning Bullish As 2023 Kicks Off

Silver: A Divergence Of Epic And Historic Proportions

One Silver Chart Justifies ‘Buy The Dip’ For Long Term Positions

Why Junior Silver Miners Will Have An Amazing 2023

We are aware that we are beating a dead horse. Maybe, just maybe, there is a good reason for this.

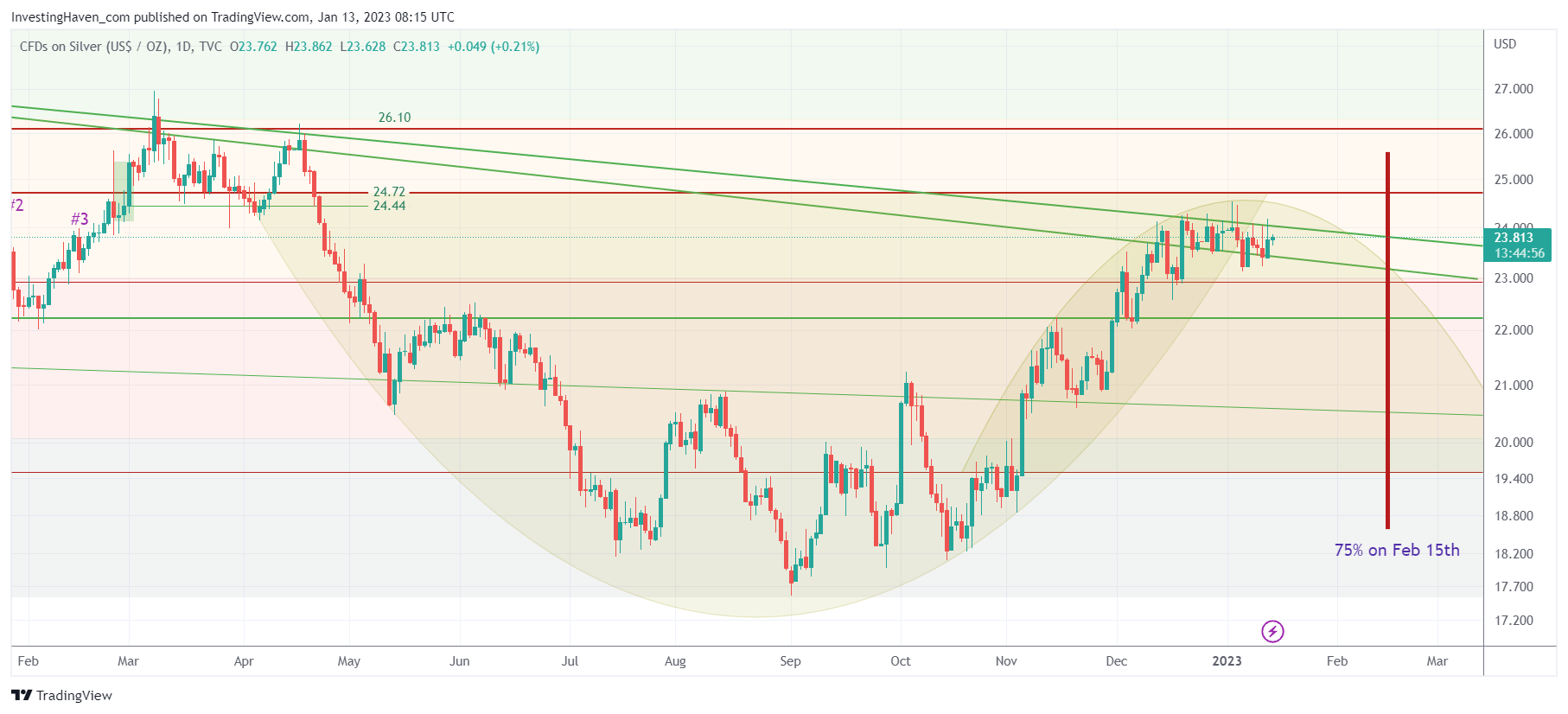

From time to time, we feature a chart from our premium services. In this article, we include one of the many silver charts that we shared in our latest research note to premium members. This particular silver chart looks at price, we also have charts that track the silver time cycles or indicate when price moves are stretched (in either direction).

As seen, silver concluded a long term bullish reversal. It took some 8 months for silver to complete this rounded bullish reversal. Right now, there is a smaller, more tactical, bearish pattern. We believe the downside is contained, still we believe a pullback is underway as suggested by the ongoing rounded chart pattern.

Just to be clear, this pullback is not concerning, it’s a buy opportunity.

So, when to buy?

Well, from our chart pattern we can derive that February 15th (+/- 3 days) might be a good moment to evaluate an entry. It might not be the perfect entry, it’s a good moment to asses both price and time on the silver charts.

We recommend checking out Silver Stocks Outlook For 2023 for investors considering to buy the dip in silver stocks and/or physical silver.