Case in point: silver priced in Australian Dollars (AUD) is printing a series of new ATH lately.

RELATED – Silver prediction 2025.

It is so easy get caught up in the precious metals universe. Gold and silver are primarily expressed in US Dollar terms. This tends to create a biased view, certainly if price trends of those metals expressed in other global currencies shows a very different behavior.

Silver priced in AUD – New ATH

A few months ago, we wrote this piece Silver Reaches All-Time Highs in Most Global Currencies with conclusion:

What matters is this – the global silver trend is up, hitting new ATH in most currencies, not yet in the USD. It’s the silver bull market dynamic that truly matters.

We added:

It is a matter of time until silver priced in USD will also hit ATH.

It is truly phenomenal to go back to the article, and see how silver was already setting ATH in most global currencies. Silver priced in AUD was ‘inches below ATH’ back then.

This has changed in the meantime.

Silver priced in AUD has been hitting a series of ATH since then. Particularly in December, when silver priced in USD was weakening, the exact opposite happened in the grey metal priced in AUD.

Silver leading indicator nowhere near extremes

What’s equally important is how leading indicators of the grey metal are trending (hint: it’s not China buying nor an FOMC meeting nor tariffs).

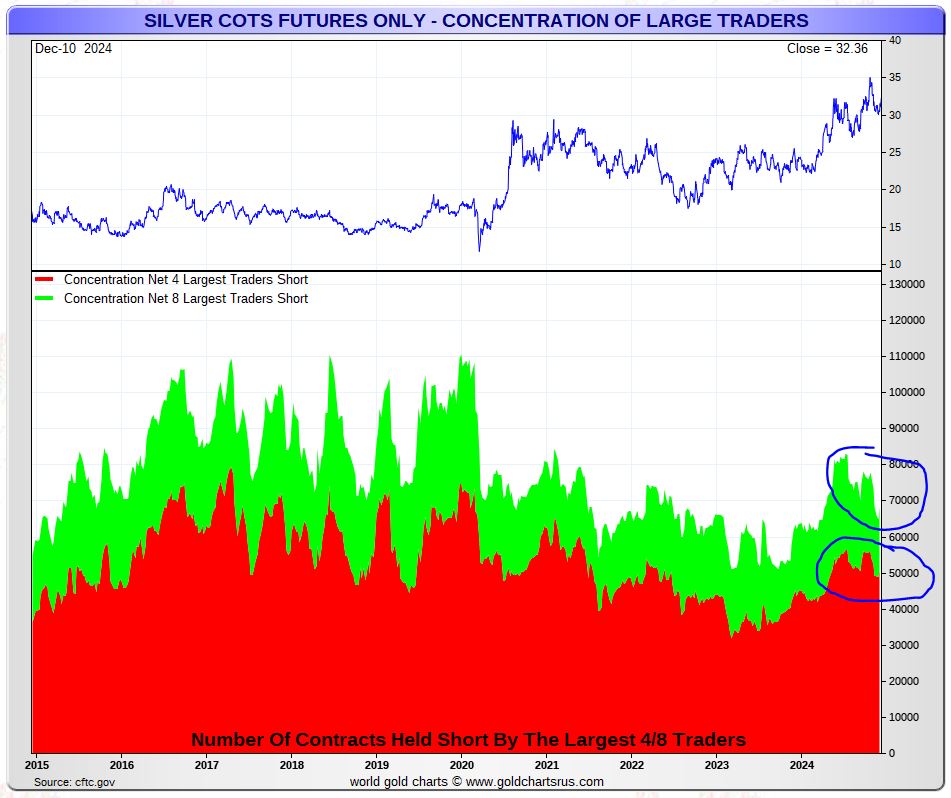

Concentration among the net 4 and 8 largest traders short in the silver futures market is one of the leading indicators of the price of silver. A very high level of concentration, near historic extremes, suggests limited upside potential. The opposite is true as well.

We covered this topic in great detail lately, and updated one of the important silver leading indicator readings a few days ago in Silver: This One Leading Indicator Confirms Massive Upside Potential In 2025:

What’s very interesting is the steep drop in concentration of the 8 largest traders short since October 2024. The circle on the next chart highlights our point – the price of silver came down some 14% but the concentrated silver positions dropped significantly. This is a very healthy development because it brings concentration of the largest 4 and 8 traders short to very low levels (a bullish development).

Remember, this leading indicator is not a timing indicator. It may have a bullish reading, but it tends to function on long timeframes. Moreover, other leading indicators will determine the timing of a bullish outcome.

Silver priced in USD?

This leaves readers with the question – when will silver priced in USD finally go up?

There is good and bad news:

- Bad news – silver’s 2024 rising trendline is being tested, the medium term oriented uptrend is vulnerable if silver drops below $30.5 for more than 5 to 8 consecutive days.

- Good news – on the longer timeframes, there is plenty of support with $26.7 acting as the line in the sand.

Below is the chart. Note that Jan 21st, 2025, is going to be one of the few decisive dates for silver.

We stick to our long term outlook in which we believe that silver will move to $50 sooner or later.