The World Silver Survey 2023 is out and forecasts another year with a supply deficit. Surprise surprise, the report forecasts a flat silver price against last year (on average). The fact that this report is not in synch with our silver price forecast for 2023 is not our concern, we stick to our bullish silver forecast. The larger point, though is that the silver market is going for a 2nd consecutive year through a supply deficit. Any normal market with a supply deficit comes with an appreciation in price (more demand than supply results in a higher price), not so in silver apparently. What to make out of this anomaly?

First of all, we have point out that the Silver Institute, editor of the World Silver Survey 2023, is only looking at fundamental data. The other point is that the Silver Institute tends to take a very conservative approach, it also likes to stick to the consensus view.

From our perspective, we are focused on price. Our silver chart observation has a very different message than the World Silver Survey 2023. We are very clear in this: This Giant Bull Flag On The Silver Chart Will Be Fuel For The Big Explosion Of 2023.

Note that the big breakout in silver is already in progress, after the secular breakout got cleared. There is still tons of resistance to be cleared, around 28 USD in spot silver. In other words, a secular breakout is a multi-step process. We believe it is a matter of time until the final breakout is a fact.

Once 28 USD is cleared, we’ll see readings close to 38 USD in ‘no time’.

That said, let’s turn our attention to the World Silver Survey 2023. Below is a summary:

- 2022 saw a large deficit in the silver market, but institutional investors remained indifferent or bearish towards the metal. According to the report, this should not be surprising, as factors that are positive for institutional investment are negative for key demand segments. Rising and persistent inflation drove physical demand for silver, with retail investors seeking to protect their wealth. However, inflation pushed institutional investors away from silver, as it fueled policy rate hikes and market expectations of a continued hawkish stance, driving US yields higher.

- The downward pressure on silver prices from institutional activity further boosted physical demand, particularly in India, where low prices encouraged the entire supply chain to replenish its stocks. Industrial fabrication, largely linked to the robust solar industry, also contributed to demand growth. However, a lack of supply gains resulted in a marginal decline in mine production while recycling barely rose, culminating in a likely all-time record deficit of 237.7Moz.

- Despite the recent boom in investor demand and the rally, the research note predicts that 2023 will see much of a repeat of last year. Another hefty deficit is forecasted for the year, and institutional investment is expected to run out of steam. The current market consensus that the Fed will be forced to cut rates in H2 will be proven wrong, leading to silver falling to the low $18.00s before year-end, culminating in a full-year average of $21.30, down 2%.

- Overall, the research note suggests that while the silver market saw a large deficit in 2022, institutional investors remained bearish towards the metal. Factors such as rising inflation and the hawkish stance of the Fed negatively impacted institutional investment, while boosting physical demand. The lack of supply gains resulted in a record deficit. However, the research note predicts a repeat of last year in 2023, with another deficit and institutional investment running out of steam, leading to a fall in silver prices.

Again, the above points are not our viewpoint, it’s our summary of the report.

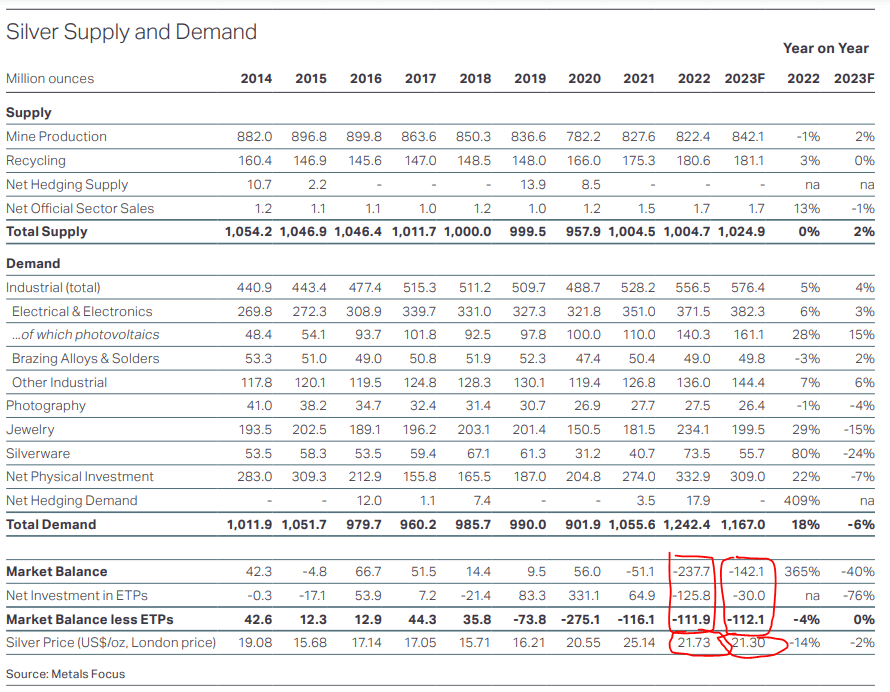

Below table presents the data underpinning the report (the red annotations are ours):

So, here we have a 2nd year with a supply deficit and the conclusion, from a leading silver institution, that this is normal and to be expected.

We’ll pick out one particular paragraph that makes this point. Again, this is not our viewpoint, we copied this paragraph from the report:

“Of course, silver prices rarely take their cue from market fundamentals and are instead largely driven by professional investor activity; 2022 was no exception. For reasons touched on earlier and discussed in detail in Chapter 3, institutional investors were not keen on silver for large parts of the year. This explains why the silver price was generally under pressure from mid-April through to mid-October and also why its average was 14% lower y/y.”

The Silver Institute emphasizes the point that it’s normal (“of course” and “silver prices rarely take their cue from fundamentals”) that a supply deficit does not have an effect on price.

Please re-read this a few times.

We have an expertise in reading charts, not in analyzing every detail of the silver market. That’s why we prefer to to let a real expert comment on what the Silver Institute wrote there. Ted Butler, by far the most competent analyst and expert, in our humble view, since 4 decades, wrote a few thoughts to his premium members. We have the permission to re-print the following (recommended reading: Butler Research):

The World Silver Survey 2023 goes on to try to explain that despite the axiom of the law of supply and demand that more demand than supply (by a large margin) must result in higher prices, that silver prices were lower on average over the year 2022 than the year before. The Silver Institute’s pithy explanation for something that should be impossible under the free law of supply and demand, namely, prices moving lower when demand is greater than supply was due to “institutional activity” in silver. Isn’t that just marvelous? I suppose “institutional activity” sounds a lot more dignified and proper than does blatant price manipulation.The fact is that the only possible explanation for there being much greater demand than supply and prices falling (as the Silver Institute is reporting), is if someone is monkeying with the price. ”Monkeying with prices” is a bland term for what the collusive COMEX commercials do for a living. I guess price manipulation is a term to be avoided at all costs in these reports, despite the fact that all the data in the survey point to that inescapable conclusion.The reason the Silver Institute is reporting a gaping deficit in silver and flat production growth for more than a decade is precisely because prices have been artificially suppressed and manipulated over this time. Nothing, other than price manipulation, is capable for the specific set of facts laid out in this survey. It’s not possible to have more demand than supply, to a record level, and for prices not to explode higher.

Indeed, there can only be one explanation for a flat price trend when supply is exceeding demand: anomalies. These anomalies can last for a long time, but for endless and forever. Sooner or later, price will react to the market reality of a supply deficit.

Readers should verify the line ‘Industrial (total)’ in the table. It’s clear how persistent industrial demand keeps on growing.

This is what Ted Butler is concluding when it comes to the future of the silver price:

The good news for silver investors is that the artificial depressed prices have existed for so long and silver inventories have been so thoroughly depleted that the silver manipulation appears to breathing its last gasps. Any day, week or month is all that stands between where we are in silver prices currently and where we’ll be looking down at in a very short time.

This is what we are concluding when it comes to the future of the silver price: the chart is a pressure cooker that will start exploding not later than in 2023.

We firmly believe that silver is starting a raging bull market. We are not experts in supply/demand data, we believe that the market imbalance provides additional evidence that an appreciation of price, to adjust to the market reality, is near. Regardless, charts don’t lie, the silver chart is explosive, period.

For our Momentum Investing members, we created a selection of top silver miners:

Top Silvers Stocks For Long Term Portfolios >>