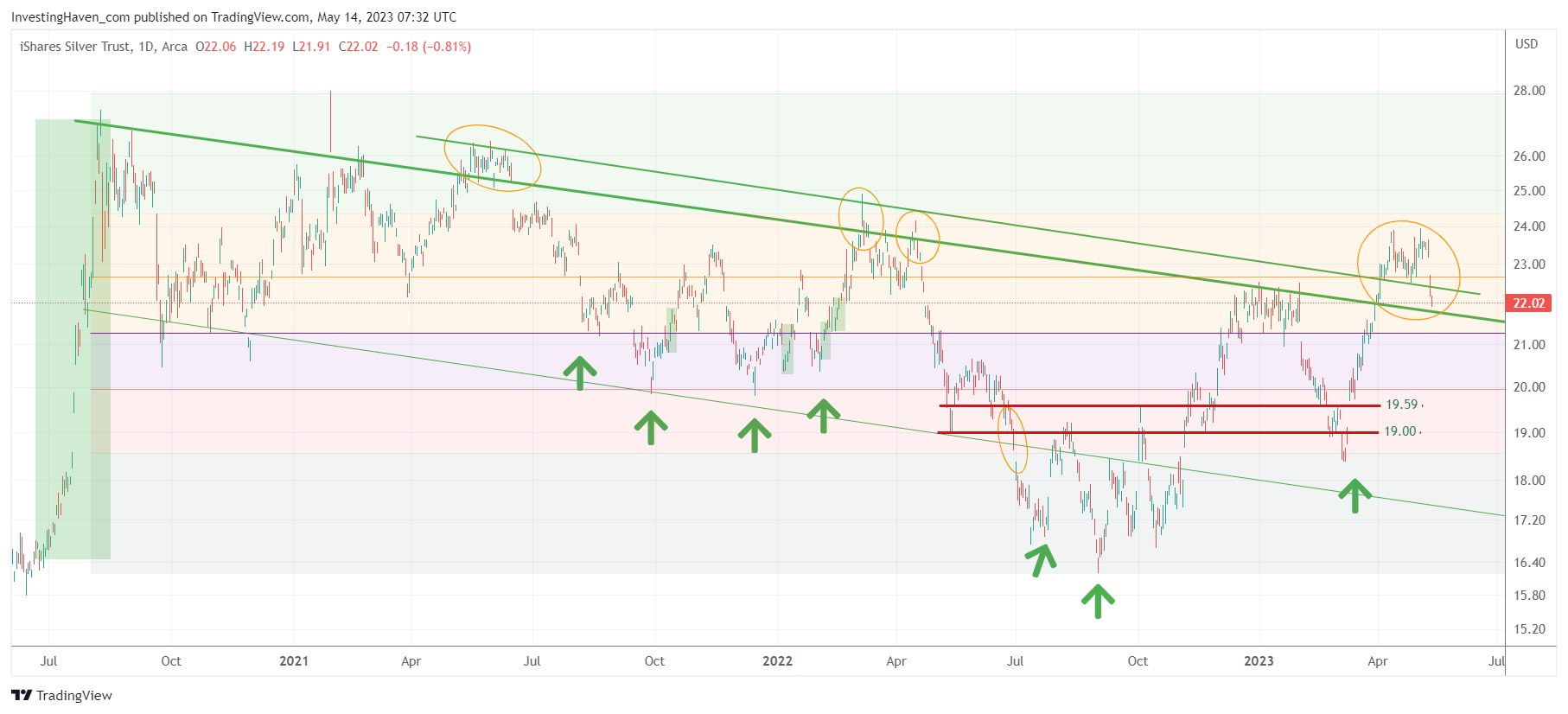

Back in March, we signaled that silver was completing a giant bull flag. One month later, we noticed the confirmation of a secular breakout in silver. Again one month later, today, silver is back-testing its secular breakout. Price action in the silver market in the coming 5 days will be telling. In case of a breakout, we will know that our bullish target as per our silver forecast 2023 will be exceeded. Alternatively, we expect a 2nd breakout attempt in a few weeks or max. 2 months to be successful.

Analyzing the silver market has become a top priority for chartists at InvestingHaven’s research team, as there are compelling signs indicating a potential significant rally in the precious metal. Throughout history, there have been only a few key moments when silver experienced substantial price surges, making it a coveted investment opportunity. Recent developments and market indicators suggest that silver might be on the cusp of another remarkable bull run in 2023.

Several crucial factors have been observed over the past nine months, indicating a potential silver rally. These include a supply deficit in the silver market, structural changes supporting a long-term bull market, and an extreme gold-to-silver ratio. The convergence of these factors has ignited anticipation among investors, eagerly awaiting a potential surge in silver prices.

Analyzing the Silver Chart Structure and Breakout Event

The chart of the SLV ETF, representing the silver market, reveals a notable event: the breakout of the falling trendline on April 1st. This breakout signaled a potential shift in market dynamics, suggesting that silver could be poised for a secular breakout. The subsequent six-week period has seen a back-test of this breakout level, which is currently unfolding. This back-test is a critical event that will provide valuable insights into the strength of the breakout and the sustainability of the bullish momentum.

In addition to the breakout and back-test, other chart findings support the case for a potential silver rally. The silver market has experienced structural changes, setting the stage for a sustained bull market. These changes, along with the supply deficit, have laid a solid foundation for silver’s upward trajectory. Moreover, historical analysis reveals that significant silver bull runs have often originated from extreme levels of the gold-to-silver ratio. The current positioning of this ratio suggests the potential for a momentous silver rally.

Conclusion

The upcoming week will prove decisive for the silver market, as it tests the crucial level that confirms a secular breakout. A successful back-test, with the SLV ETF trading above 22 USD in the next one to two weeks, would validate the breakout and provide confirmation of silver’s upward trajectory. Such confirmation would likely fuel increased momentum, potentially leading to a sustained rally in the coming weeks and months.

However, if the breakout level fails to hold, silver may need more time around its 50% retracement level to gather energy and consolidate before resuming its ascent. This scenario would delay the breakout but not necessarily negate the long-term bullish prospects for silver.

Investors, silver enthusiast and chartists alike eagerly await the outcome of this critical testing period, as it has the potential to shape silver’s trajectory in the near term. As anticipation builds, market participants should closely monitor silver’s performance and adapt their strategies accordingly, ensuring they are well-positioned to capitalize on potential opportunities in this historic market.

For our Momentum Investing members, we created a selection of top silver miners:

Top Silvers Stocks For Long Term Portfolios >>