We typically write our market forecasts around year-end. In this article, we summarized the 5 most important investing tips for investors based on our 2023 forecasts, published in November. Which investing tips can help determine terms do’s and don’ts in 2023, which markets look good, which investing types should be considered and which ones not? This article predicted that there would be no stock market crash in 2023.

Ed. note added on June 18th, 2023: we follow up on this article, which was written and originally published in the first week of November 2022. We add commentary, in each section, indicating where we are adding commentary, so to keep ourselves honest on our forecasts.

The tips shared in this article are based on the following forecasts we recently published:

- Why Markets Should Resume Their Uptrend The Latest In March of 2023

- Stagflation Investing: How And Where To Invest In 2023

- Lithium Forecast: Lithium Stocks Will Be Wildly Bullish In 2023

- Which Is The Biggest Investing Opportunity Of This Decade? (published 18 months ago)

- How To Play The Green Battery Super Cycle In 2023?

- A Silver Price Forecast For 2023

Investing tip #1. Quality stocks above momentum stocks

Investing tip: Initially, the focus of investors should be on quality stocks that generate revenue and keep on growing. As time passes, some more focus on momentum stocks are allowed.

2023 should come with rising inflation expectations.

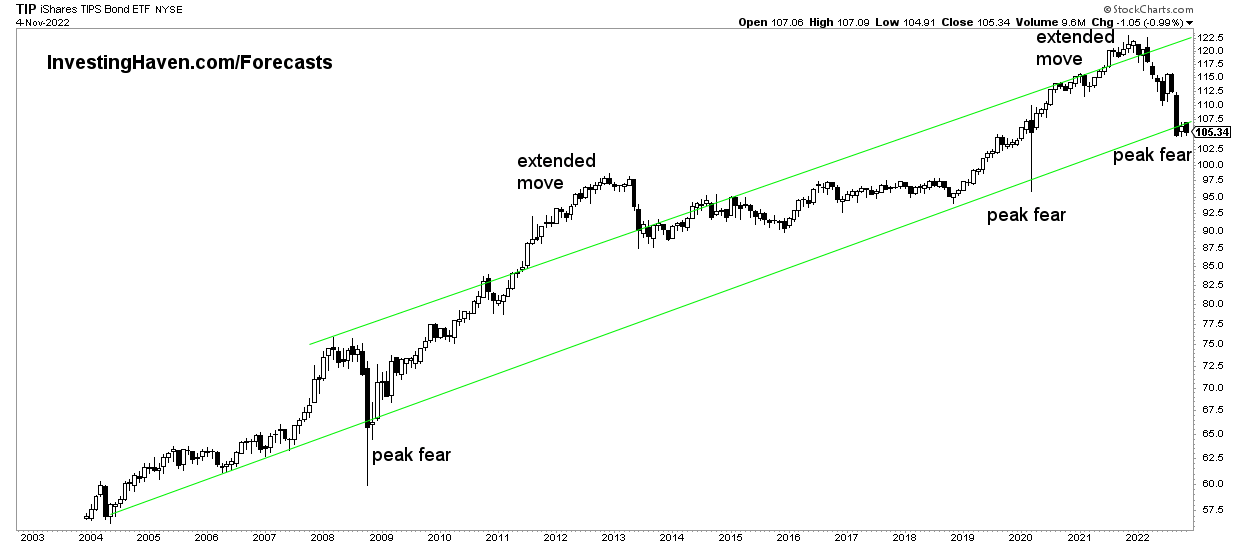

We used TIP ETF throughout our 2023 forecasts as a recurring topic, the red line. It is a measure for expected inflation came down aggressively in 2022. That’s because of the very aggressive stance of the U.S. Fed as well as other monetary policy makers globally. However, we believe the decline of TIP ETF has run its course. As seen on the chart, the decline in 2022 touched a rising trendline that is dominant since 18 years.

What this really means is that monetary policies should soften in 2023. Inflation expectations can rise again, presumably moderately (at a more regular pace closer to the 2% desired inflationary rate).

Typically, stocks tend to react to the rise of TIP ETF in a cyclical way: first quality stocks go up, at the end of the uptrend in TIP ETF (top of the long term channel) are momentum stocks reacting to the upside.

That’s why momentum stocks should (a) only be considered towards the end of 2023 (b) some of them, beaten down quality momentum stocks, can be picked up at discounted prices in this early stage.

Commentary added on June 18th, 2023:

- Inflation expectations as per TIP ETF continues to trade within the long term rising channel.

- We made the point, one week ago, in this article: The Most Important Chart Of 2023 (updated).

- We gave TIP ETF one of the most important charts, also the implications of respecting the long term channel. This was the prerequisite for a recovery in markets, which we got so far in 2023.

Investing tip #2. The EV boom continues

Investing tip: EV sales continue to boom, beaten down EV stocks that are keeping their delivery and production promises can be bought.

The EV boom is for real.

However, not all EV stocks are worth your portfolio.

We have said repeatedly to only consider EV stocks that have a long and visible (proven) production backlog with paid pre-orders and confirmed production plans.

This seems an obvious list of criteria, it certainly is an obvious list, however the number of EV companies that are meet all criteria is limited.

Moreover, the key commodities for the EV space are lithium and graphite. Top lithium and graphite stocks are a must-have in any long term portfolio.

Commentary added on June 18th, 2023:

- So far, the prediction is proven right.

- The slowdown in China did impact both EV and lithium/graphite, in the first half of 2023.

- It looks like the numbers are picking up again, which translates into signs of recovery in EV stocks as well as lithium stocks.

- The 2nd part of 2023 should come with an accelerated rise in EV + lithium/graphite.

Investing tip #3. Watch rate and USD sensitive stocks

Investing tip: The USD will come down in 2023, so will yields. Stocks that are rate and USD sensitive should be considered early on in 2023.

Further to tip #1 which was all about rotation from quality (early in the year) to momentum (late in the year) we believe that USD and rate sensitive stocks can be considered.

It is really easy to find the sectors that are USD and rate sensitive: just look at which sectors outperformed last week, when the USD and rates came down a lot.

Those sectors will do well in the first half of 2023 because it is now clear that both the USD and rates are topping.

Commentary added on June 18th, 2023:

- The USD came down, as expected. Yields came down but are on the rise again, at the time of writing.

- The USD remained below 105 points, so far. Yields are not making higher highs, at the time of writing.

- This helped quite some stocks to recover, a handful of them to rise significantly.

Investing tip #4. Volatility readings will gradually decline

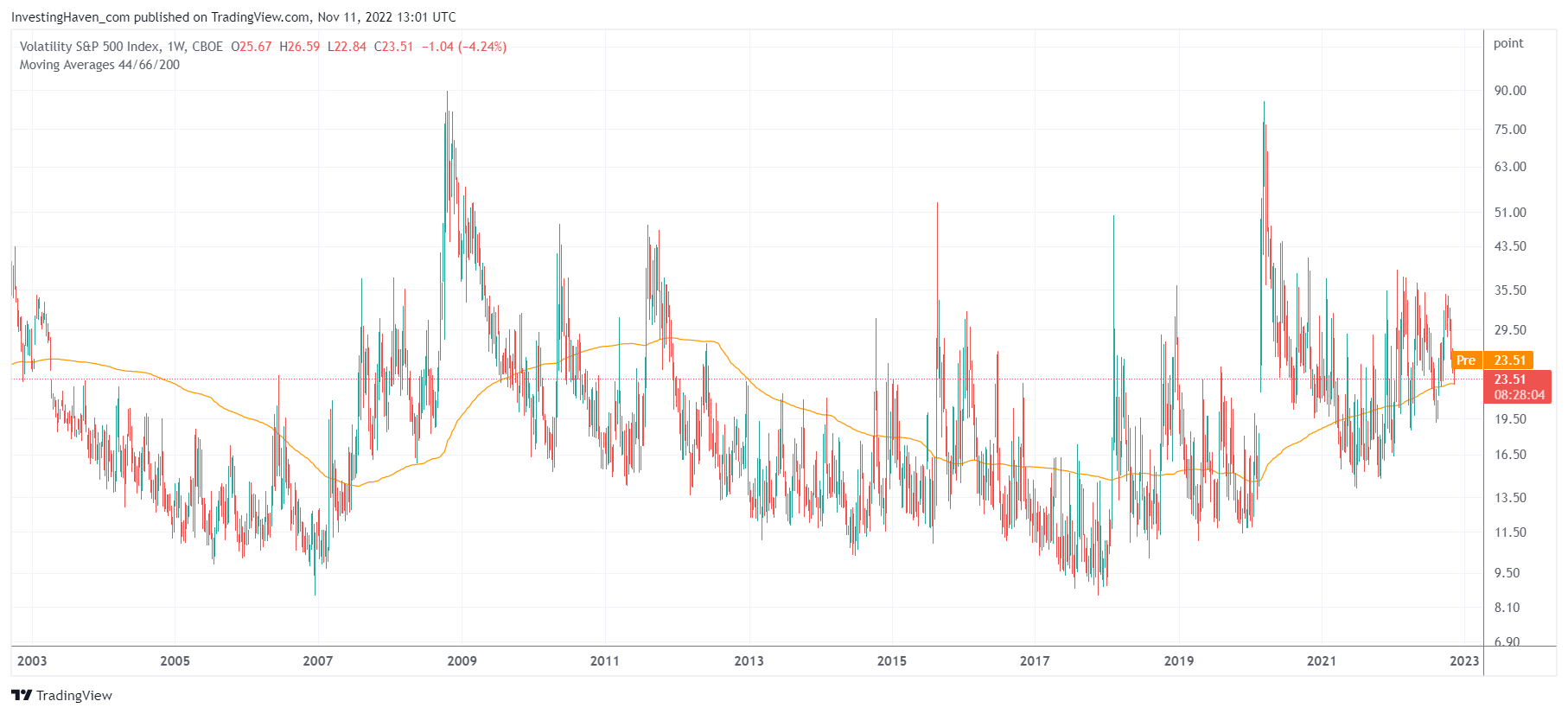

Investing tip: We believe that better times are underway. VIX is setting lower highs on its weekly chart. It might finally fall below its 200 WMA which would be great news. 2023 will be really different.

Volatility levels were persistently high in 2022, however we expect that the average volatility level will be lower in 2023. This really means that investors can buy the dip, respecting the other investing tips shared in this article.

Commentary added on June 18th, 2023:

- This was absolutely right.

- Our initial prediction was published in November, when volatility levels were really high.

- Since January, volatility started coming down, exactly as forecasted!

Investing tip #5. Watch for silver’s secular breakout

Investing tip: The price of silver will move to our first target which is 28 USD. Once it is able to clear secular resistance at 28 USD, we see a quick move to 34.70 USD or even 41 USD in 2023 or 2024.

Silver is the outlier in 2023.

It is the market with explosive potential.

However, we must be patient and see the bullish confirmation appear on the silver chart. This might take many more months, ultimately we expect somewhere in 2023 to see an explosive move in silver.

This is what we wrote in our silver forecast:

As seen on the longest timeframe, the silver price chart over 50 years, there is a giant cup and handle in the making. This is a strongly bullish pattern, one that might take two more years to truly explode.

We continued:

- Leading indicators Euro and inflation expectations turned bearish in Q2/2022, pushing silver lower.

- The silver CoT turned extremely, historically bullish as we head into 2023.

- Once the Euro and inflation expectations start rising, we silver see taking off.

That’s why we see silver easily moving to 28 USD in 2023 and moving to our first and longstanding bullish target of 34.70 USD. Our silver price forecast 2023 is 34.70 USD. Whatever happens at that price point will inform us about the intention of silver to attack ATH, presumably near the end of 2023 or in 2024.

Silver is the outlier, the bonus, the wildcard in the game. If and when silver takes off, it will be ‘hallelulaj time’. Investors should not wait for this to happen, they should start accumulating silver assets over time to be well positioned once the silver market starts booming. It’s a matter of time, but don’t wait for it. Rather, let it happen.

Commentary added on June 18th, 2023:

- So far, this prediction did not come true.

- However, as said in Silver’s Leading Indicators Suggest It Will Resolve Higher as well as Silver’s Secular Breakout Now 44 Days In Progress the silver market is readying itself for a secular breakout confirmation.

- We believe that silver will register the first part of its rally not later than August/September of 2023.

Must-Read 2023 Predictions – We recommend you read our 2023 predictions as they are very well researched: