Financial media can be a great source of information and insights on the market, but it is important to be wary of it as well. Many financial media outlets make predictions about the stock market that turn out to be misleading or inaccurate. It’s not their intention, but during times of extreme sentiment financial news tends to be loaded with lots of emotions. This tends to coincide with turning points. This is one of the biggest mistakes by investors: they tend to look for news to explain their emotions, often seeking help, but will only get served more emotions while in reality they are desperately looking for turning point related insights. Turning point analysis is not what financial media will serve, unfortunately.

It is important to understand that moments of extreme sentiment (both bullish and bearish) the market is often at an important turning point. The irony is that people tend to look for news exactly when sentiment is most extreme. The human, intuitive reaction, of looking up news to explain extreme sentiment, is understandable. However, financial media is not the answer to the human need. Turning point analysis is the answer. Not any financial media outlet will mention a turning point in markets, not any. They will do what they have to do, as a commercial organization, which is sell stories to maximize ad revenue.

Lots of illustrations from the recent past

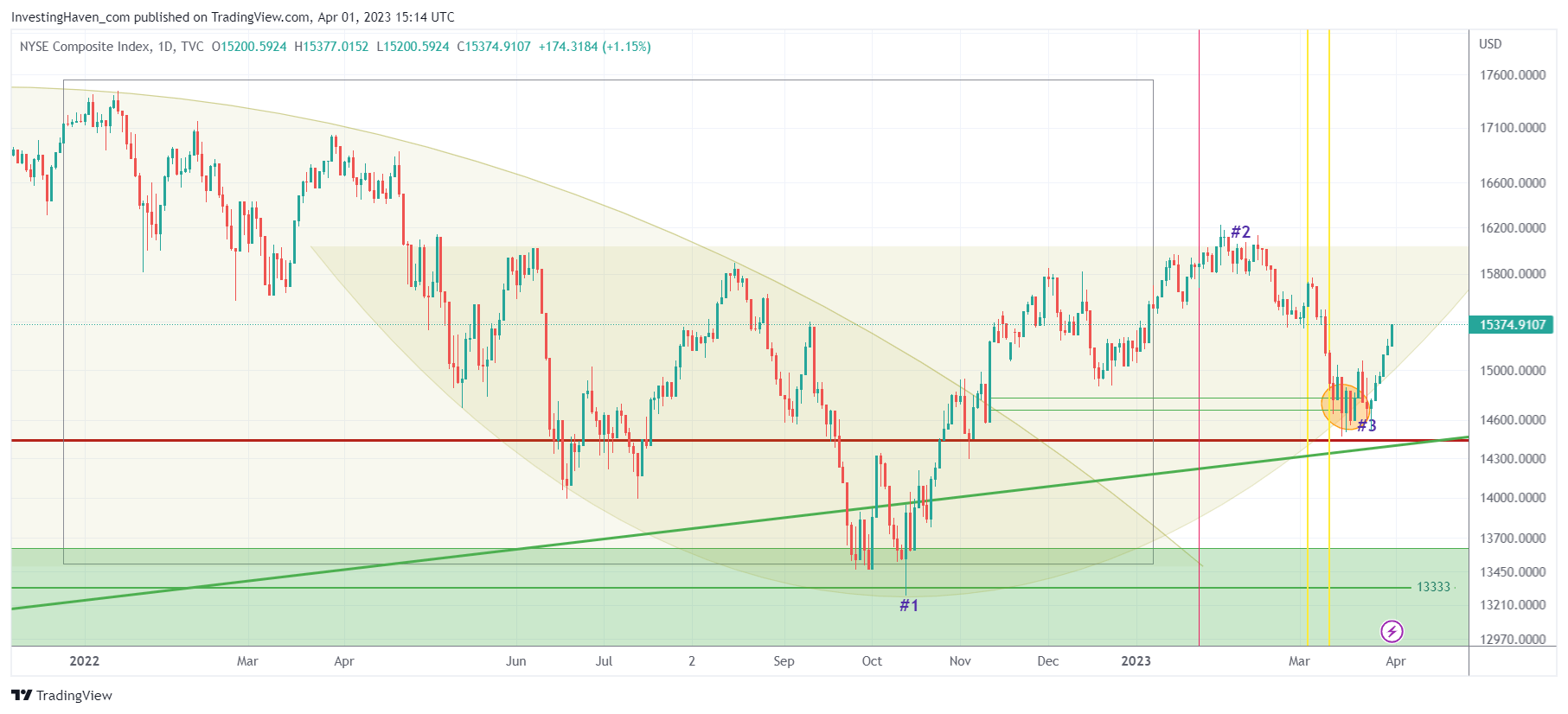

The chart shows the NYSE index over a period of time with annotations marking points of extreme sentiment. Point #1 is marked as an instance of extreme bearish sentiment, Point #2 as an instance of very bullish sentiment, and Point #3 as an instance of extreme fear. In all those instances, the NYSE index went the other direction, suggesting that extreme sentiment tends to coincide with turning points in markets.

At point #1 on October 13th, 2022, there were a few factors that contributed to extreme bearish sentiment in the markets. The S&P 500 had just experienced a significant decline, with some analysts predicting a further drop. The US Federal Reserve had also just announced plans to reduce its bond-buying program, which was seen as a negative signal for the market.

- This is one of the many illustrations of financial media headlines: ‘It doesn’t feel to me like the stock market low is in’.

- This is what InvestingHaven was writing, even in the public domain: The Market Will Not Move 50% Lower Contrary To What The Gurus Are Telling You.

At point #2 in early February 2023, sentiment had turned very bullish, with the S&P 500 experiencing a strong rally. This was due to a number of positive economic indicators, including strong job growth and higher-than-expected corporate earnings.

- This is one of the many illustrations of financial media headlines: A new bull market is underway amid Powell’s acknowledgement of falling inflation.

- This is what InvestingHaven was writing, even in the public domain: Leading Indicators Confirming A Pullback Is Underway.

At point #3 at the end of March 2023, sentiment had turned extremely negative again, as a banking crisis in Europe threatened to spill over into global markets. There were concerns that major banks could fail, leading to a systemic shock to the financial system.

- This is one of the many illustrations of financial media headlines: IMF chief warns global financial stability at risk from banking turmoil.

- This is what InvestingHaven was writing, even in the public domain: Markets Downside Target Reached – What Now.

It’s all and only about the turning point

Investors may be better served by focusing on the broader market trend and turning point analsyis, rather than trying to time the market based on short-term sentiment or news events.

This supports the idea that extreme sentiment can be the ultimate contrarian indicator provided it is confirmed by turning point analysis.

Many investors tend to make decisions based on their emotions and follow the herd, which can lead to buying high and selling low. However, tracking news can be misleading as it tends to reflect the current sentiment of the market rather than providing insight into potential turning points.

Therefore, it’s important to be aware of extreme sentiment and avoid making decisions based solely on emotions or following the herd. Instead, investors should focus on analyzing market trends and indicators to make informed decisions.

Stated differently, stay away from financial media when it feels very good or very bad. Better spend time on turning point analysis… or follow analysts that can help you with this.

More illustrations from the past

The 2016 Brexit vote: After the United Kingdom voted to leave the European Union in June of 2016, sentiment towards the global economy was extremely negative. Many investors were concerned about the impact of Brexit on the markets and the economy, causing stocks to sell off. However, after an initial dip, the market rebounded and went on to reach new highs. Those who were able to remain calm and buy stocks during the Brexit selloff were able to make substantial gains as the market recovered.

Another example would be the 2011 European debt crisis. In the summer of 2011, there was widespread fear and panic in financial markets over the solvency of several European countries, including Greece, Italy, and Spain. Many investors were selling their European stocks and bonds in a panic, fearing a total collapse of the eurozone and a global financial meltdown.

However, as it turned out, the crisis did not lead to a complete collapse of the eurozone, and the European Central Bank eventually stepped in with a series of measures to stabilize the situation. By the end of 2011, the markets had rebounded strongly, with the S&P 500 index up over 10% for the year. Investors who had stayed the course and not panicked during the crisis were rewarded with strong returns.