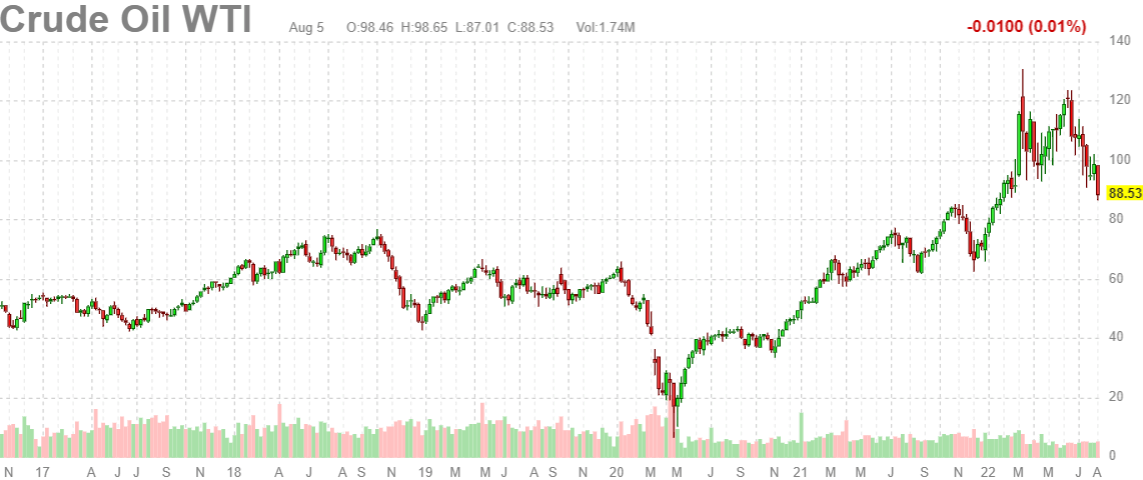

So far the commodities super cycle and the crude oil opportunity. It turned out to be a 3 week opportunity, that’s it. The bullish sentiment surround commodities, especially crude oil, continued to live on for many more months, seducing investors to invest in the crude oil sector. It was an illusion, bullish price action took only 3 weeks but the perception continued for many months… until the crude awakening of last week’s crude oil breakdown. In our Momentum Investing research we wrote on June 12th that both crude oil and energy stocks had topped which, in hindsight, appeared to be an epic turning point observation!

What’s interesting about this current market environment is that the traditional intermarket correlation between the USD and commodities is broken. As we observed this Must See Bearish Pattern On the US Dollar Chart in recent weeks the commodities space did not move higher (with the exception of a relief rally in precious metals gold and silver).

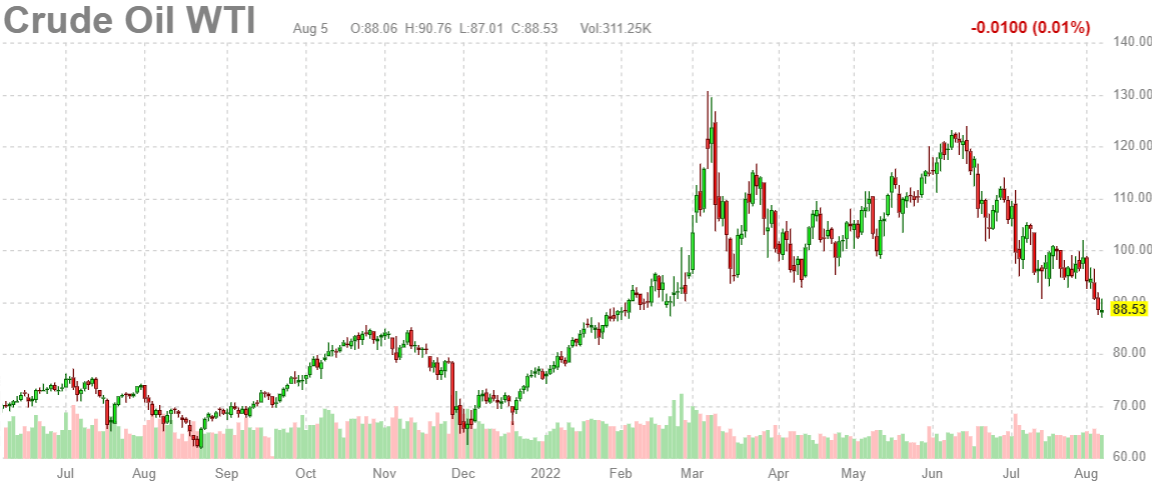

The daily crude oil chart is now officially in a breakdown process. It violated 93 USD/barrel which was the line in the sand. It’s the price level that marked the breakout right after the Russia/Ukraine war started.

What’s interesting, looking at this chart, is that the bull run in crude oil started in the 2nd week of January. That’s 6 weeks before the war broke out. Did the market know more? Maybe, probably, presumably.

While the daily crude oil chart officially signals ‘breakdown’, we can see how the weekly crude oil chart is now officially ugly. Not only does the weekly confirm the breakdown on the daily, it also confirms the epic turning point and major (double) top in this market.

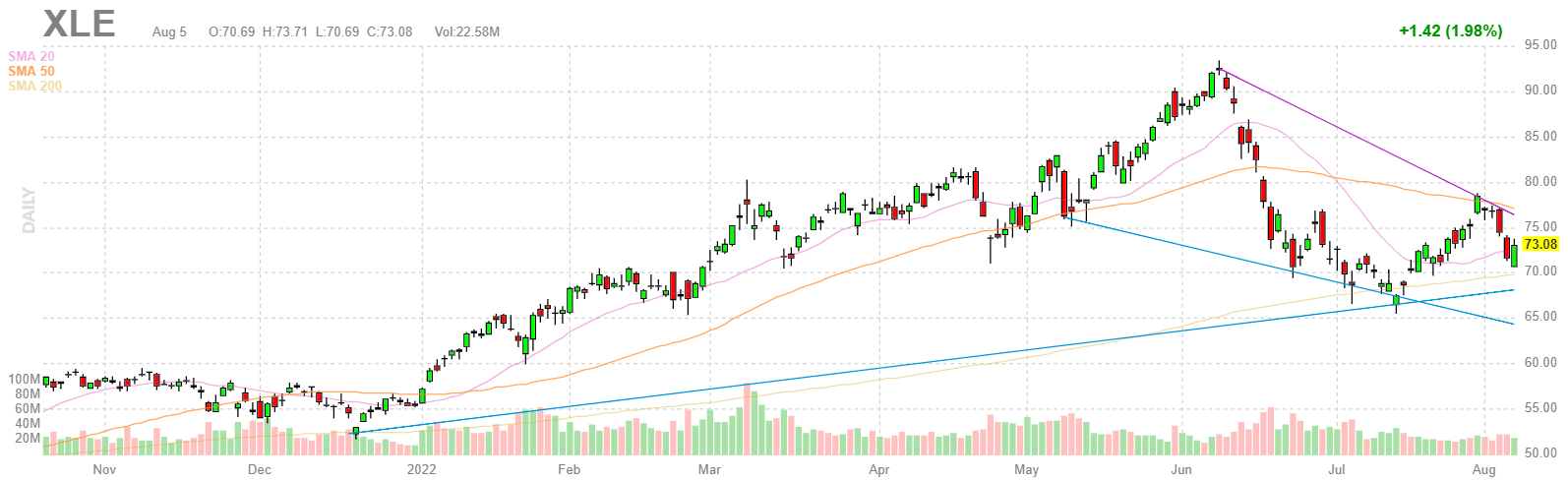

In the first week of June we got a few premium members asking for recommendations to invest in energy stocks. We thoroughly checked the XLE ETF chart and concluded that it had set a top. On June 12th, two days after the epic top was set, we wrote this in our Momentum Investing research service:

We are not tempted to enter energy stocks. On the contrary, pending confirmation, we believe there is a potential topping pattern on the crude and XLE charts. XLE hit 93.31 June 6th, a very powerful time/price combination so it looks like a turning point. The arc setup on the XLE chart might be confirming this, also pending confirmation.

The above was our observation exactly 2 days after the top was set in XLE ETF, when XLE was trading at 88 points (the chart is available in the restricted area). This is the current XLE ETF chart:

Why is it so important that we mention all this?

Because news is lagging, and it is a big risk for investors to give news too much value. This is what financial media outlets were writing on exactly the same day we called a top and a turning point:

Energy Stocks Are Set to Get Hotter. 6 That Can Get You a Piece of the Gusher (June 12th, Barron’s)

Energy has more room to rise, though. There’s still time to buy into the stocks, particularly for investors willing to consider the term “energy” broadly. That means buying renewables-focused companies, too, and evaluating companies in part on their efforts to lower carbon emissions, a key trend going forward—and one that will be at least as big an economic driver in the longer term as traditional energy uses are today.

The One Type of Stock That’s Booming During the Bear Market (June 17th, Money.com)

A months-long selloff finally culminated in stocks officially entering a bear market this week. But one area of the market is actually thriving.

The article continues:

We’re heading back to the office and even traveling again, all of which entails using oil. “We do have high demand for oil as economies continue to normalize and are recovering following the pandemic,” says David Sekera, chief U.S. market strategist for Morningstar. “The market between oil supply and oil demand is very tight.”

Fortunately, there is also a section in the latter article that mentions a money manager suggesting to take profits in the energy sector.

But the point is this: financial news is lagging.

Because of this, financial media will always miss the turning point.

If you look at the crude oil and energy stocks charts, you can clearly see the turning points which were set around June 8th.

Over here, at InvestingHaven, we include turning point analysis in our methodology. That’s why we were able to identify the turning points in both crude oil as well as energy stocks (XLE ETF) just a few days after it happened. That’s why we never recommended our Momentum Investing members to get into energy stocks. Noe that our top pick is a large cap semis stock that is growing tremendously fast in the automotive and clean energy sectors which consume an exponentially higher number of chips. We like growth sectors and are fully invested in the mega super cycle of this decade (also, our top stock shortlist has only stock tips in this decade’s super cycle).