Commodities were hot in the aftermath of the Corona crash. First, gold and silver started moving (until last summer). Base metals came next. In recent months we saw strong momentum in special metals (cobalt, lithium, rare earths) as well as grains and some softs. What’s next in markets in 2021? Can we expect commodities to continue to shine? Are we in a commodities super cycle?

We take a look at the Australian Dollar, the Aussie, to get an understanding of the trend in commodities. It’s certainly not the only leading indicator, but it is a reliable leading indicator.

We take a classic top-down approach in reviewing trend patterns on the Aussie charts.

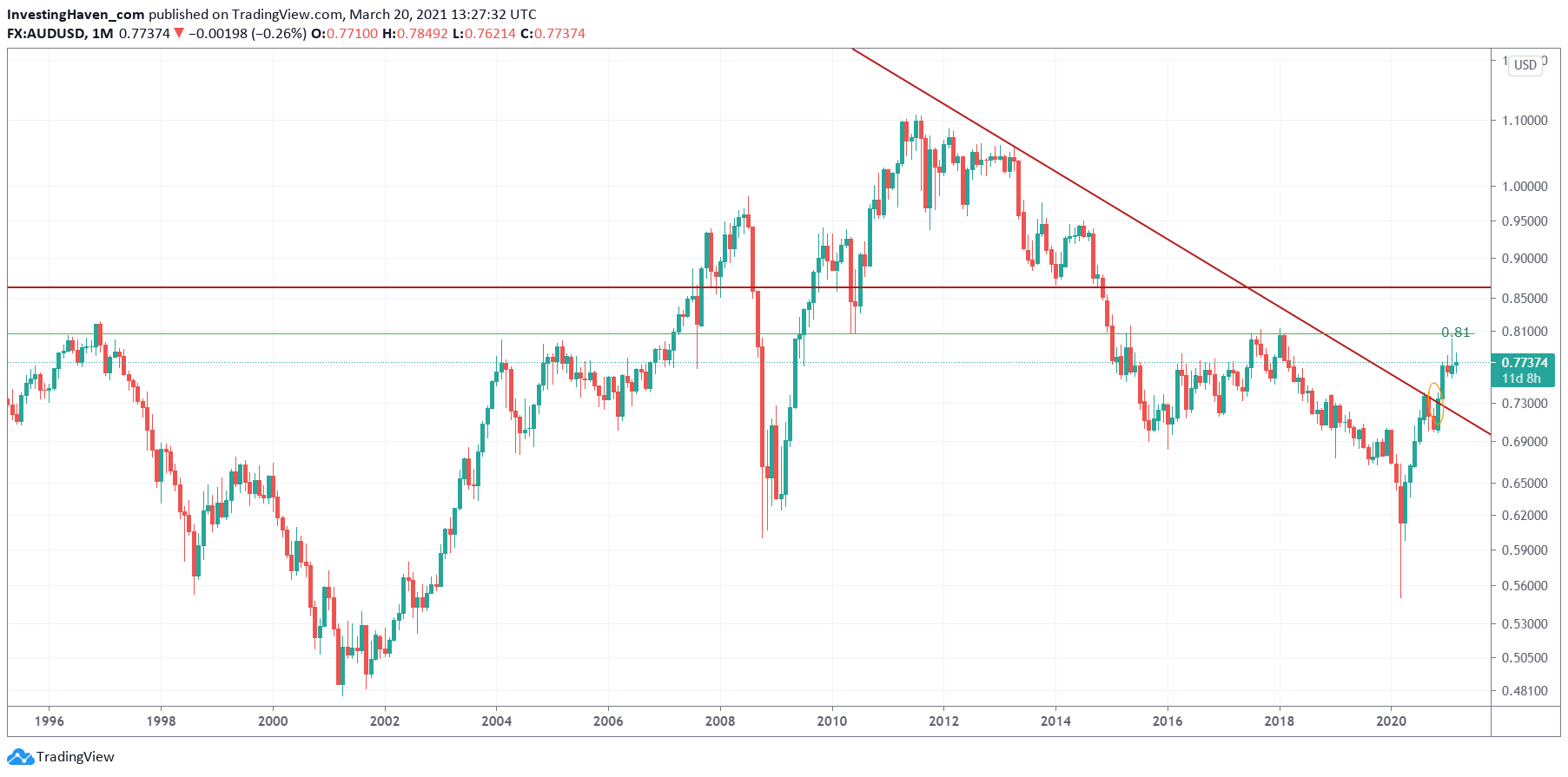

The monthly chart says it all. The Aussie recently hit a decisive level that goes back multiple decades: 0.81 points. No surprise it wasn’t able to break through it immediately. And the million dollar question is if and when it will move above it.

The monthly chart above has 2 more observations that are important, but for which we need the lower timeframe (weekly chart, below) for a better understanding:

- The falling trendline, say the bear market trendline, that goes back to 2012.

- The 6 year reversal pattern that goes back to 2014.

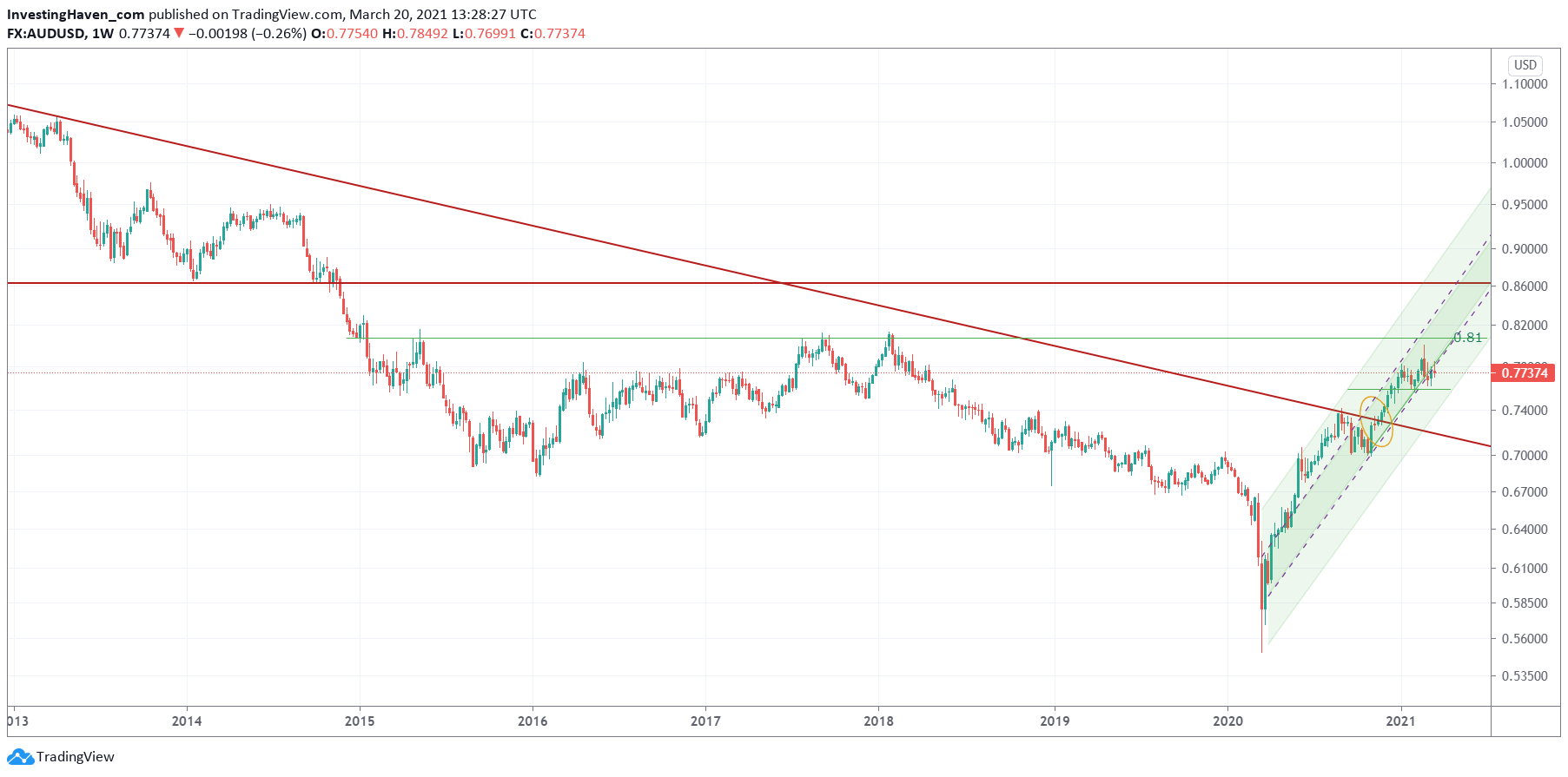

The weekly chart below shows how the bear market trendline (falling red line) was broken to the upside in November of 2020. The daily chart (3d chart in this article) shows the closeup. That’s very bullish, on all timeframes.

When it comes to the 6 year reversal pattern, since 2014, we see a long and slow reversal between 2014-2018, followed by a steep decline going into the Corona crash lows. That’s when the ‘right part’ of the bullish reversal started.

This chart doesn’t help us understand how we go from here, especially in completing the long term reversal. Do we need a long and slow reversal pattern similar to the one in 2015-2018? Or will this current rising trend (which started in November of last year, arguably in April of last year) continue at its current pace?

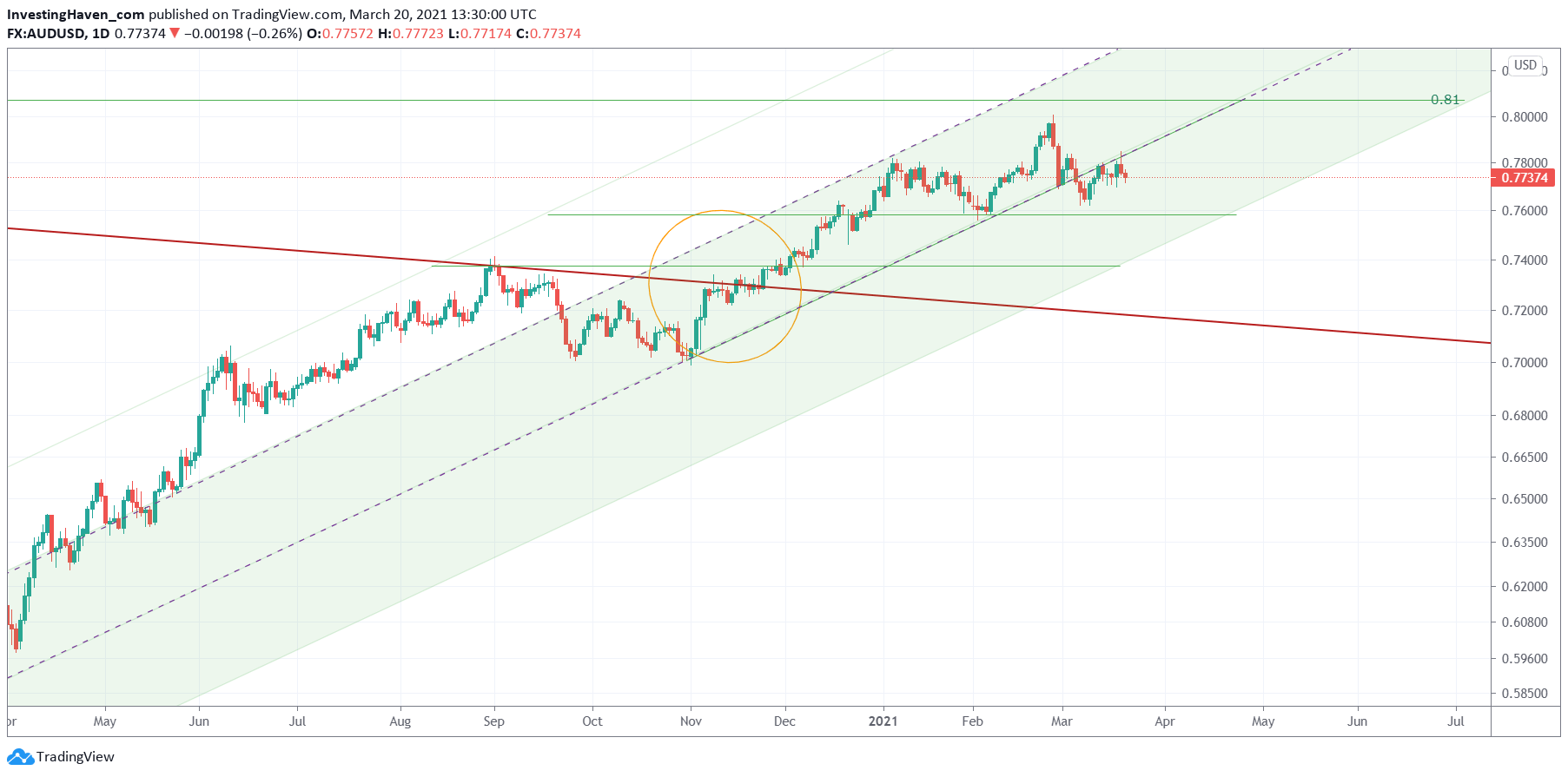

The daily chart only partially helps us answer the above question. And the way it looks, at present time, is ambiguous.

On the one hand we see a consolidation that started in the first week of January, after a steep rise in November/December. Flat until proven otherwise, is what one might conclude. And we would need a short term bullish reversal that will respect 0.765 in April and May of this year …. before we head to 0.81 and next 0.86 points.

On the other hand we could see a head-and-shoulder pattern that is playing out since the first week of January. In that scenario we are now completing the right hand shoulder, and it might be a topping pattern.

It’s clear that’s unclear at this point in time. The medium and long term trends are higher, and the November 2020 breakout after an 8-year bear market is probably indicative of a new secular bull market in commodities.

April will be an important month. It will be the month in which one of the two scenarios outlined in the commentary of the daily chart (above) will become clear.

Commodities need a rising (or flat) Aussie to be bullish. A falling Aussie will not be good for most commodities. Moreover, we do know from history that commodities don’t rise simultaneously, they move in clusters.

All this implies that as long as the Aussie respects 0.76 points we will see some commodities do well, and others consolidate. We believe that April will be a decisive month for the medium and even long term outlook for commodities as an asset class.