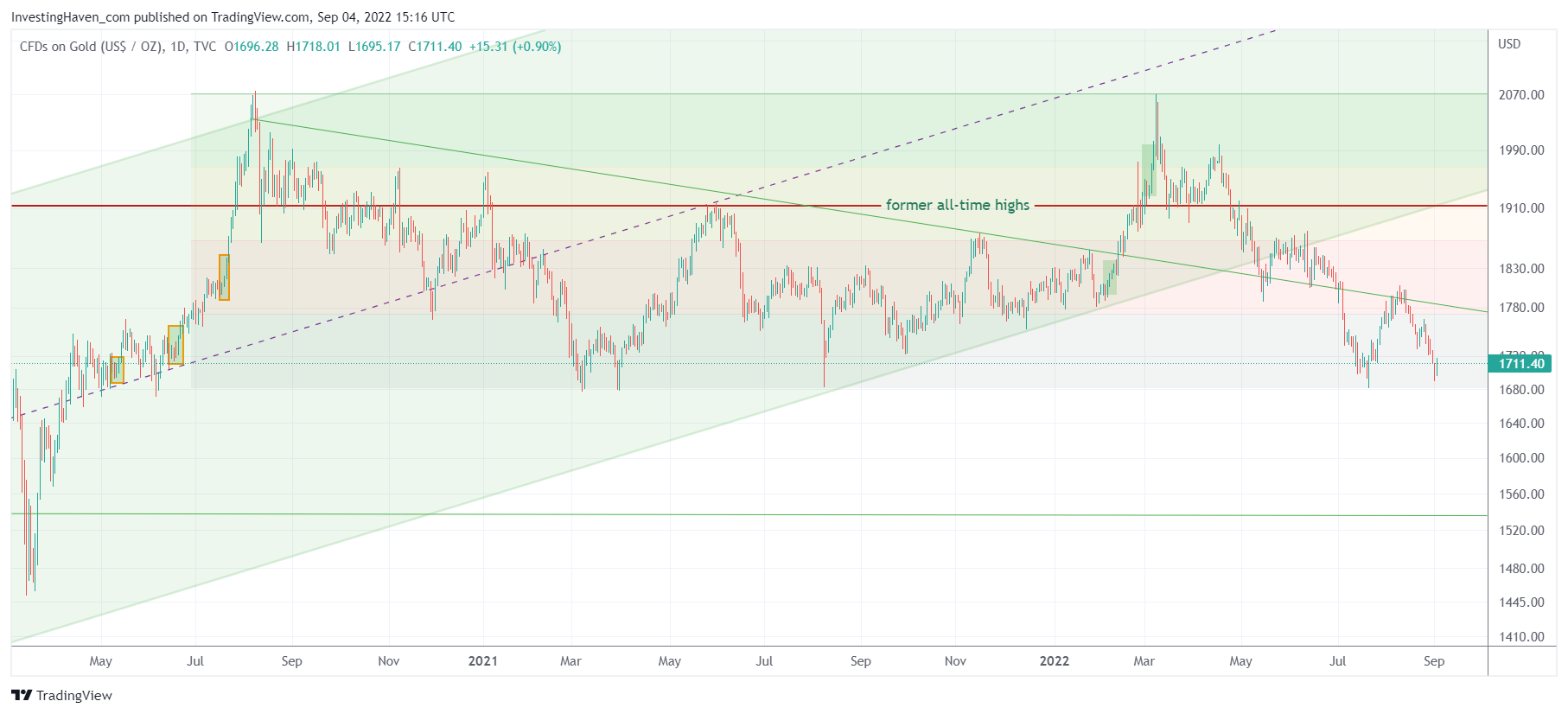

Gold is close to testing a really important level. The market is clearly eager to test 1680 USD. The fight between gold bulls and gold bears will reach momentum and it is happening a few days before the next CPI figures are out.

Gold is trying to hold, is what the gold chart tells us. There is certainly a really crucial test ongoing. The market is preparing a big bounce or a breakdown by Sept 13th when the next CPI report will be out.

Gold has not lost its luster. At least, not yet. To be more precise, as long as gold respects the 1680 USD level which goes back 18 months there is no damage and only a long term bullish consolidation.

Recently, we wrote this piece Gold’s Chart Suggests Stagflation Is Here To Stay In 2023 And Beyond with this conclusion:

If gold was able to hold strong, amid monetary tightening and softening economic growth, it must mean one thing: STAGFLATION is here. Given the structure, we would argue that stagflation is here to stay.

We can imagine that the gold chart holds and that the world has entered a period with inflation (getting under control, to be confirmed by the next CPI data) and lower economic growth.

Stated differently, the gold chart structure at the time of writing is signaling exactly that.

The reality is that the market is waiting for the next CPI report. Much will depend on the pace at which inflation is decelerating which will directly inform monetary policy (read: rate hike by the U.S. Fed). This, in turn, will inform the pace of monetary tightening and will instruct the USD. That’s what we concluded in A Gold Chart You Have To See As We Head Into Another FOMC Meeting:

If the upwards move is done in the USD, that means that Gold will make a spectacular bounce from the bottom of this multi year consolidation channel. This bounce would clearly lead to the materialization of our Gold price forecast for 2022 with a price target of $2500.

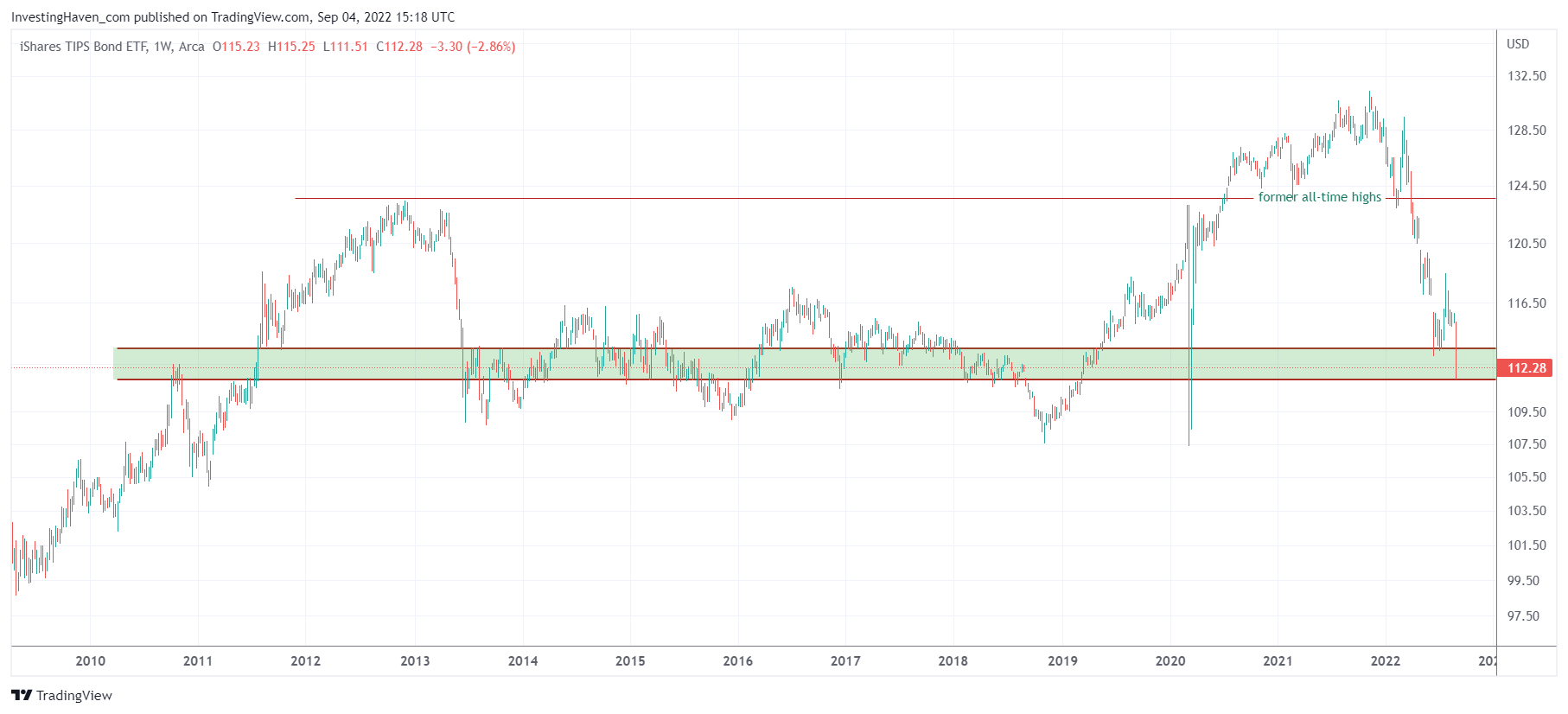

In the meantime, we see that inflation expectations (TIPS ETF) got lower last week, particularly on Wednesday. TIPS is now back at levels from the period 2013 – 2018. Arguably, this should act as support which would imply that monetary tightening will not accelerate but stagnate, again to be confirmed by market developments.