2023 has been marked by an 18-month-long sector rotation that has left analysts and investors scratching their heads. This phenomenon has poses multiple challenges and opportunities for market participants. Amid relatively low levels of bullish sentiment, an environment in which a secular sector breakout is not the most expected ‘event’, there is one sector that staged a truly spectacular breakout. In fact, this breakout is so powerful that we can conclude, with a high level of confidence, that we are now witnessing THE most spectacular breakout of 2023. After the single most important chart of September 2023, we invite you to see the most spectacular chart and breakout happening in September of 2023. While most of our 2023 forecasts have proven to be accurate, we did not expect this particular commodities sector to stage such powerful turnaround in 2023.

What does that mean, a “spectacular breakout?” Well, in our view, it means a breakout that is so powerful because of its tremendous upside potential. As we all know, tremendous upside potential is only possible after a spectacular decline.

That’s exactly what we see in the sector breakout that we cover in this article.

Trend #1. Unpredictable sector pops and drops

As mentioned, sector rotation is the dominant market trend since 18 months.

Sector rotation has made it incredibly challenging to predict which sectors will rise and which will fall. This environment of constant flux has rendered traditional forecasting methods nearly obsolete.

- Analysts who once relied on historical data and patterns are now finding it difficult to offer reliable insights.

- Investors, accustomed to having some degree of predictability, find themselves facing a dilemma: where should they allocate their capital? Even the most seasoned analysts may find it difficult to stay ahead of the curve.

The market has become a whirlwind of shifting dynamics, where yesterday’s leaders can quickly become today’s laggards. This unpredictability has made it very tough to hit those few winning trends.

Trend #2. Portfolio evolution and emotional impact

As sectors ebb and flow, investors often experience a rollercoaster of emotions. Some positions surge while others decline, making it feel as though there’s little progress in their overall portfolio. This emotional aspect of investing can be a significant hurdle to overcome, as it requires discipline and a long-term perspective. The psychological challenge of adapting to rapidly changing market conditions is something investors may underestimate. It’s not just about the money; it’s about managing the emotional highs and lows that come with it.

Staying invested in a well-thought-out strategy can be tough when some sectors are flourishing while others languish. Investors are being tested on their ability to stick to their long-term goals and avoid impulsive decisions based on short-term market fluctuations. For many, it’s a mental game as much as a financial one.

Trend #3. Sector breakouts

Amidst the chaos of sector rotation, a few winners emerge. These sectors or stocks attract significant attention and large sums of money, leading to rapid and sometimes unexpected trends. Investors who identify these opportunities early can benefit greatly, but they must act swiftly to capitalize on the momentum.

The fear of missing out (FOMO) can become palpable as investors rush to get a piece of the action. However, the challenge here is that these trends can be short-lived, and timing is crucial. Jumping into a hot sector too late can lead to losses as quickly as gains. It’s a balancing act of identifying trends, assessing their sustainability, and managing risk.

Sector rotation has made risk management and quick decision-making essential skills for those looking to ride these waves of momentum. Investing in the next big thing requires both diligence and a stomach for risk, as not all emerging trends will prove sustainable. Patience and a well-defined strategy remain essential for investors navigating these treacherous waters.

The Most Secular Sector Breakout of 2023

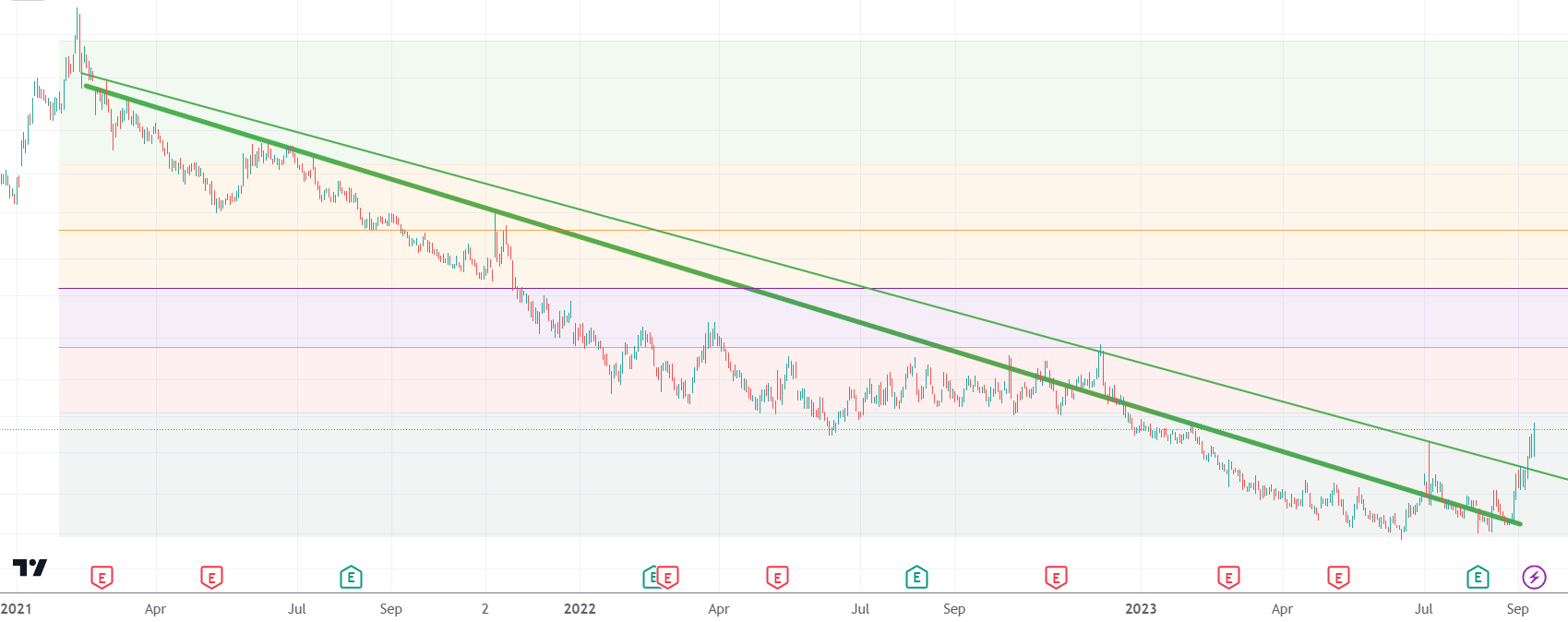

In the tumultuous landscape of sector rotation, where investors have witnessed sectors rising and falling with surprising speed, two standout performers have defied the odds. One of these is an entire sector that had previously experienced a daunting 90% decline over an extended period of 640 trading days. In a sudden and unexpected turn of events, this sector began its remarkable ascent from the depths of despair. Similarly, a specific stock pick, following an 80% decline, experienced a jaw-dropping breakout. These examples serve as a testament to the unpredictability and sheer dynamism of today’s market environment.

A Powerful Setup In This Stock Breakout

While the extraordinary success of these sectors and stocks is evident, we’ve chosen not to reveal their identities in this post. This decision is not intended to withhold valuable information but rather to underscore the importance of active engagement in the investment process.

Successful investing isn’t solely about receiving tips and recommendations; it’s about actively seeking opportunities, conducting research, and making informed decisions. By encouraging our readers to proactively explore the market and uncover potential breakout candidates, we empower them to become more self-reliant investors.

However, for those with time constraints, we provide access to our research area, where they can delve into the detailed alert titled “Secular Breakout In This Stock: High Risk/Reward Opportunity” to gain a deeper understanding of these remarkable breakout stories.

The upside potential in this stock is tremendous. The first target is the fine red line, the second target the purple line which is 100% above the price when we tipped this stock (last weekend). Eventually, we see this stock returning to the fine yellow line, maybe not in 2023 but in 2024.

The upside potential in this stock is tremendous. The first target is the fine red line, the second target the purple line which is 100% above the price when we tipped this stock (last weekend). Eventually, we see this stock returning to the fine yellow line, maybe not in 2023 but in 2024.

Commodity sector breakouts happening amidst sector rotation

This recent breakout in a commodity sector not only defied market expectations but also served as a compelling illustration of sector rotation dynamics. While the summer months of June and July saw specific tech stock sectors in the limelight, September has ushered in a resurgence of interest in select commodities sectors. The breakout in this particular commodity sector underscores the ongoing sector rotation narrative, with investors shifting their focus from technology to the commodities sphere. This shift highlights the market’s adaptability and its ability to generate opportunities across various sectors, demonstrating the dynamic nature of today’s investment landscape.

Conclusion

The recent unexpected breakout in a commodity sector and a notable stock pick emphasizes the importance of staying actively engaged in the ever-evolving investment landscape. With sector rotations taking center stage, investors need to adapt and stay informed to spot potential breakout opportunities. While we respect our premium members’ exclusive access, we encourage all readers to actively participate in the market’s twists and turns.

The swift and often unpredictable sector rotations we’ve witnessed demand constant vigilance. What was out of favor yesterday can become the star performer of tomorrow. Staying informed and engaged is paramount to navigate this shifting landscape successfully. As investors deal with the challenges and opportunities presented by sector rotations, one thing is clear: proactive participation is key.

Investing often requires proactive engagement, and for those with limited time, our research area offers further insights into high-risk, high-reward opportunities.