Last week, we reminded our followers that Silver Has The Most Bullish Chart Setup In History Of Markets. We came to this conclusion based on the longest term timeframe (50 year chart). So, with such a great outlook, what exactly does this mean for silver miners in the short to medium term?

In the end, when it comes to silver miners, nothing has changed compared to the findings we shared on March 6th in this article Is It Time To Buy Gold And Silver Miners?

Silver miners are really lagging. Does this sound as an opportunity?

An amazing opportunity, and we are going to be frank: the only commodity, other than green battery metals, that we are really interested in is SILVER. We love the fact that silver spot as well as silver miners are lagging: it gives us time to get organized, also in our portfolio. Moreover, it gives us time to get really aggressive on the next silver dip!

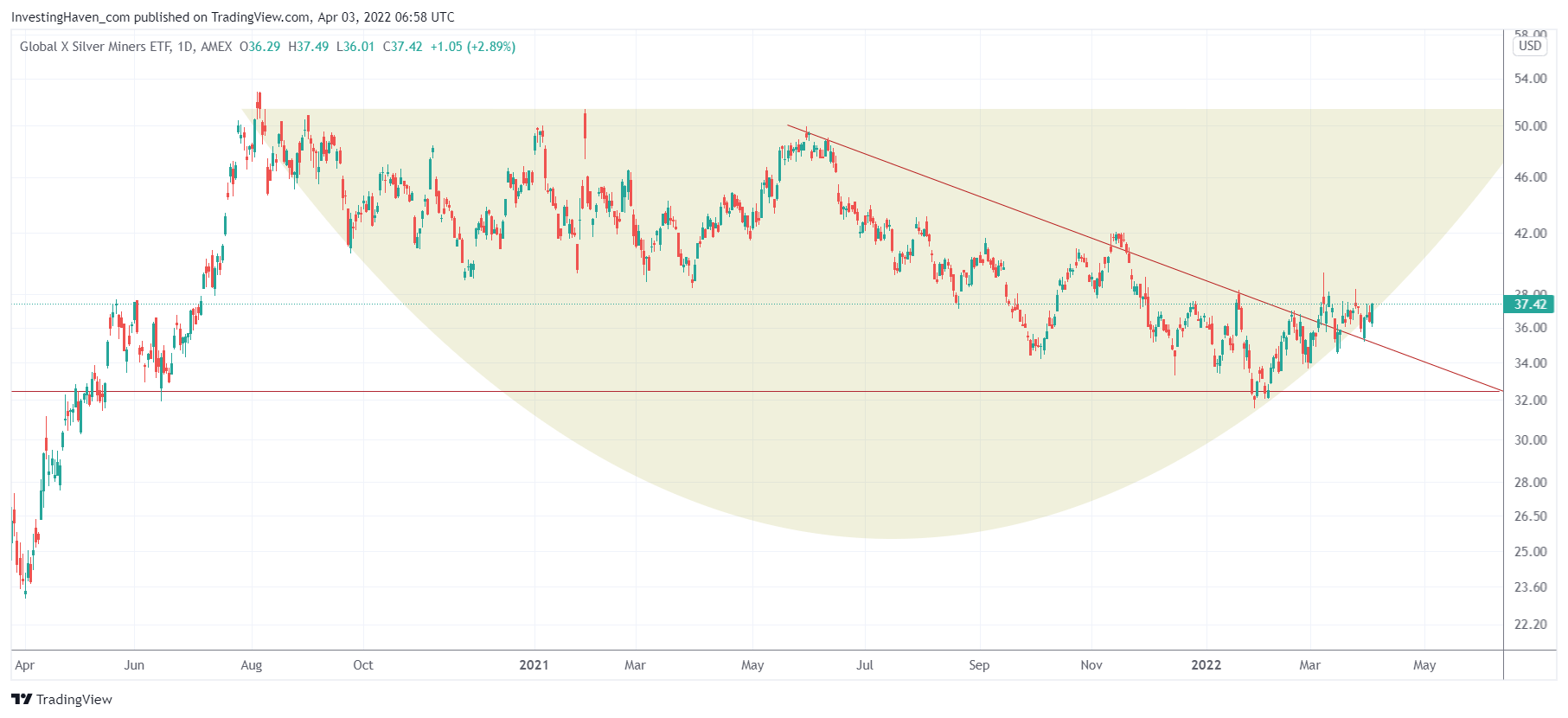

The entire month of March marked one major phase of consolidation right at the breakout area of the leading silver mining ETF SIL.

Moreover, and more importantly, all this is happening right at the edges of a 20 month bullish rounded reversal pattern.

The 38-40 area in SIL ETF is the one to clear. We believe it is a matter of time, it might take a few more weeks but probably not much more than that.

We are preparing a silver mining list for long term portfolios because we believe silver is the most undervalued metal out there. Silver miners are lagging, and we are working on selecting a top 5 silver miners selection