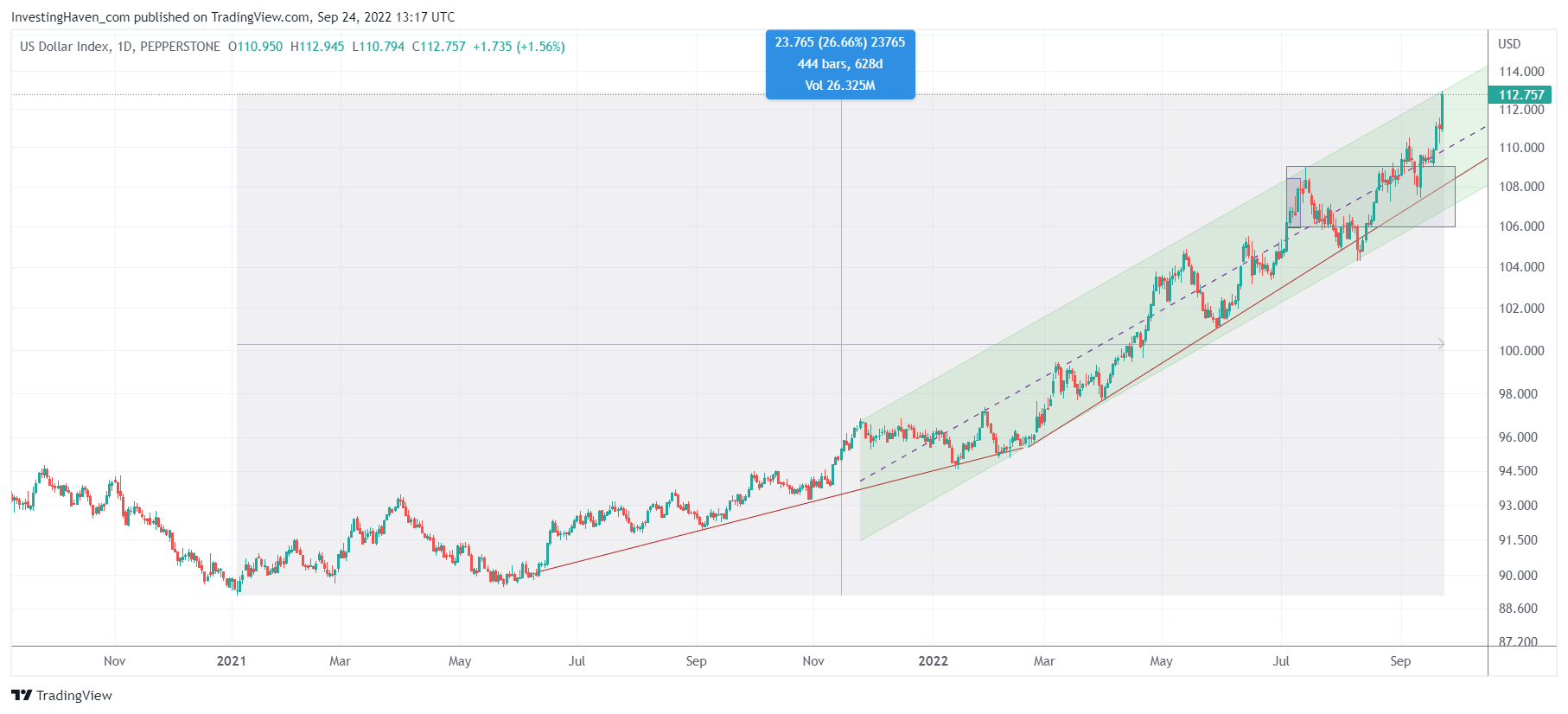

The U.S. Dollar created havoc in markets, last week. Investors went in ‘risk off’ mode, stocks were hit hard but commodities were hit much harder. The commodities sell-off created also turbulence among stocks. In the meantime, the USD is hitting the top of its 2022 rising channel, a point that might come with a little bit of relief although it looks like there is a slightly higher target that the USD is working towards!

Last month, we wrote Will Commodities Be Hit By A Strong U.S. Dollar and concluded:

The USD created serious resistance around 109 points in the 2nd week of July for reasons explained in great detail in our research. If anything, the USD trend in recent months clearly invalidated the idea of a lasting and broad based commodities rally. We are most likely entering a bi-furcated commodities trend. We expect the commodities universe to exhibit bullish, bearish and neutral trends.

Indeed, we challenged the idea of a super trend in commodities. A few months ago, many investors and analysts thought that they were hitting a mega trend in commodities. We thoroughly disagreed.

We were very specific in the price points to watch. In the above mentioned article as well as this one The US Dollar Could Be Printing a Major Reversal we pointed out that 107.7-109.2 was the key level to watch. Both articles were published back in June.

It took the market until September 21st to clear that level. In the last 3 trading days of last week we got a breakout in the USD, clearing 107.7-109.2 for 3 consecutive days.

It looks like the USD might be hitting some resistance in the short term.

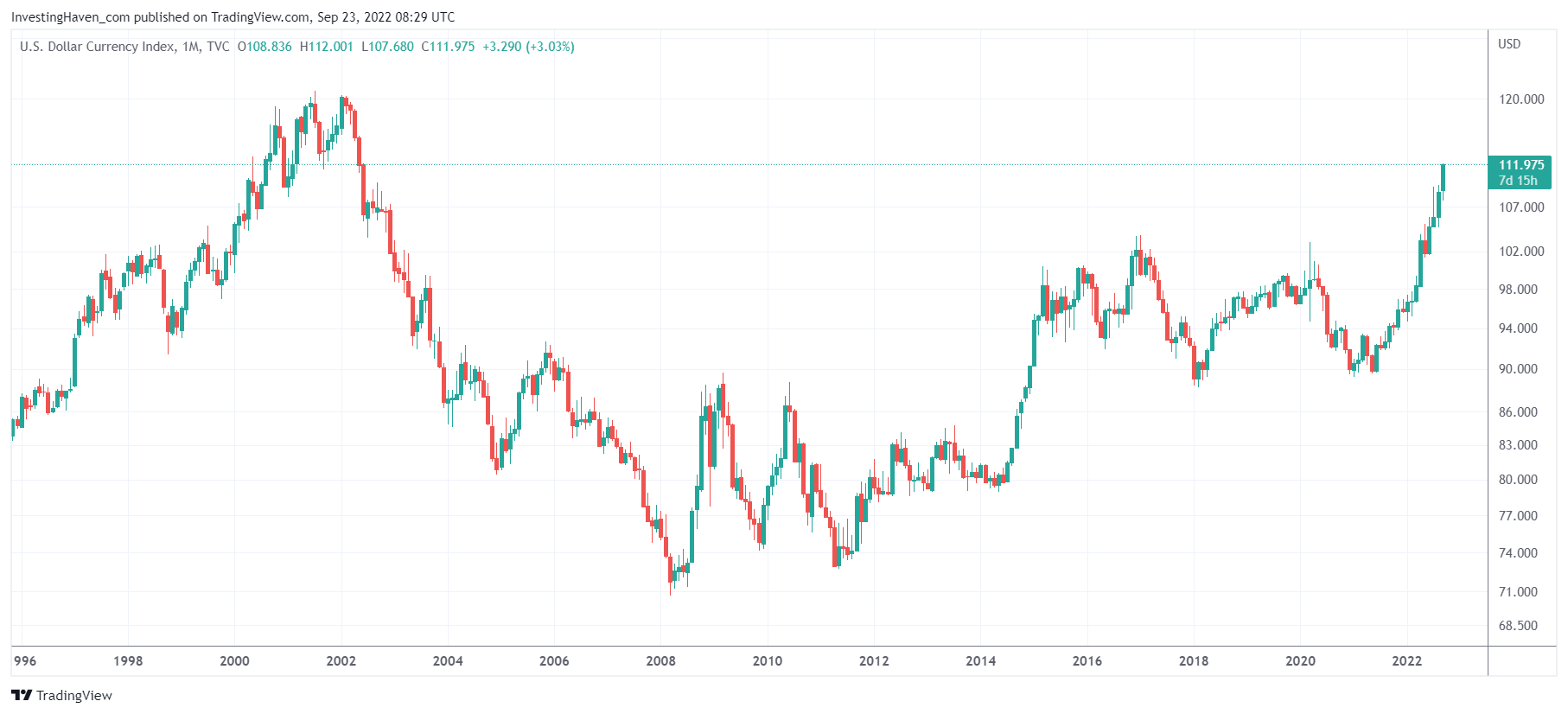

However, the long term chart is strongly bullish and suggests that 118 to 119 is the next target.

Most commodities will continue to suffer. There might be a select few that will recover, we believe silver will be one of them. Obviously, THE leader in the commodities space remains lithium. Please read Australia Looks Good But ‘Big Lithium’ In Australia Looks Astonishing. Until the USD reaches its next target, we recommend to be very cautious with commodities and only focus on the ones that have a bright future, i.e. green battery metals. Certainly stay away from traditional energy investing.