The US Dollar price is definitely about to choose a direction here, and it is fair to predict that the new direction is likely be lower. It has been weeks now that we have spotted weakness and early signs of exhaustion on the chart.

Our article today is meant to provide an update on the US Dollar price action after June’s FOMC meeting and the historical 75 bps rate hike.

For the most recent US Dollar price’s road map and intermarket analysis, you can find the detailed analysis and charts here:

Where is the USD heading? Must see secular chart : 3 Scenarios and price levels.

InvestingHaven Market pulse following the FOMC meeting: CRB, Silver, SPX, Dow Jones and Industrial, Euro and the USD reaction to the announcement.

US Dollar Price Action Following the FOMC Announcement

Following the announcement, the stock market rallied only to gap down the next day. These knee-jerk reactions after any FOMC announcement are very frequent. In fact, it happens every time! And they don’t last.

Investors have to be careful reacting to short term moves and forgetting the big picture. The point is the rally has to be taken into consideration within the context of the primary trend:

- Is the rally happening within a strong downtrend? Then it’s a relief rally and it will not last. It will just run to test the recent broken support and get rejected there.

- Same for retracements. Within a strong uptrend, they are usually pullbacks to back test the previous resistance. If that previous resistance turns into support, we have a buying opportunity.

That’s why our update today will cover the daily and weekly chart. This should provide a clear picture of the US dollar price’s general direction and how it is performing on the daily.

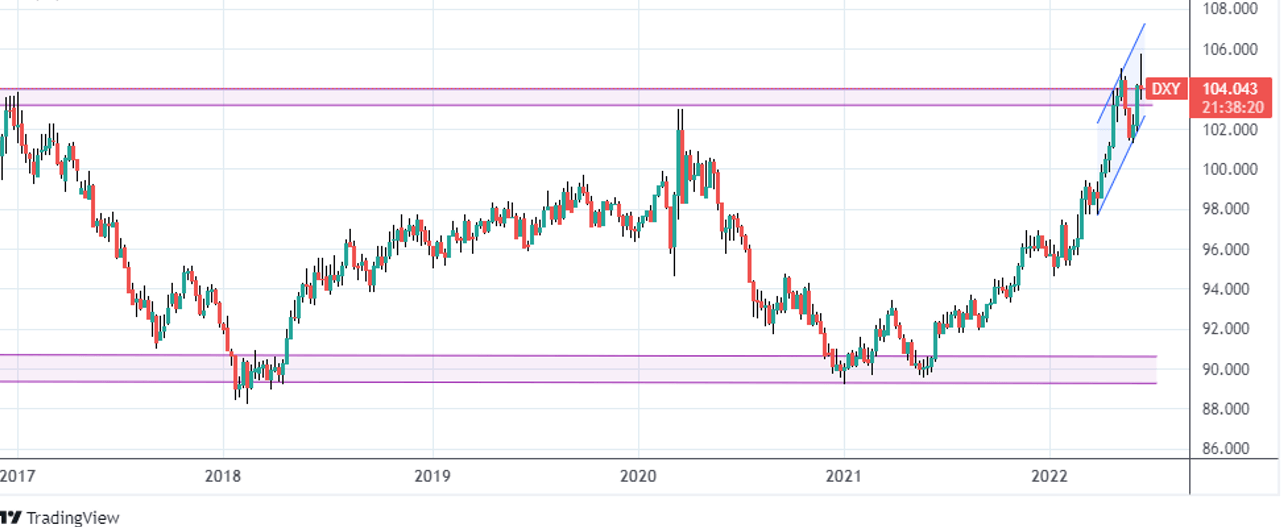

From the weekly chart below, we observe the following:

- The primary and long term directions is actually sideways. We have a consolidation channel.

- After touching the bottom of the channel in 2021, the USD has been on an uptrend in 2022.

- There is no confirmed breakout yet. The confirmation will be crossing above 105 USD with volume and a successful back test of 105$. That’s when we officially have a breakout in the US Dollar.

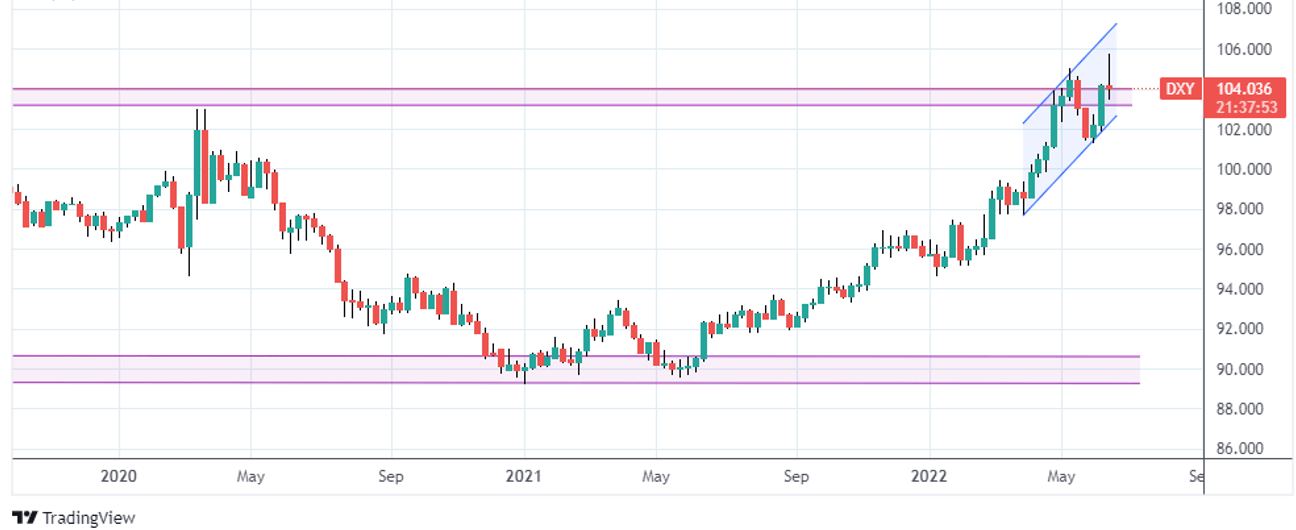

This week’s weekly candle will be extremely important as we can see below. That is a strong and clear reversal candle. Incomplete but worth mentioning since it’s happening at an important resistance level, $105.

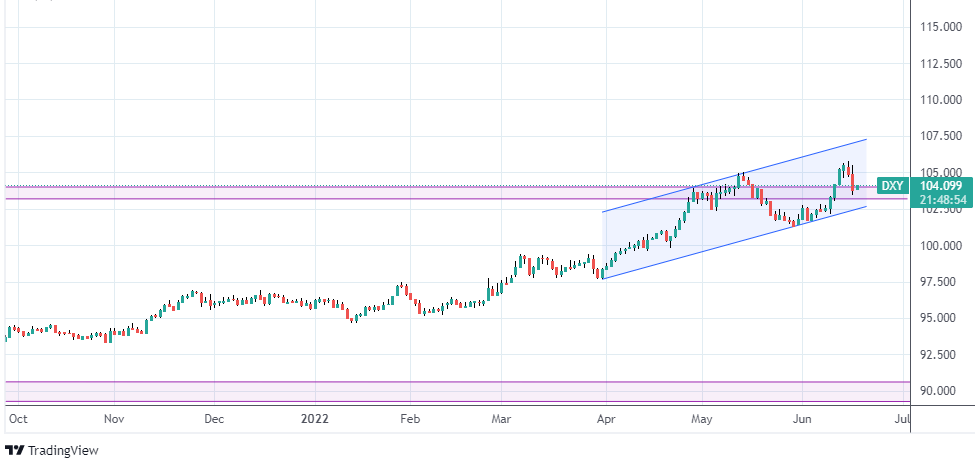

Next is the daily chart. The daily chart can go either ways. We have a double top close to the top of a steep channel. We also have a support area near by, The purple trendline. That’s where the Bears and Bulls are fighting.

To conclude, the chances of a reversal and a top in the US Dollar are strong, but we need to see confirmation especially on the daily. We will keep you posted.

Written by hdcharting.