Russia invades Ukraine. That same day, Thursday February 24th, gold spikes and closed the day sharply lower while stocks sell off but close the day sharply higher. How is this possible? Also, what does this dramatic rejection in gold mean for both gold and silver investors? Does all this imply that our gold forecast and bullish 2022 silver prediction got invalidated?

There is a saying on Wall Street which everyone knows but mostly forget to apply when it’s relevant: buy the rumor, sell the news.

We have said it many times and we’ll continue to say so: investing is a mental game. Yes, successful investing requires a solid methodology, obviously, but assuming that most market participants have a methodology the real differentiator is the ‘inner game.’

According to our 7 Secrets of Successful Investing at least half of the conditions to realize success is about the ‘inner game’. Think of handling emotions, understanding narratives, ensuring a positive mindset.

Likewise, whenever investors are confronted with fear, which is what we could find in media when checking the Russia/Ukraine news it goes without saying that the human system automatically becomes defensive. The intuitive reaction is to buy a safe haven, and sell high risk assets.

The point is this: the market knows more, much more. We wrote an epic analysis to members of our premium research service with exactly the same title. In it, we made the point that a sell-off event was in the making since mid-December. We collected the charts that we have been featuring in our research service for more than 2 months that really showed that the market was working its way lower to that sell-off moment.

Gold, as well, was improving in the last 2 months PRIOR to the day of the invasion.

Here is the difference between the smart investor that knows much more and the average retail investor: the smart investor start adjusting positions with a specific outcome in mind (buy the rumor) while the average retail investor wakes up once “it” is in the news (buy the news).

Remember, per our 1/99 Investing Principles success in markets is highly asymmetric. It is just 1% of market participants that realize 99% of profits.

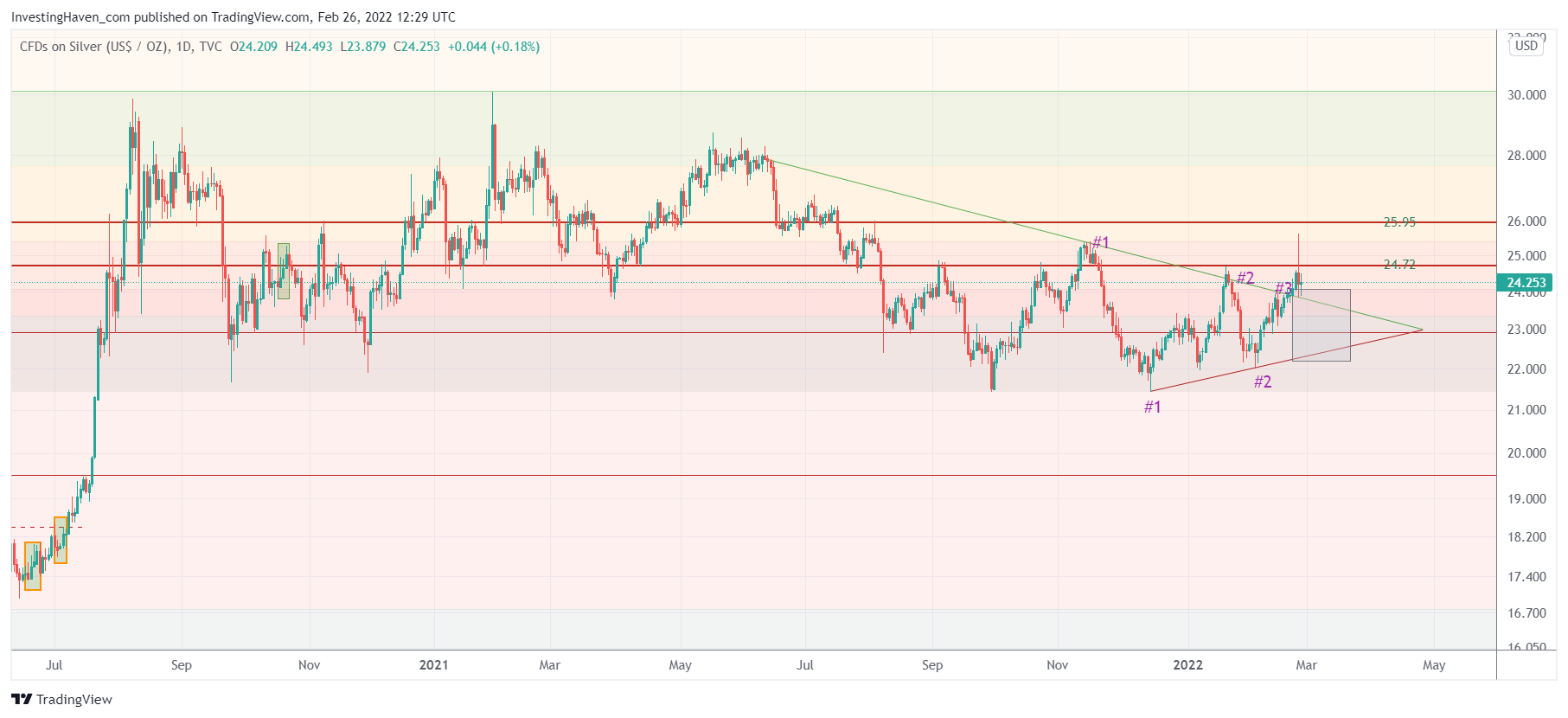

We have been covering silver for a long time. As seen on the previous obvious silver chart structure silver is still working on a bullish reversal. However, compared to gold, we believe the rejection in silver is not as dramatic. Moreover, silver made it to the area above a bullish triangle setup. We continue to be wildly bullish on silver for 2022 and beyond, nothing has changed in our view.

This article originally appeared on InvestingHaven.com: What Does Gold’s Dramatic Rejection Mean For Silver Investors?