It was a disappointing week for global markets. Because markets are more interdependent than ever before Bitcoin did not escape the sell off. Where does Bitcoin go from here, and is our BTC forecast for 2020 still valid?

Our answer is simple, but probably not as intuitive.

When thinking about future price direction most crypto investors think about it the wrong way. They start including concepts like BTC halving or volume/transactions (as part of fundamentals), moving averages or RSI indicators (as part of technicals), chart patterns, Google searches (momentum), etc.

It’s even worse when crypto investors turn to Twitter, looking for information of what others say and think. The thinking goes like this: more followers a person has, the more likely he/she will be ‘right’ and their tweets are reliable.

We are here to tell you that all this is a waste of (y)our precious time.

Absolutely worthless are the sources we just mentioned to understand future price direction.

Let’s do the ‘math’: we are 100% sure that you can derive an equal number of bullish and bearish conclusion out of your ‘research’.

Let’s put it differently: LESS IS MORE, is our guiding principle in crypto investing. As the first in the world to run a premium crypto investing service we do know what we are talking about. Our medium to long term calls about the direction of crypto markets were all spot on.

‘Less is more’ means a few things in a crypto investing context:

- Less trades, more profits. That’s because of the ultra volatile nature of crypto prices, extremely challenging to get many trades right … better find great medium to long term entry and exit points as opposed to trading more often.

- Less indicators, more precise forecasts.

- Less charts, more efficient way to get to conclusions.

When it comes to crypto market direction we use a few BTC charts (multiple exchanges, timeframes, patterns). That’s all we do to spot hugely profitable entry and exit points, not only for BTC but for the entire crypto market.

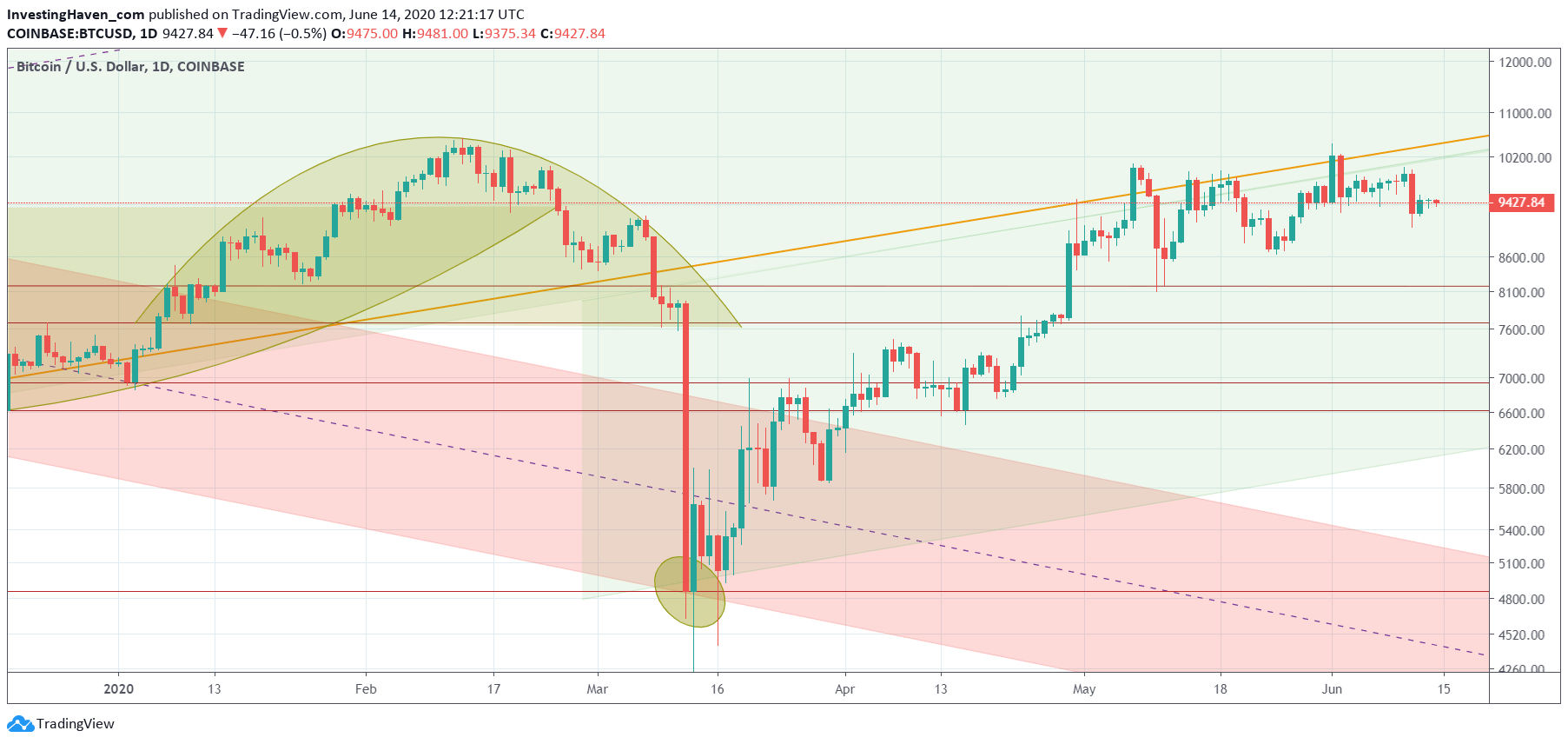

Currently, there is one data point that matters: the yellow line on the daily BTC chart, see below.

This ‘yellow line’ has a long history of course. But crypto investors should not look any further: as long as BTC remains below this yellow line we cannot expect a lot of excitement (at least, not to the upside).

Interested to follow our work, which as said above is pretty ‘lean’ (less is more)? Sign up today, and get instant access to 100 crypto alerts in 2020 sent to premium members.