After nearly 7 months of bullish price action in BTC “it” is happening: a rejection of the fast rising bullish channel. Today, April 29th, two days for the start of the new month, BTC is rejecting to move above 55.5k USD. The daily BTC chart shows why this is not good! Our crypto predictions for 2021 may have been crushed, so crypto investors in our premium crypto research service had an amazing profitable start of 2021. In the next few months, as per Bitcoin’s current path, it’s not going to create bullish momentum anytime soon, unless it starts a major move in the next 72 hours.

[Ed. note: on May 2nd, 2021 we added a short update with an up-to-date chart, please scroll down to see this update.]

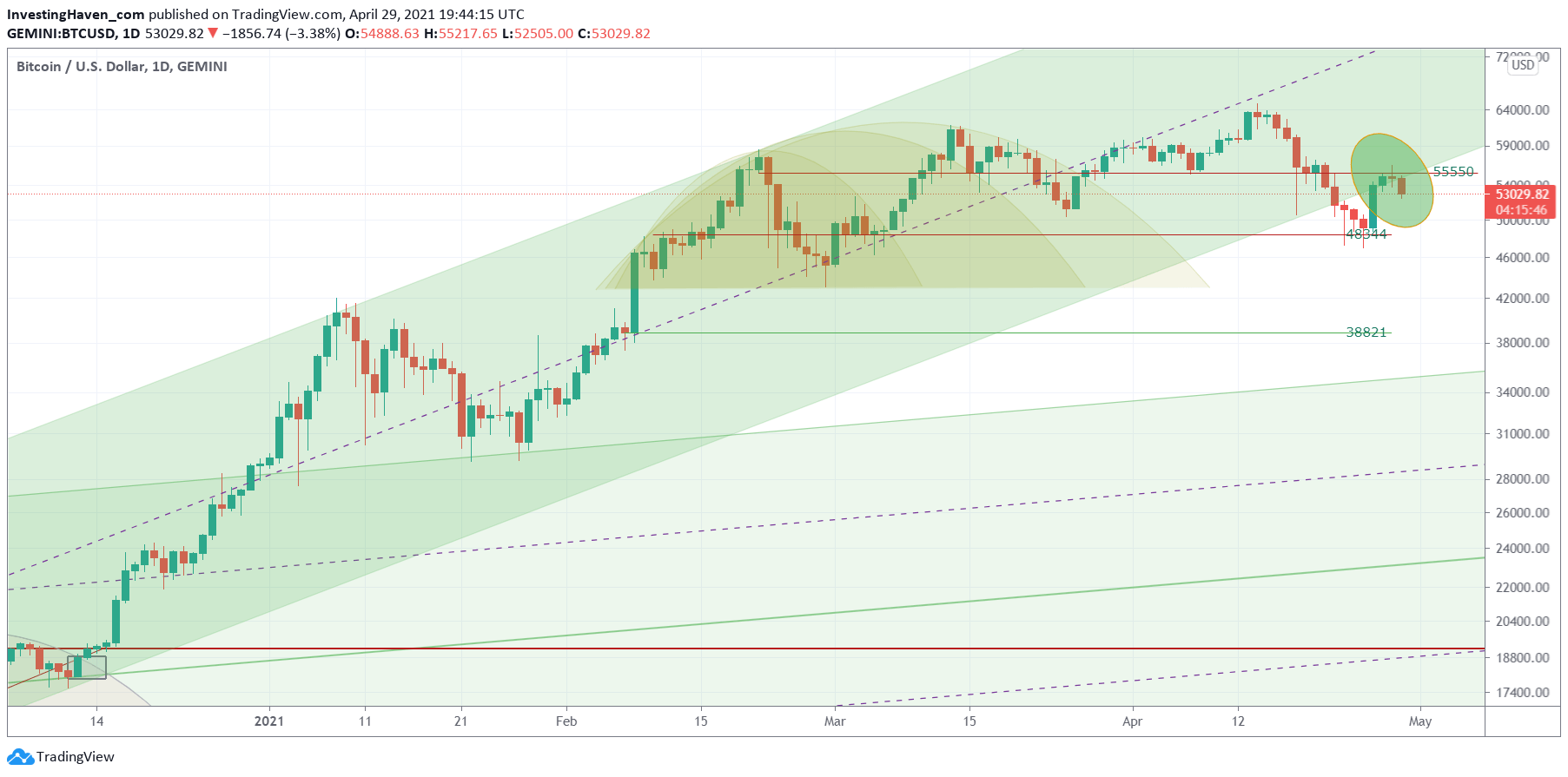

The daily chart makes the point.

It clearly shows that the rising channel was invalidated last week Thursday. After a few days BTC came back up and tried to move back in its channel. However, today it looks like the market is rejecting the channel.

Moreover, we identified 55,550 USD several months ago as a decisive level. Today we see that 55.5k USD coincides with channel support.

So this is a double rejection, and this amplifies the importance of the rejection.

Note that this comes after a very complex consolidation which probably has been pretty exhausting for many crypto investors. The 3 rounded patterns on the BTC chart (yellow) show the complexity of the consolidation that started in February.

Why is all this important? Because BTC is the leading indicator for the crypto market. BTC sets the direction, all other coins follow. This dynamic may not work on a day by day basis, it certainly works on if we look at the trend on the daily chart.

In other words BTC is starting a cooling off period. Because of this the entire crypto market will be cooling off. That’s not a bad thing, that’s a good thing. Because a cooling off period can open the door for a new bull run.

How to handle this?

In our latest premium crypto research update we shared this with our members:

What is the biggest risk for crypto investors in a cooling off period like the one we will be going through?

- Buy at the wrong moment. The right time to buy in the previous 3 month ‘momentum cycle’ was right before a major rise. In this cycle it will be buying right after a sell off stabilizes. So buying lower. It’s a different entry tactic. And only enter occasionally.

- Investors get frustrated because they don’t see multi-fold returns. They start blaming others, saying “it doesn’t work” and “they don’t know to help me” and so on and so forth. They quit, don’t pay attention to the crypto market, and they will miss the best possible entry which will be when this market calms down and sets up for the next bull run. We don’t know WHEN this will be, it might take many months, we simply don’t know. All we do know is that many will quit, won’t be paying attention and miss the perfect moment to re-enter later this year. They will get interested again when prices are rising, and will be chasing this market.

Instead of being frustrated, instead of being sad, instead of being disappointed… crypto investors better take some profits off the table, relax a bit, and stay very sharp in identifying the next great entry point. It may be a few months out, it probably is a few months out, but what’s wrong with that? Once momentum enters crypto again we’ll be hitting multi-baggers over here at InvestingHaven.

So let’s relax, let’s be positive, and let’s be sharp. We are eager to re-enter, but not now. We now have to celebrate the profits we realized over the last 12 months, that’s also an important part of investing!

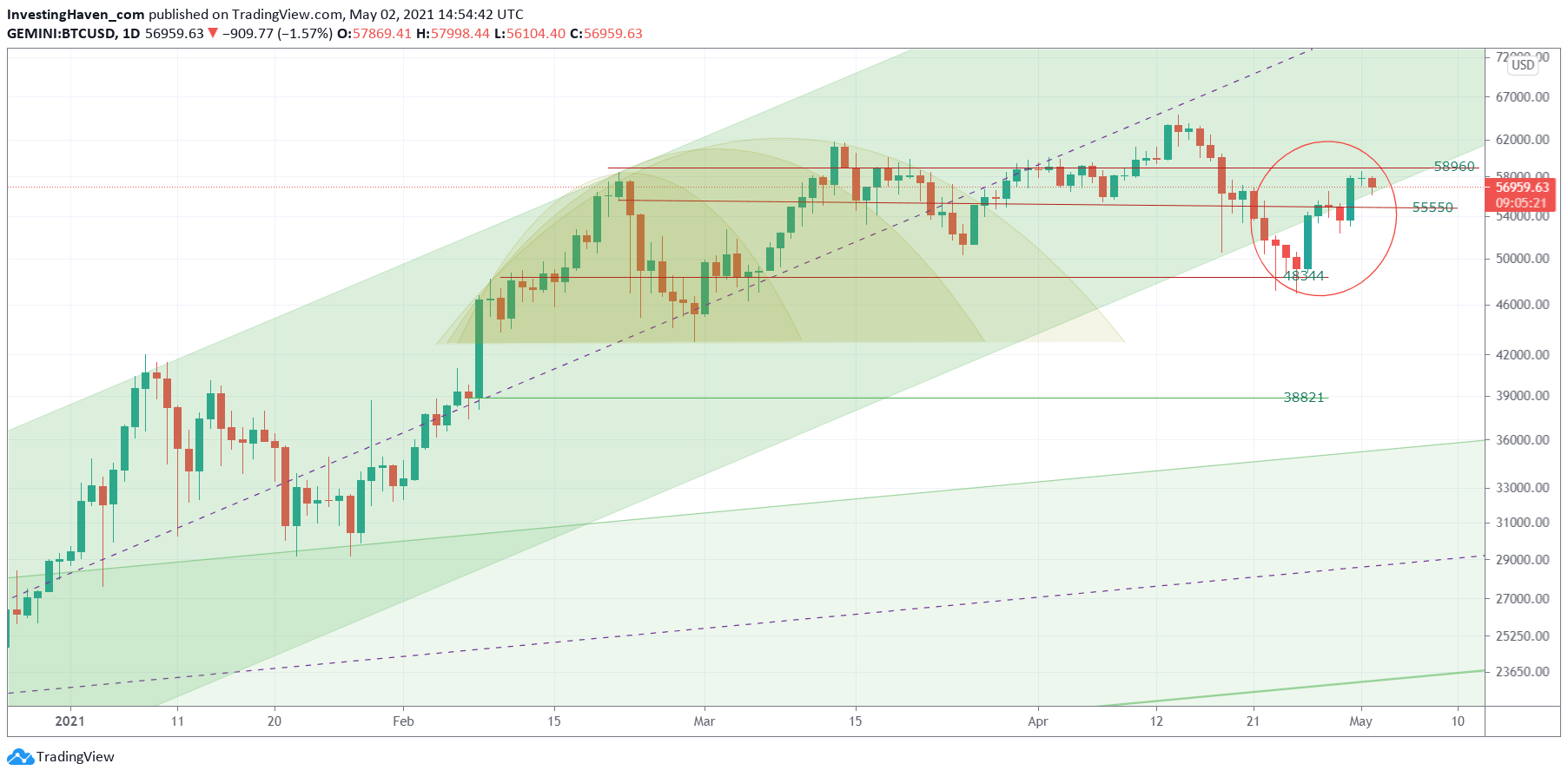

The day after we published this post, with the daily BTC chart shown above, the market decide to move higher. The green candle on Friday pushed BTC back into its rising channel.

However, 58.9k appeared to be too much of resistance for BTC. And BTC finds itself truly ‘sandwiched‘ now.

As the saying goes “one day does not make a market” we don’t read too much into Friday’s green candle. Only if we see BTC clear 60k convincingly, will some sort of momentum return into the crypto market. Until then there is a flat crypto market which is vulnerable to the downside.