Bitcoin crashed and recovered in March of 2020 in a phenomenal way. It was a once-in-a-generation type of move, and it certainly was the first time Bitcoin’s strong uptrend (between December and February) got stopped … in 11 years of Bitcoin’s existence. Pretty unique, pretty scary. Our premium crypto members were able to take some good short term profits, and got guidance in when to take partial profits on long term holdings but also when to get back in. As per our Bitcoin forecast and crypto predictions for 2020 we remain firmly bullish on crypto long term. Shorter term we see a nice trend on Bitcoin’s chart which should hold in order to confirm its bullish short term trend.

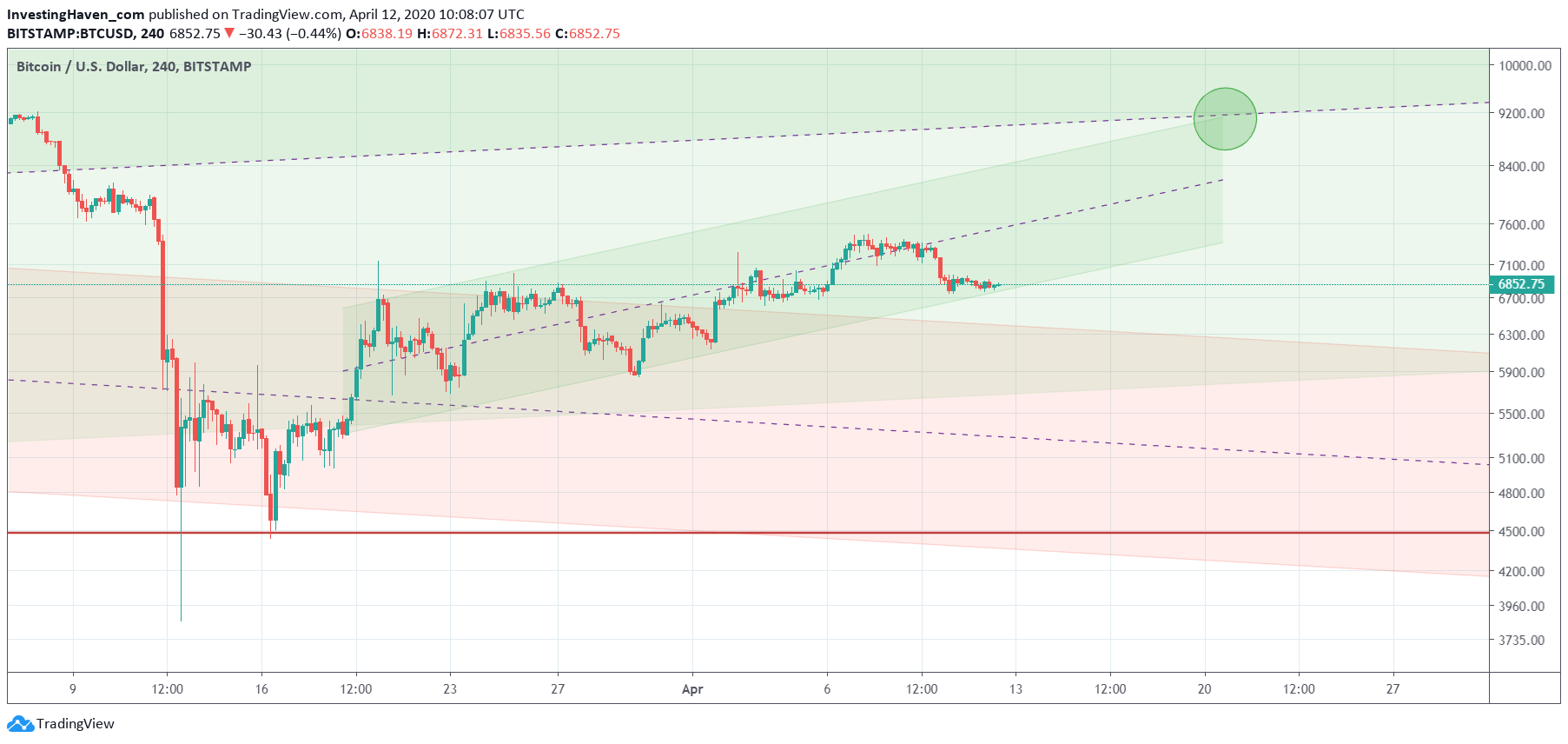

The channel shown on the intraday chart of Bitcoin (see below) is the one we are closely tracking to determine the trend in April of 2020.

The current level of 6800 USD should hold in order to confirm its bullish trend.

Moreover, and equally important, later this month we will see an important ‘collision’ of trends: the short term uptrend (green channel in which BTC currently moves) with the median line of a larger uptrend (dotted line), as indicated with the green circle.

These ‘collisions’ are very important, they can provide resistance. So we have to be cautious in monitoring what happens later this month around 9200 USD.

Our premium crypto members get multiple updates per week with this type of analysis and ‘guidance’. Once per year we take a short term position in BTC with the intention to make a 30% to 300% profit. Other than this we stay focused on the long term trend, and the long term portfolio in a ‘hodl’ fashion (trade less, more profits, in long term crypto portfolios).