InvestingHaven is on record forecasting the slowest bullish reversal in history of crypto. Yes, we believe that crypto will eventually resolve higher. No, it won’t happen as fast as investors want or desire. It certainly won’t happen as fast as previous instances in history. In fact, this ongoing consolidation in BTC is going to take a long time until it works out. In the meantime, there are many alternatives that have much more upside potential than Bitcoin.

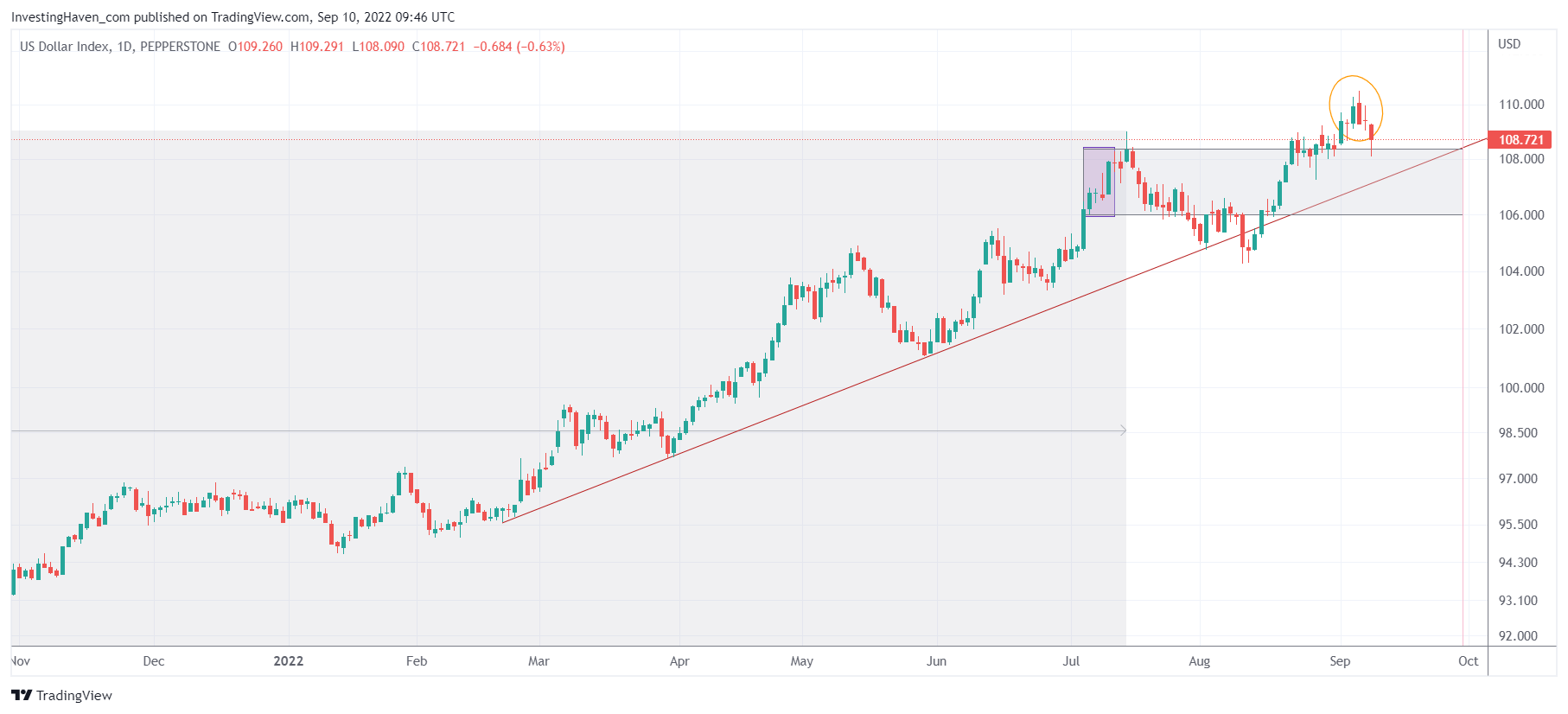

The USD is labeled ‘King Dollar’, for a reason. That’s because it has the power to dominate the direction of all markets globally as soon as it starts trending (up or down).

Similarly, if there is one term we would like to use to label BTC (going forward) it would be ‘Slow Bitcoin’.

We noticed Bitcoin’s Most Trendless Period In History, an article which we published in the public domain early August. All volatility got sucked out of Bitcoin’s chart, to a degree never seen before.

This really means something. The message of the market and chart, according to us, is that BTC is going to go through a long consolidation, one that is going to remain boring for a long time.

The daily Bitcoin chart says it all (from time to time, it is justified to look at the most basic charts like the one below, without annotations, to get a clear picture of the dominant structure and avoid bias).

One thing to note: this week, BTC retested its June lows (closing prices). For now, it is successful.

Needless to say, BTC *must* respect its June lows on a 3 to 5 day closing basis, otherwise it will start a longer term downtrend.

From an intermarket perspective, the USD is the big driver of the BTC price. BTC went down in 2022 in 3 stages. The USD went up in 2022 in 5 stages.

Note that the USD made a marginally higher high while BTC was able to respect its recent lows. A divergence, an important one, we pay attention!

In the meantime, we see so much more better setups in the crypto space, one of them outlined below. This is ETH in USD and the picture becomes even more clear when looking at ETH priced in BTC.

We reported in our crypto investing research service, on August 27th, that a structural change is ongoing in crypto markets. There are some specific type of tokens that are outperforming. Long term chart structures suggest that this outperformance is here to stay. In other words, our findings have strategic portfolio implications. You can sign up to get access to our deeper insights in the crypto world and position yourself for the bull run we expect to unfold in the next 18 months. Waiting until ‘it’ happens is too late, positioning when the market is boring or even outright scary, provided some investing rules are respected, is the most profitable way to play a market like crypto.