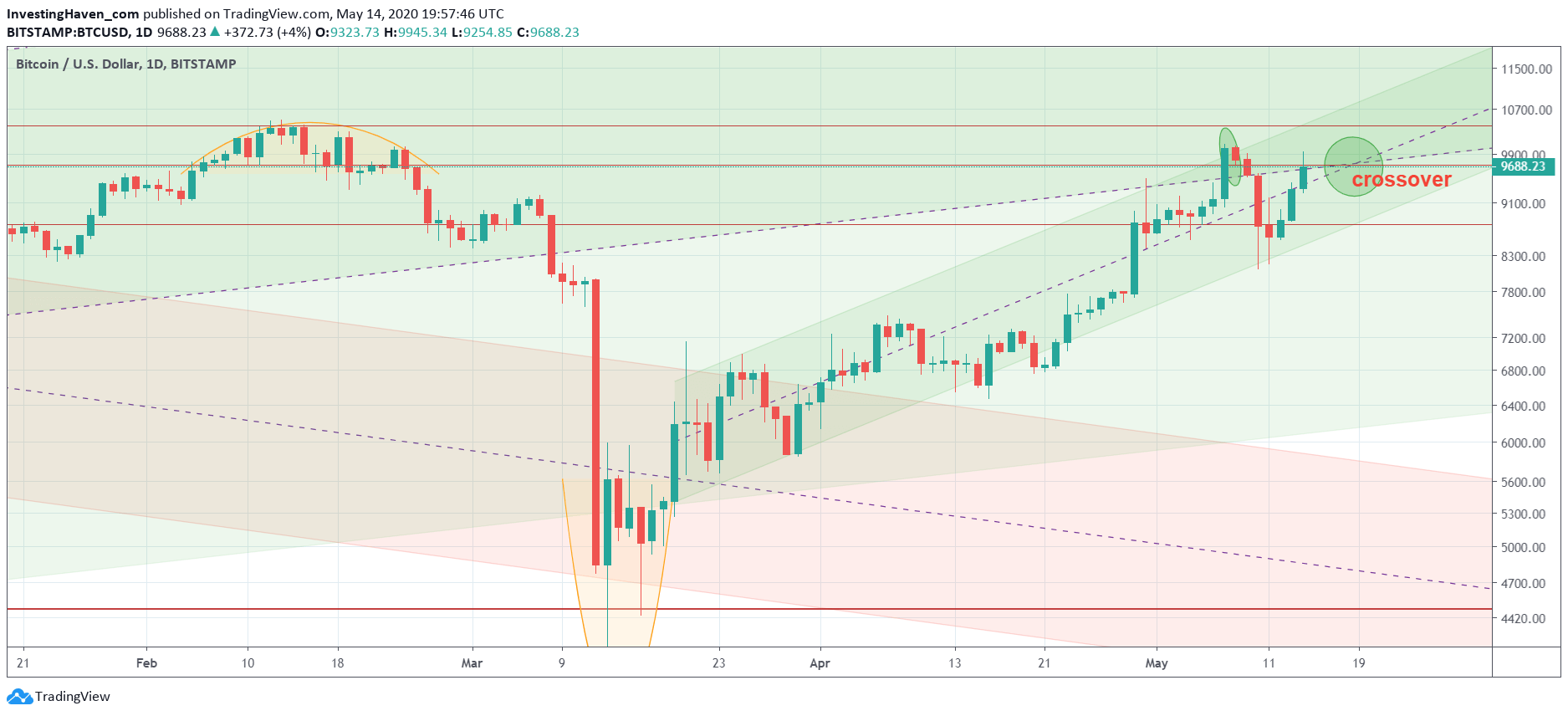

There is one concept on any chart that bears watching: crossovers. It is the concept that creates havoc OR a big rally. Yet, this remains an unknown concept to most investors and traders. Bitcoin’s long term forecast is still valid according to us but short term we are closely watching the crossover due on Monday to understand medium term price direction.

The crossover is due on Monday, May 18th, and it is a crossing of two median lines: the median line of the short term rising channel and the median line of a long term rising channel.

The short term started in the last week of March 2020, while the long term channel started in the first week of April 2019.

What happens when two important (dominant) median lines cross each other?

Either the price of the underlying asset is stopped cold, and the best example comes from a similar situation we witnessed mid-February this year. Bitcoin was in a perfect uptrend, but the crossing of the median lines created havoc (too much resistance). In hindsight we know it is Corona crash related, but in the end does it matter what the ‘reason’ is? All that matters is that the crossover resistance helped us understand to close our position, which is what we did, to protect our profits (which is what we did back then).

Or price jumps higher which is important especially right before or after the crossover occurs.

Whatever happens around 9745 USD in the next few days will be telling about the strength of the short to medium term Bitcoin and crypto uptrend.

Members of our crypto investing service receive detailed and frequent updates whenever this type of important ‘chart event’ takes place. The next few days will be telling, and we’ll provide the guidance that crypto members require to understand what this may imply for short, medium and long term crypto positions.