It is a matter of time until the mother of all supply deficits will hit the world: green battery metals. The EV boom is for real. We are not talking speculative EV stocks, we are talking the replacement of one billion of cars by electric vehicles. Demand for lithium, graphite and cobalt will suck up all available supply between 2024 and 2026. Financial markets will start reacting to this already in 2022. Our top green battery picks are lithium, graphite, cobalt. Near term producers of those green battery metals will become multi-baggers in 2022 and beyond. That’s the underlying rationale for our wildly bullish green battery metals forecast for 2022, one of the most important forecasts we have ever written.

Some might argue that a bullish forecast is not appropriate because a stock market crash is underway. We don’t think so. Yes, stock markets will go through regular pullbacks but not a stock market crash similar to 2000, 2009 or 2020, at least not yet.

Classic stock market cycles show that strong bull markets tend to last 3 years. Our analysis suggests that a stock market crash might start in the 2nd half of 2023, going into 2024. IF this stock market cycle will be the dominant once again there is plenty of time for our wildly bullish green battery metals forecast to create serious wealth.

The macro view supporting our bullish green battery metals forecast

We explained in great detail why green battery metals and clean energy is going to be the Biggest Investing Opportunity Of This Decade. It’s a must-read article, and everyone who followed the rationale explained in there did boost its wealth significantly in 2021 with multi-bagger lithium stocks which we tipped in our Momentum Investing service.

As a refresher, this is the summary of how we concluded that green battery metals will qualify as the number 1 investing opportunity of this decade:

The big rotation that comes with market crashes help us understand the big opportunity for each decade, prior to it starting. We saw this in 2000 and 2010 so we should see it again in 2020 and beyond. It is commodities that came out of a major bear market, so some segments in the commodities space should create a secular trend in 2020 and beyond.

Moreover, this makes sense, fundamentally. Commodities prices typically react on supply/demand dynamics. If renewable energy is going to continue to grow this decade it will be the commodities as inputs into green batteries that will be in high demand, ultimately even potentially in supply deficit. IF this is what’s underway the market will react to this, way before the real deficit hits in the real world.

The rationale mentioned above pointed us in the direction of commodities.

However, not all commodities will be super opportunities in the next few years. It will be green battery metals first and foremost because of the shortage we see coming, please continue reading to understand what we are saying.

Why green battery metals will be bullish in 2022

EV sales data suggest that 2021 is the year which will be a turning point. While many are talking about and expecting the metals boom since many years it is only since 2021 that the demand side is ready to put pressure on the supply side.

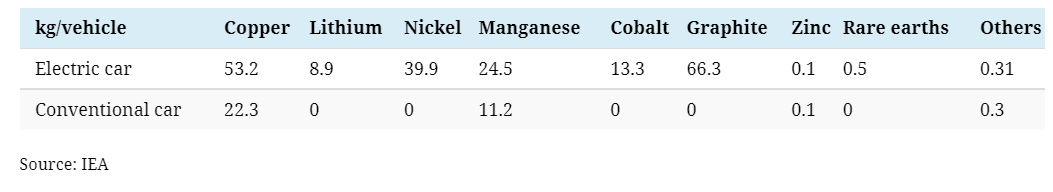

All this makes sense once you realize the weight of strategic metals in Electric Vehicles compared to conventional cars. Knowing that the number of EVs is going to grow 100-fold this decade you’ll understand how big this mega trend in strategic metals like graphite is going to be.

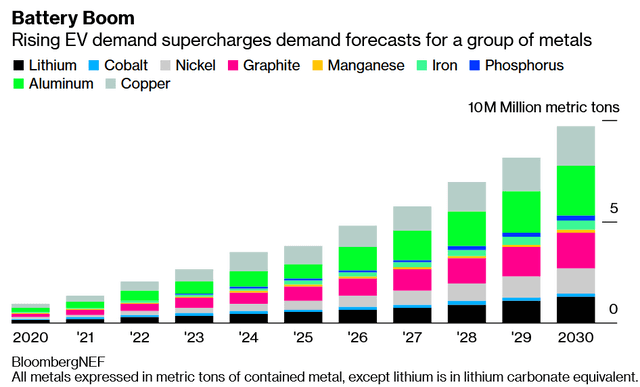

This next chart was featured in our graphite forecast 2022 the battery boom is going to suck all available green battery metals metals out of the ground.

There are more charts in this article we recently wrote: The Super Cycle In Green Battery Metals Starts In 2021.

What stands out is that several metals will be in high demand: lithium, cobalt, graphite, nickel, copper, aluminum.

Still, we have a preference to focus on lithium, cobalt, graphite.

Why only those three? Because of several reasons:

- There is sufficient information available on these 3 metals which allows for decent analysis.

- Many of the miners or suppliers of each of the 3 metals are pure plays which helps understand sector trends. They tend to focus on only one metal (as opposed to many miners which have a mix of multiple metals).

- All of them have a clear lead indicator: the price of the metal. For lithium and cobalt it is easy to track their prices, however for graphite it’s a bit more complicated.

When it comes to nickel we have found a loose connection between the price of nickel and its miners. This does not give us sufficient trust, we prefer not to focus too much on nickel.

So, let’s see what the leading indicator charts for lithium, cobalt and graphite are telling us.

Which green battery metals deserve our time, attention and capital

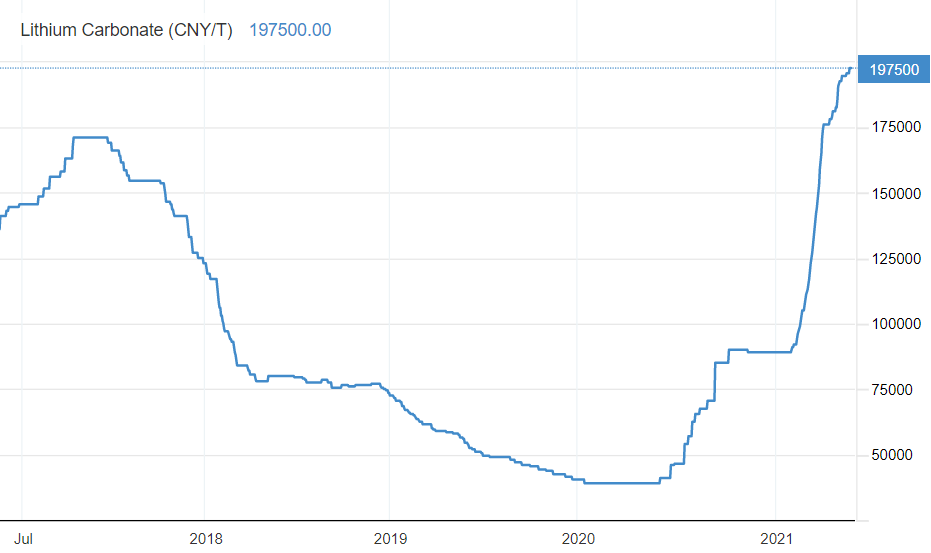

Lithium’s long term chart is amazingly bullish. It currently trades above its 2018 peak. It’s one of the few green battery metals that already cleared its 2018 highs.

Yes, a slowdown can be expected. But we also expect a bull run continuation in 2022.

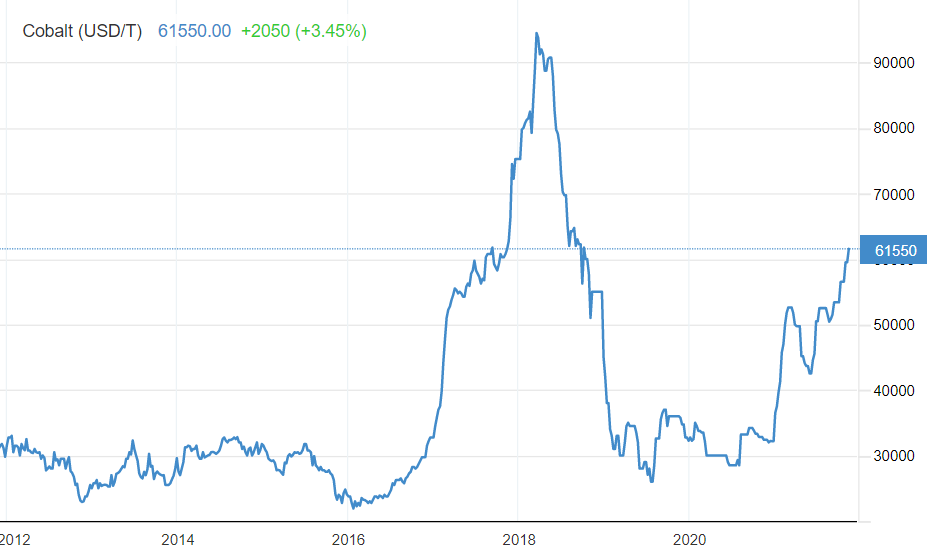

Cobalt is right now going through its acceleration. After a long reversal price is accelerating going into 2022. The first target is the 2018 peak.

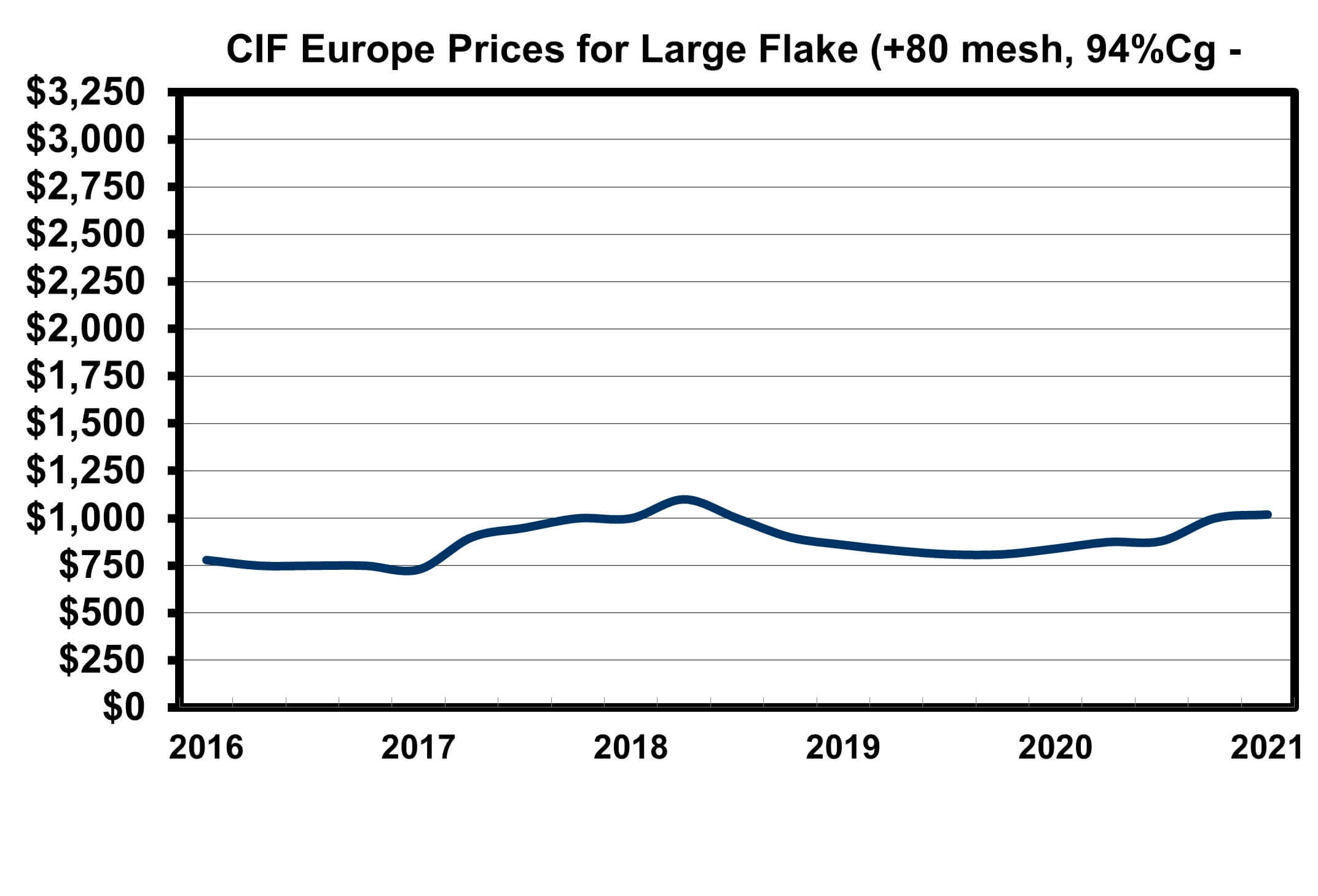

Graphite is a different story. There is no spot price in graphite similar to most other metals. The only chart we could find is this one. Conclusion: an uptrend which is not a great conclusion but it is what it is. Detailed graphite prices can be found and easily tracked here.

Green battery metals stocks

As explained in great detail in 7 Secrets of Successful Investing our tip #4 is all about ‘beautiful investments’. They are scarce, very scarce:

The intuitive reaction of any human is that this is a great number to choose from. Plenty of choice, it can only help success.

Our point of view is the exact opposite. There is only a handful of stocks, every year, that is worth your capital. Empirical evidence of InvestingHaven’s research teams suggests that approx. 0.25% of the total number of stocks is worth your capital. We are talking 20 stocks in a given year that are worth your capital.

The way to think of it is ‘hidden gems’. They are very scarce, and it’s preferable holding no position as opposed to compromising to this rule.

We mention this quote because our research in 2021 has shown that the few truly beautiful investment setups were to be found in green battery metals:

- We had exceptional chart setups in lithium, absolutely phenomenal, several of them.

- As explained in our graphite forecast for 2022 we currently have similar setups in the graphite sector.

- Cobalt stocks may be more rough but they still qualify as beautiful investments.

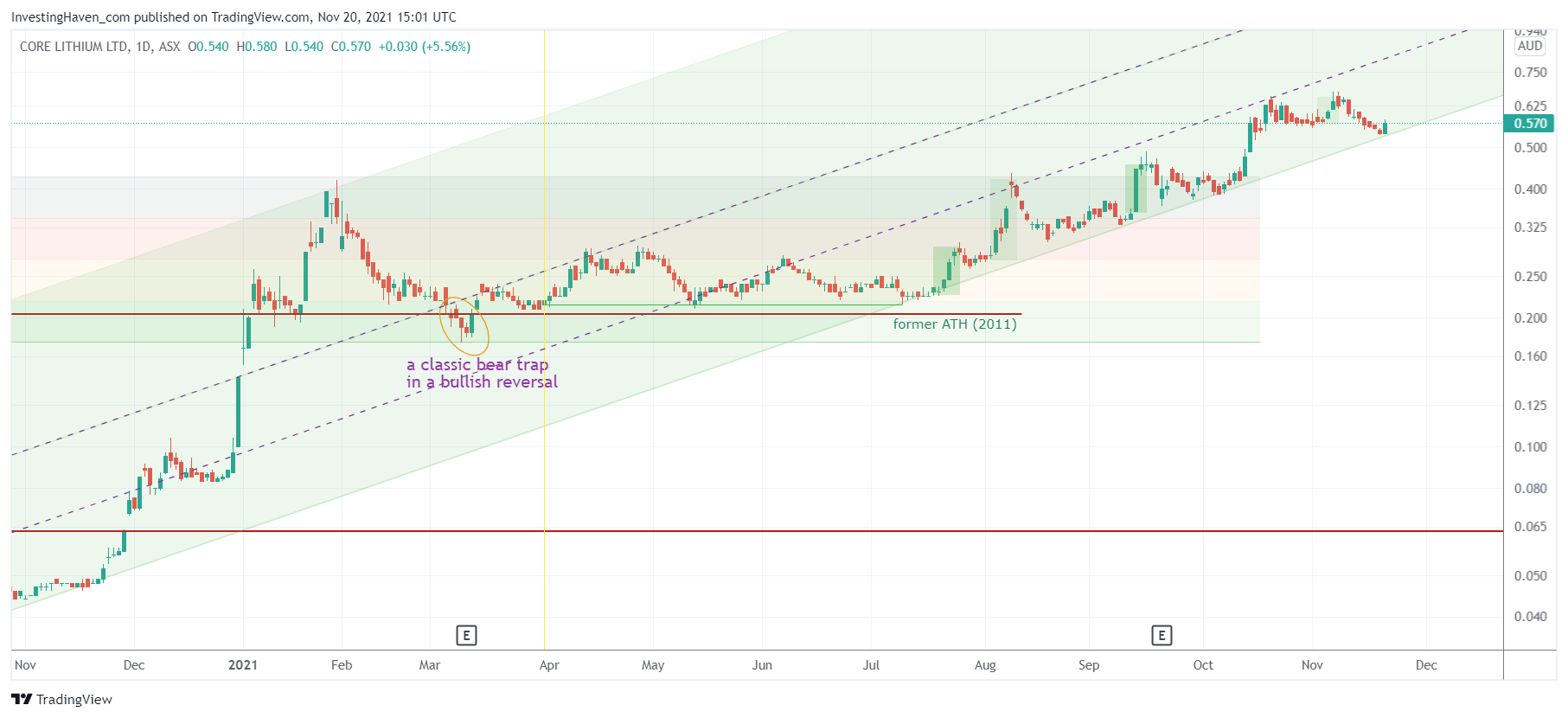

An illustration of absolutely beautiful is this lithium stock:

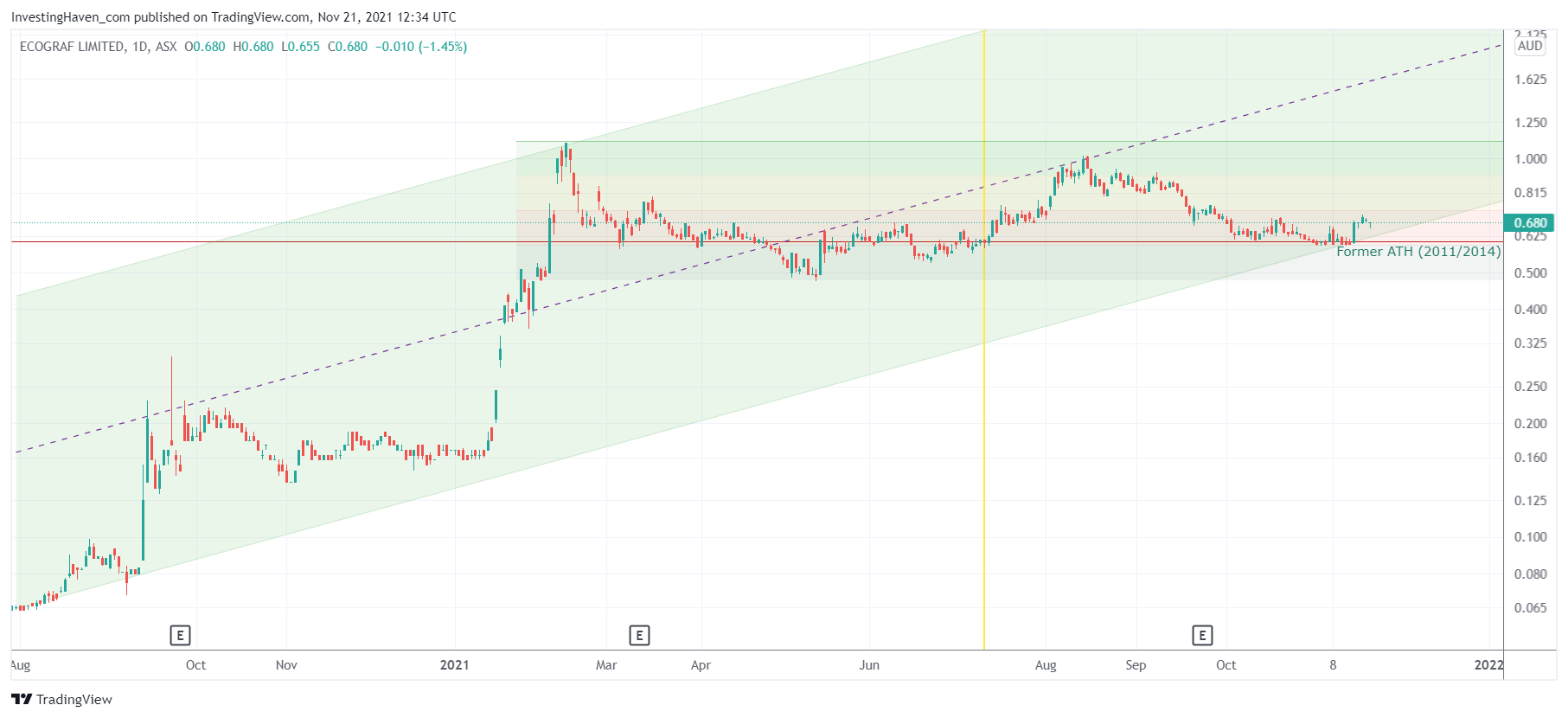

Another illustration is this graphite stock:

The point is this: these type of beautiful, clear, clean, smooth setups were primarily (only?) to be found in green battery metals. This means something, and we got the message of the market.

Note that these charts comes from a top selection of green battery metals top stocks which is available to all Momentum Investing premium members. This list contains the very best green battery metals stocks in the world, by far, based on a thorough research of 700 to 900 green battery metals stocks by by InvestingHaven’s research team.

Going into 2022 we believe that investors need to take into account the cyclical nature of these markets but also the cyclical nature of this type of mega trends. They typically move higher with bull runs followed by pullbacks that respect support (previous resistance becomes support in each new cycle).

We expect 2022 to bring one or two bullish cycles in green battery metals. Being very picky, selective, strict when selection green battery metals stocks is crucial. There are high quality but also many low quality green battery metals stocks.

In our Momentum Investing service we identified green battery metals as the powerful bull market of this decade. We are heavily invested in green battery metals. Our green battery metals stock list features the best stocks, all available to members of the service. Returns in those stocks so far have been phenomenal, even in a year like 2021 which has proven to be extremely challenging for the vast majority of market participants.

Must-Read 2023 Predictions – We recommend you read our 2023 predictions as they are very well researched: