The ‘inflation monster’ is the biggest concern currently for markets and investors. The problem is not inflation, but the real problem is ‘out of hand rates of inflation’. The media is a lagging indicator, so reading news is only going to paint a picture of a never ending wave of inflation. What we are looking for, as investors, is leading indicators. We want to forecast if and when inflation is peaking ‘as it happens’. Here is one inflation indicator that could act as a leading indicator: the fertilizer market.

Fertilizer stocks may have peaked in 2022. We believe this is an additional validation piece to consider in our attempt to forecast the future direction of inflation and some commodities. In other words, an inflation indicator. So how did we come up with the assumption that Fertilizers stocks peaked in 2022 and how it could impact commodities and inflation? That’s exactly what we will be looking into today.

Before we dive into the topic, we want to recap important and relevant insights on this same topic:

- Topping Commodities Index $CRB along with intermarket analysis.

- A high probability of a topping US Dollar.

- Inflation about to roll over? Why June 2022 is an important month for inflation.

Now off to the first point: Why we believe Fertilizers stocks made a top in 2022.

Fertilizers Stocks Look Toppy In 2022

To make the point, all we need is a look at major fertilizers companies and their charts. These charts are all displaying the same topping pattern: A rounding top.

This pattern would typically happen after a strong upwards move, which is the case here. Once the pattern is completed, you might still have the bounces to the previous support areas but the price will likely get rejected at those levels.

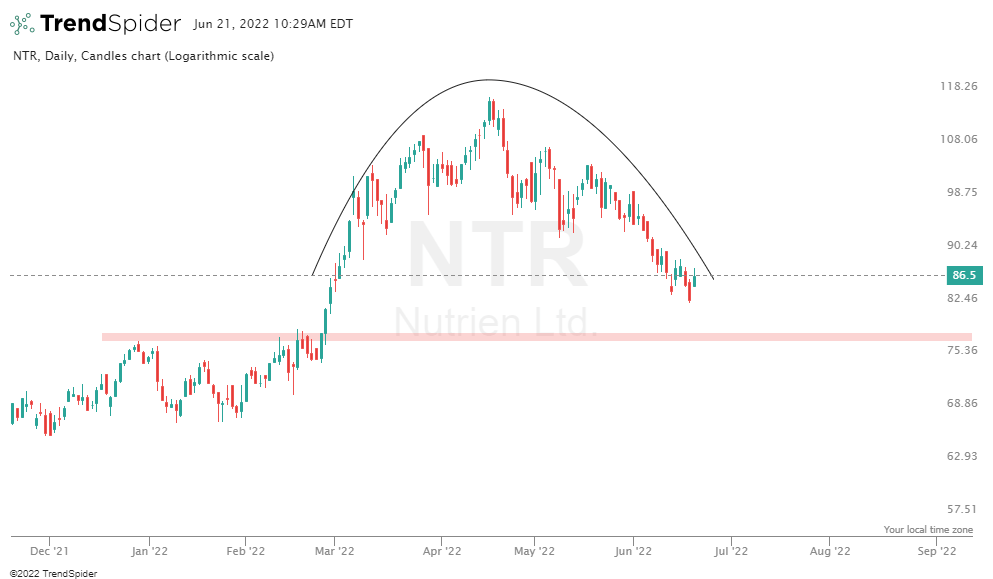

The first chart we will look at is Nutrien Ltd: Clear topping pattern, looking to back test the previous breakout level.

Nutrien is a Canadian fertilizer company based in Saskatchewan. It is the largest producer of potash and the third largest producer of nitrogen fertilizer in the world.

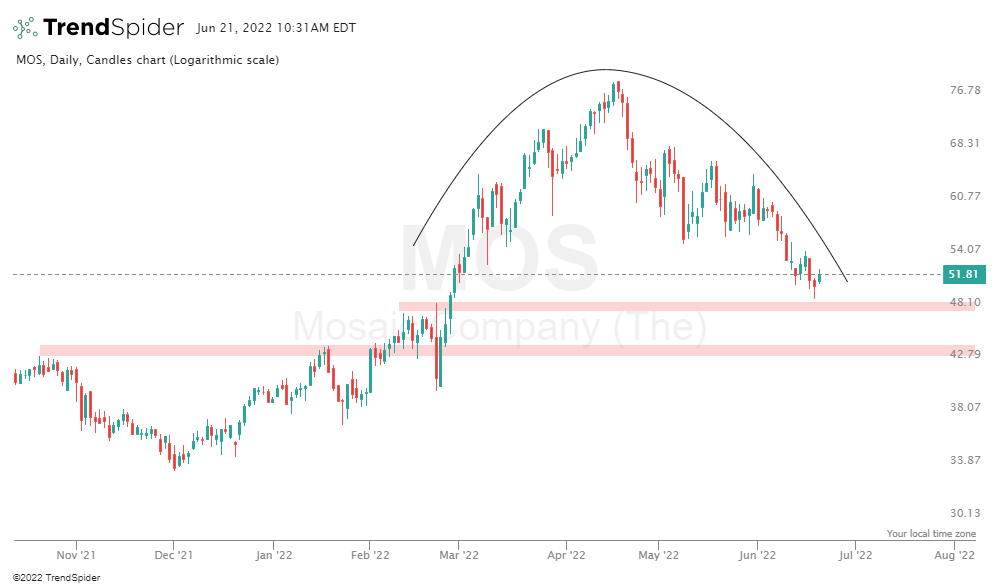

Similar pattern in Florida’s Mosaic Co chart

The company mines phosphate, potash, and collects urea for fertilizer, through various international distribution networks. It is the largest U.S. producer of potash and phosphate fertilizer.

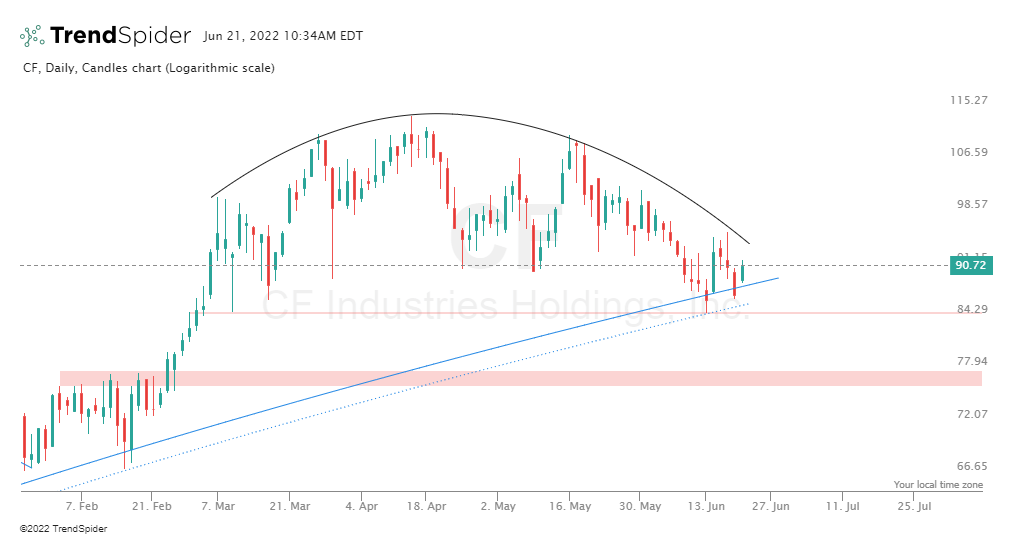

The last chart we will feature is Illinois’s based CF industries holdings, a North American manufacturer and distributor of agricultural fertilizers. Again same rounded top pattern showing up on the chart.

The Impact Of A Top in Fertilizers As An Inflation Indicator

It’s very hard to forecast the future direction of inflation, even in the short term. Nevertheless, it is important to highlight that there is a series of one off measures and situations that accelerated the rate of inflation in the last 12 months:

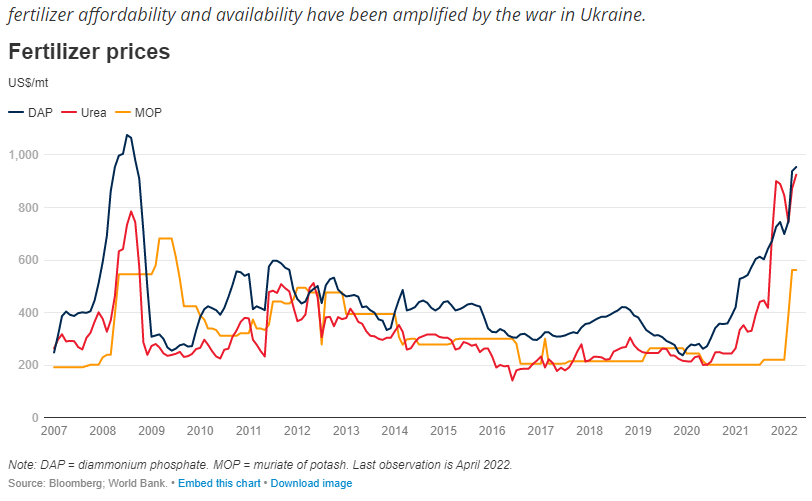

The war in Ukraine, an important wheat and fertilizers ‘ exporter:

- Ukraine’s wheat exports represent around 10% of the international wheat exports.

- Their Sunflower Oil’s export represent 50% of the global exports.

- Russia and Ukraine’s combined Fertilizers’ exports equal around 28% of the word’s nitrogen and phosphorous fertilizers.

- Russia exports around 48% of the ammonium nitrate based fertilizers.

- Canada for instance, decided to put a 35% Tariff on Russian fertilizers, as fertilizers prices are around all time highs..

- Countries like India, Argentina.. decided to pause wheat exports.

With all this pressure on the supply side, no wonder some commodities prices are sky rocketing in 2022.

But the common denominator here is that none of these measures are sustainable long term. As fertilizers’ prices roll back and some of the sanctions are relaxed, this could lead to a decrease or at least a “flattish” action in Inflations’ rate.

Fertilizers Prices & Overall Impact On Inflation

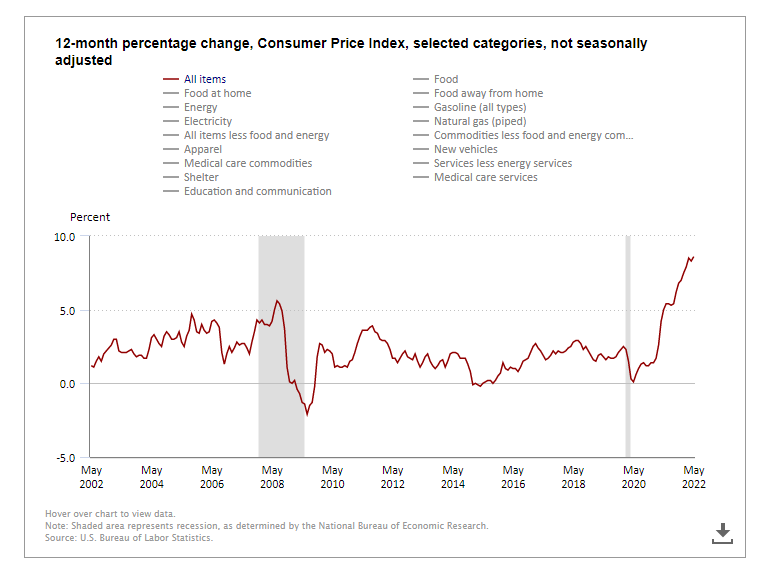

- The steep increase in fertilizers prices started earlier in 2020.

- The CPI Index displays a visibly accelerated commodity prices in May 2020.

- A slowing down inflation level, closer to normal levels (as opposed to ‘out of hand inflation rates’).

- No need for further rate increases which would be Bullish for equities.

While crude oil was an amazing investment in the last 24 months, we believe the upside potential might be limited in the short to medium term. There was much better opportunities out there, is what we are thinking.

Written by hdcharting.