Lithium stocks had an amazing 2nd half of 2021. Our long term portfolio tips contained the very best lithium stocks; all of those tips went up triple digits since we tipped them around summer, all of them. But the mega secular bull market in lithium stocks is not over yet, far from it, as explained in our green battery metals forecast for 2022. It is even not halfway according to us. It is rather clear from the charts that some lithium stocks might be taking a breather to recharge themselves but they will continue to perform well in 2022. We have a very bullish lithium stocks forecast for 2022 especially for lithium miners that will be producers before 2025 but also for lithium stocks that have developed technology for rechargeable batteries (also those processing waste lithium ion batteries). Similar to our graphite forecast 2022 we predict a cyclical nature of this grand secular bull market: one or two momentum periods per year in which crazy moves take place especially to the upside. We add this lithium outlook to our long series of 2022 forecasts, and explain in this article how to play the lithium boom as per principles outlined in our 7 secrets of successful investing.

One year ago we published a bullish lithium stocks forecast.

It took 7 months for our forecast to start materializing but once ‘it’ started ‘it’ was unstoppable. With ‘it’ we refer to the boom in lithium stocks that took place starting in the summer of 2021. All the lithium stocks that we tipped in our premium stock investing research went ballistic, all of them are up triple digits since we tipped them.

Last year’s lithium stocks forecast was spot-on

This is what we wrote near the end of 2020 prefacing our lithium stock forecast from back then:

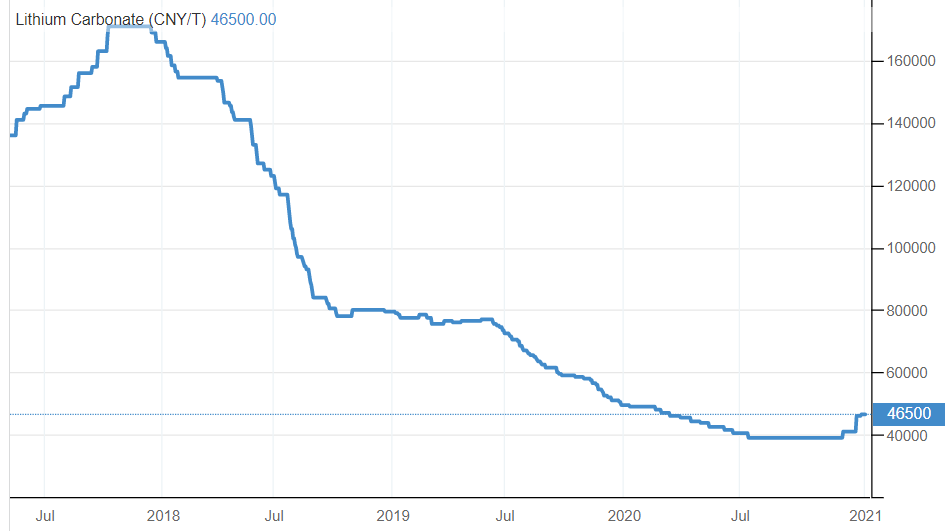

The lithium price looks to be in a major basing phase now, and it looks like it is coming out of this base. This implies that there is more upside than downside potential in the lithium price.

Is this the next driver for lithium stocks, next to the electric vehicle trend?

Imagine what will happen with lithium miners once the lithium price doubles, as the trend looks to have started recently and the price has some 80% upside potential until it hits a first resistance area (80000).

We published this spot lithium chart from back then:

Presumably, this is not the end but just a pause in the long term lithium bull market.

Lithium market not done rising, only now warming up

You might think that we are exaggerating. We are not because we came to the conclusion of a mega bull run in green battery metals (especially lithium) based on a macro level perspective on investing and mega bull runs in the last few decades. We did document this here Which Is The Biggest Investing Opportunity Of This Decade but at it always goes in markets only a happy few will be profiting from this mega trend. Most investors will come late to the party, and may even not be able to be profitable in the green battery mega trend!

Even fundamentals underpin our investing thesis explained in the article mentioned above. This quote comes from a recent lithium market research:

The global market for lithium mining is poised for considerable expansion at more than 26% CAGR over the period of 2021-2025. The global valuation of lithium mining market will reach over US$1 billion towards the end of forecast period. Increasing consumption of Li-ion batteries by automotive and consumer electronics industries is expected to create a measurable boost in need for lithium mining activities in the near future.

While we don’t lose our precious time to fundamental analysis (because mostly fundamentals only create narratives and never succeed in timing the market) we welcome fundamentals in the form of objective and quantified data especially if they underpin our investing thesis.

Top lithium stocks and their chart patterns

There is one thing we have seen consistently in the lithium space in 2021: phenomenally bullish chart setups.

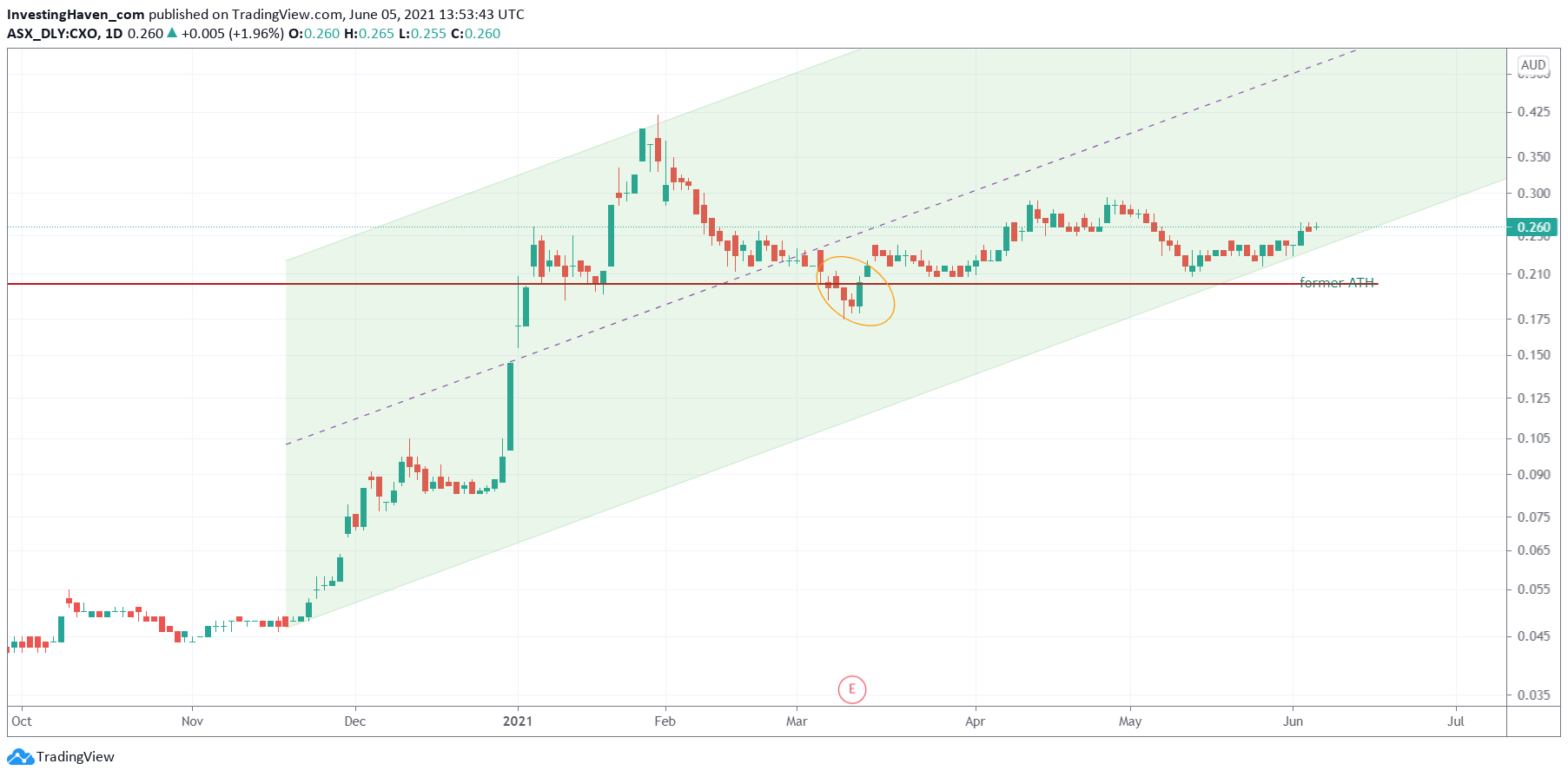

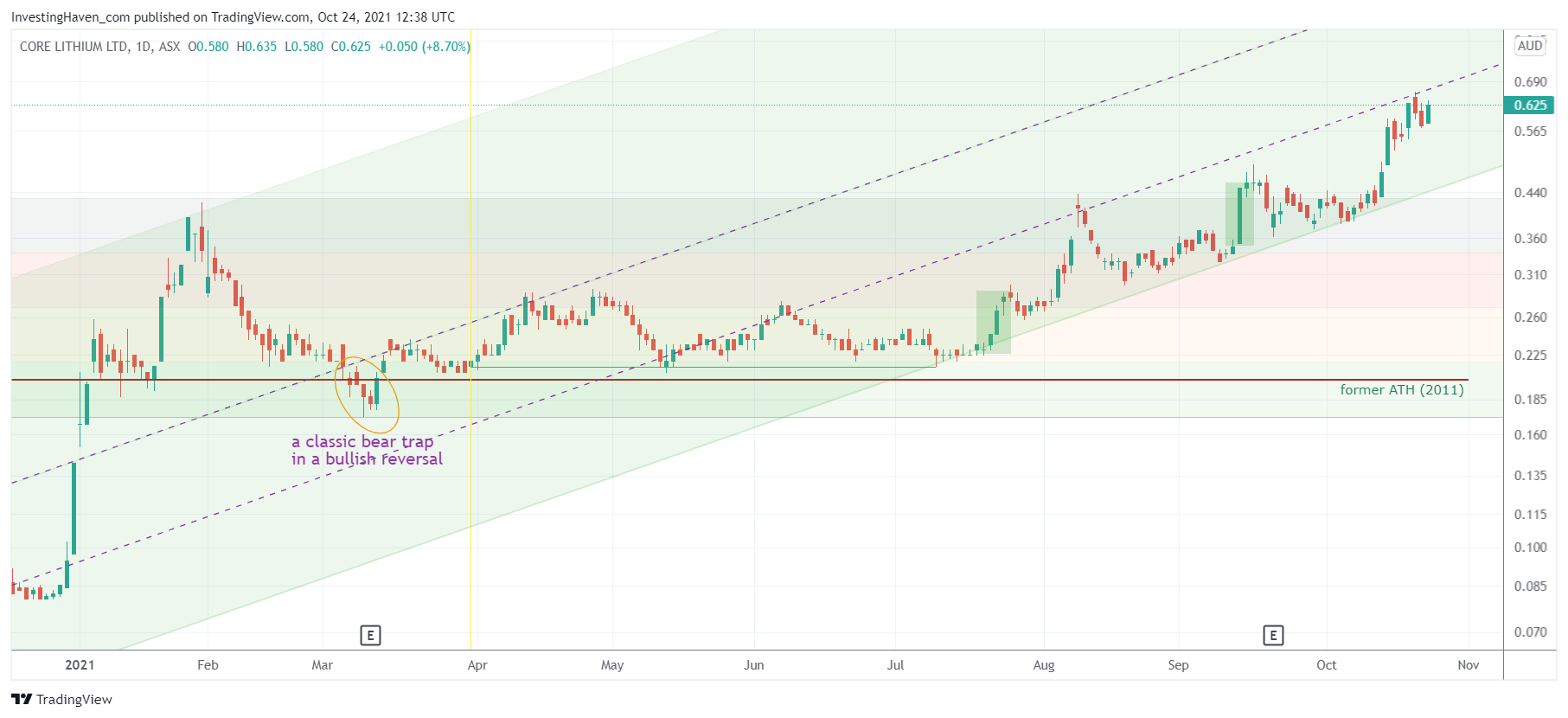

We even believe we did found the best textbook case ever. It is Core Lithium trading in Sydney, a small cap lithium stock that is rapidly evolving to a large cap.

This is the chart with the timestamp from back then (June 5th). Do you see beauty in this chart?

The chart above is one we tipped to our premium stock investing members, and we wrote this on July 1st, 2021:

We want to emphasize that Core Lithium in Australia is among our top favorites for the remainder of 2021. Don’t take the OTC position, but only the shares in Sydney.

Fast forward and you can see what the outcome was on the next chart.

The point is this: we have seen consistently throughout the entire year similar chart setups in green battery metals but primarily in lithium.

No coincidence, beautiful chart setups result in great profits. We explained this principle in great detail in this article which appeared in the public domain Investing Secrets: Beauty Results In Profitable Investments. What do you think of this quote?

Beauty matters in real life in almost all domains of our life. It should matter when you invest in financial markets.

Beautiful is important in all areas of life, also in financial markets. Top lithium stocks look beautiful on their chart, and most of our members made serious money with these beautiful chart setups in top lithium stocks.

Our lithium forecast has similarities with the mega gold bull run 20 yrs ago

We have noticed really similarities between the mega bull markets over the last few decades:

- In the 90ies it was technology.

- Between 2002 and 2010 it was precious metals.

- Between 2012 and 2019 it was some tech stocks and crypto.

- This decade will be about lithium, graphite, cobalt, clean energy, electric vehicles.

These mega bull markets have a few characteristics:

- They go on for longer than most of us think.

- The accelerate only once or twice per year.

- The rise (once or twice per year) largely makes up for the waiting and pullback in all other months of the year.

- Buy and hold is delivering phenomenal compound effects on individual positions.

Emphasis on the last point:

Buy and hold is delivering phenomenal compound effects on individual positions.

It is crucial for outrageous success to find a way to create compound effect. It may be on portfolio level or individual positions.

Any of the mega bull markets mentioned above created enormous compound effects by buying & holding individual positions for a long period of time.

Lithium stocks won’t be any different, mark our words!

How to play our bullish lithium stocks forecast in 2022 and beyond

This is what we wrote one year ago in last year’s lithium stocks forecast:

However buying all-time highs may be a good idea, but isn’t always a great idea.

We would prefer to buy the retracement. And the ideal entry price would present itself if and when LIT ETF retraces to its breakout level around 50 points, consolidates for a while, and prepares its next move higher. That’s what we will be watching to add a lithium stock to our Momentum Investing portfolio.

It is the exact same idea as laid out in the previous paragraph.

We’ll script it for our readers:

- Ensure you have selected lithium stocks with the very best setup. Be extremely demanding when it comes to quality. Only high quality and very beautiful setups should be allowed in your portfolio. Set the bar very high but using our illustration of Core Lithium as the minimum acceptable quality standard.

- Buy the dip in lithium stocks.

- Free up some capital by selling a portion of your holdings (e.g., once a lithium stock has gone up 300% you can sell 30% of your holding).

- Use the proceeds to buy the dip. You can do so by either adding to existing positions or picking the next promising lithium stock (e.g., new discovery or a promising small cap).

- Buy the dip really means a serious dip, not an intraday or intraweek dip. Buy the dip is the period in the year in which those stocks come down 30 to 40 pct (if not more).

Enjoying our work? We invest in market segments in which momentum is brewing, and we do so with carefully chosen positions which we hold from a few weeks to a few months. At this point in time, we are interested in commodities stocks, and lithium and cobalt stocks are also on our watchlist. Whenever we believe the time is right + entry prices are attractive, we will take a (small) position in a lithium or cobalt miner in 2021.